Will residents not get away from higher taxes?

Jean in bed and mattress factory has been working for 11 years. There seems to be enough experience to earn a full experience, but in reality the feeling is different.

« The more I earn, the more I am counting on, » said the tailor Jean.

The share of taxes paid by the Lithuanian population is one of the largest in Europe. Lithuanians give 38 percent of income tax and social security contributions. from salary. It’s second after Belgium.

However, new plans of government will not be able to help the employees. The tax reform has already been almost agreed and the changes are also waiting for personal income tax.

« We increase prices, which means that there may be a time when Poland or Germany will pay more to produce than in the Baltic States, » said Arvydas Padvakas, the owner of Padvaukas and Ko.

LNK stop shot.

The economist says that most developed countries do not increase but reduce taxes for employees, but Lithuania is up to current.

« Increasing is upstream, because even Scandinavians reduce labor taxation, » said Luminor Chief. Economist Žygimantas Mauricas.

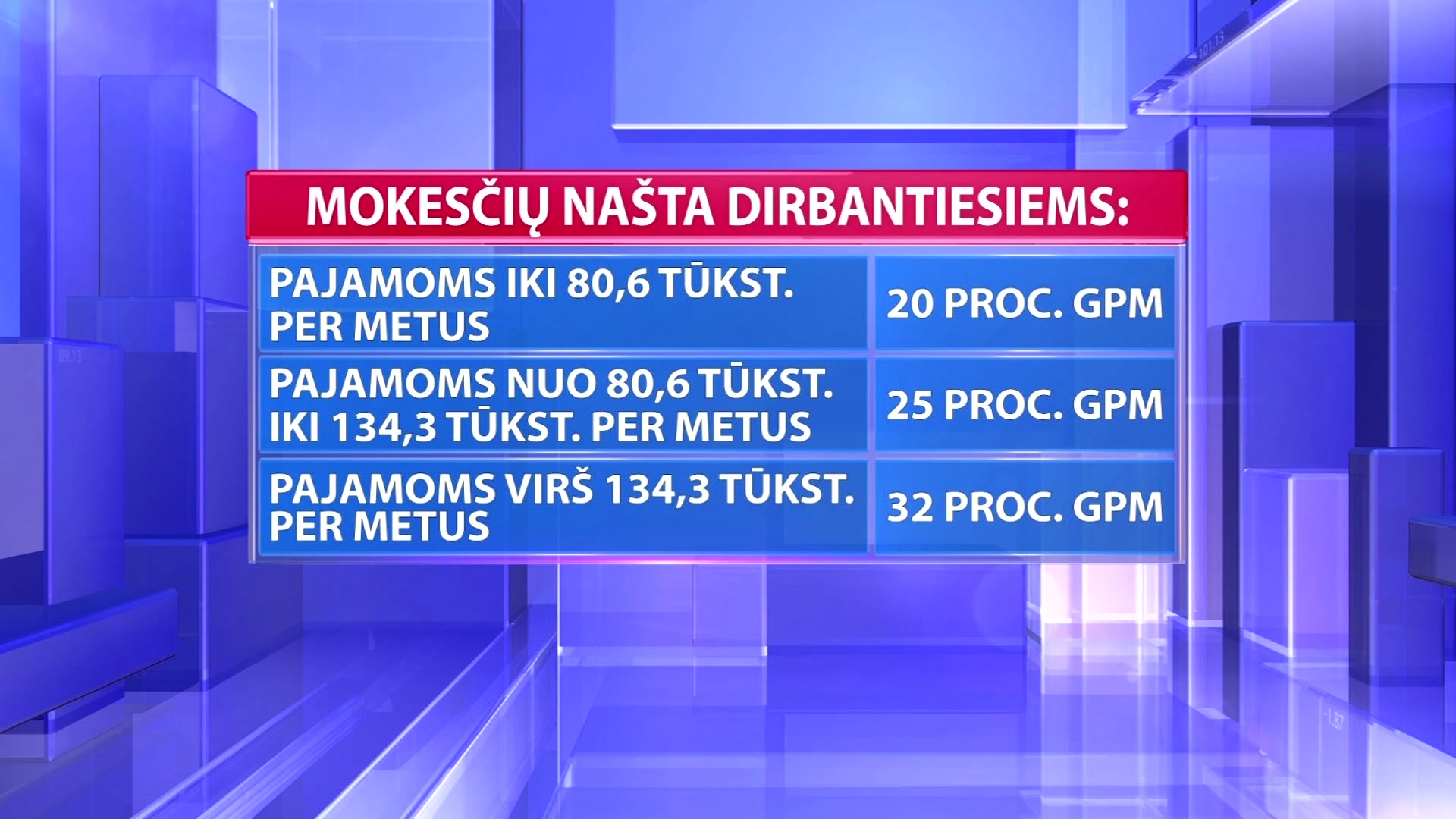

The ruling are considering three personal income tax rates. Whose income per year up to 81 thousand. – 20 % rate, earning between 81 and 134 thousand. per year – would pay 25 percent. And the richest would be taxed by 32 percent. at the rate.

The president does not call it a tax burden.

« It is not an increase in PIT, it is a more progressiveness. It is not a news that was unknown yesterday, and today it suddenly came from somewhere, » said Lithuanian President Gitanas Nausėda.

If, with the employment contract and individual activity, the PIT rates are now different, then the Minister of Finance seeks to drop this income into one cart and to tax the same.

« If we had two rates, we now have three rates. The independent rates were lower, then we will have more stairs and higher rates, » explained Ž. Mauric.

Mary is self -employed – the nail artist has been working for 9 years. The girl calculates how much you would have to pay extra if the income rate raises from 15 to 20 percent.

« It would rise from a hundred euros and up, it would contribute to the costs. Every year, utility costs and work -related measures are raised, » said Marija Volodkovičė, founder of MS Nail Studio.

Mary thinks the workplace will be pushed into the shadows or the beauty services will become more expensive.

« Self -employed people will most feel the impact of tax increases, » said the economist.

LNK stop shot.

The Minister of Finance promises that the recipients of low -income will certainly remain protected.

« The lowest -income people – be it wages or a tax on individual activity – should feel no change compared to today, » said Finance Minister Rimantas Šadžius.

However, paying more are at risk for higher income. It is projected to be most painful for those who earn from 4,000. up to 7 thousand. per month.

« The biggest impact and tax increases will be experienced by those inhabitants who fall into the average income chain, » EY explained. Partner in the Baltic States Leon Lingis.

Full LNK Report – In Video:

The tax burden is also on the high value -added staff, which causes the countries to compete fiercely.

« The government has promised to create many well -paid jobs, but it may be the case that it will create many heavily taxed jobs, » said Ž. Mauric.

And the richest tax redevelopment can leave the driest. The PIT rate is planned for them as they are now.

« The taxation of higher income earners is likely to change slightly, » Lingis said.

On Tuesday, the coalition decided not to consider an additional 8 percent. rate for very high income. But Shadius says the discussion can still come back.

In the past, the government has planned that even the interest may be paid to the deposits of deposits. And here’s the dividends paid by the shareholders of the corporate – they offer the same income rate as they are now.