World Stock Exchanges: Fed managed to stop the descending trend of the market – Economics

The American stock market recorded a light recovery after four weeks of downward trend, assisted with the Fed and Comments from this Central Bank.

A week after the S & P 500 index fell into technical correction, half the percentage, while the technological action index, Nasdaq, registered even more fifths of the percentage.

The central event last week was the session of the Fed, which was expected to make unchanged interest, but also exacerbated expectations when it comes to economic growth and inflation movements.

The Fed interest retained in the range of 4.25-4.50 percent, where it is located since December, after this central bank remained cautious given the expected negative impact of new customs to the economy that slows down.

Fed, Powell, stated that the impact of customs in inflation could be « transient » and that « in the second half of the year could be further increased. » This assessment encouraged investors, as well as information that Fed officials continue to reduce interest rate decreased by the end of the year.

When it comes to American economic growth, FED expectations for the current year are reduced to 1.7 percent compared to the December projection of 2.1 percent.

On the other hand, base inflation is expected on an annual level of 2.8 percent compared to a previous rating of 2.5 percent. These ratings indicate a realistic danger of stagflation scenarios, which is an economic phenomenon when inflation grows despite the weakening of economic growth.

After last week, the consumer sentiment of the University of Michigan was lowered to the lowest level since November 2022. years, neither American retail data gave a series image of the American economy.

The retail increased by 0.2 percent in February, significantly better compared to the amount of 1.2 percent of the previous month with initial 0.9 percent, but below the consensus of 0.6 percent.

The component of personal consumption that enters the BDP calculation increased 1.0 percent, more than expected 0.2 percent. Analysts expect personal consumption to slow down the annual rate of 1.2 percent in the first quarter, with 4.2 percent in the fourth quarter of last year.

The American GDP largely depends on the population consumption, and it is expected to be found in the first quarter in the first quarter. The largest economy of the world increased 2.3 percent in the fourth quarter.

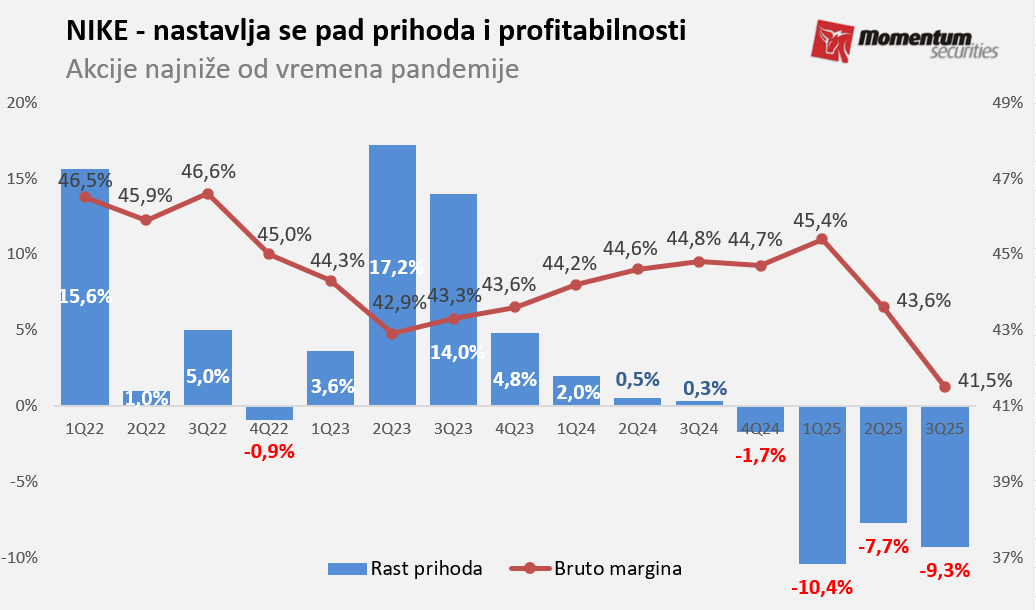

And last week’s corporate posts indicated negative movements in the American economy. The largest producer of sports equipment, Nike, lowered to the lowest level since 2020. years, after the trend of sales and profit margins continued, partly and influenced by the announced American Customs.

The negative signals also sent, FedEx, which reduced business prospects in the current fiscal year, while chip designer announced a decline in profit margins in the coming period despite the expansion of revenues based on the growth of artificial intelligence.

Winner of the week

The actions of the American Fashion House, Guess (GES), jumped on Monday 30 percent after it was announced that this company could be the subject of a download by WHP Global.

Possible withdrawal of the company from the stock exchange comes in a situation where luxury goods producers are under pressure from inflation and weaker demand from China, which consisted the main market before the pandemic. GUESS shares on the offered price of $ 13 are lower by about 50 percent over the past year, while the S & P 500 index increased ten percent in the same period.

The loser of the week

The shares of the world’s largest sports equipment manufacturer, Nike (NKE), fell by publication of 5.5 percent to $ 68, descending at times close to $ 65, which corresponds to the market capitalization of the company lower than one hundred billions of dollars.

The expected turn of Nike’s business in the quarter moves further into the future, and the new administration announced a sharper decline in the current quarter and a new impact on profit margins due to higher stocks and expected negative customs of customs customs. In the past year, the action of this company lost almost 33 percent.

The author is the main broker of Momentum Skuritiz.

Follow us on our Facebook and Instagram page, but also on X account. Subscribe to PDF List release today.