Will INR bills strengthen liquidity and stability

We have recently witnessed positive changes on the Ljubljana Stock Exchange, which strengthens confidence in the domestic capital market. The S&P credit rating has improved the estimate of the Republic of Slovenia with AA – AA, which also affected the upgrading of key insurance companies. Sava Re and Sava Insurance Company received an A+ rating with a stable promise, as well as the Triglav Group, which also received a higher rating for subordinate bonds. This confirms the good capital structure, operational performance and the importance of these companies for the domestic financial environment.

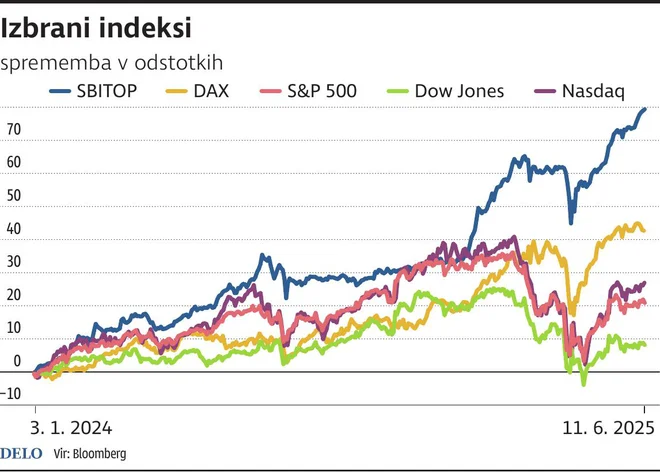

Comparison of Indexes Photo ZX IGD

The Sava Re leadership further proves confidence in the company, CEO Marko Jazbec has purchased 250 POSR shares, which reinforces a positive signal for investors. Triglav, however, is implementing a strategy for growth abroad, together with Prima Assicurazioni and Ageas partners, enters the Italian car insurance market, which means expanding the presence and diversification of revenue sources.

Telekom under the new legal pressure

Less encouraging is the events at Telekom Slovenije, which is again facing a new lawsuit of EUR 86.2 million of Runa Enia for alleged abuse of market. Telecom remains under high legal risk. The question is also to whether it is reasonable to tighten the regulations of highway fuel prices before the peak of the tourist season. Especially not without a thorough effect analysis.

Petrol and the risk of excessive regulation

Petrol points out that further regulation of margins at fuel can lead to closing stores, smaller investments and, as we can assume, also to more expensive services where there is no price control, such as trading goods, car wash and catering services. Regulation without proper analysis can damage consumers in the long run instead of protecting them.

SBI Top among the most profitable indices in Europe

The domestic stock index SBI Top is experiencing above average growth in 2025, with more than 34 percent since the beginning of the year, it is among the most successful in Europe. Key factors are good companies, stable balance, low indebtedness and above -average dividend returns. For example, some blue chips are still rated conservatively or attractive, which opens up space for further growth growth.

Photo: Blaž Samec

Most have either very low debt or even surplus cash. This means that they are not or are less exposed to the risks associated with interest rates, but at the same time they have more room for new investments, acquisitions, acquisitions of shares or higher dividends.

INR accounts as a new impetus for domestic investors?

The introduction of INR accounts, long -term investment accounts with tax benefits, which will make it easier to save on shares and ETFs, is also interested in the introduction of INR. At a high price of real estate and the end of the Koci, the record values of the gold domestic capital remains an alternative. A stable environment and business and tax incentives could increase the influx of fresh capital and further strengthen the liquidity and stability of the Slovenian capital market.

The author owns NLB shares.