What you need to know about renting rent

Since Autumn the Return is on rental for hundreds of thousands of principal or student residence.

The new measure, in an automated way, provides for the return of a monthly rent a year, based on tax returns with its income previous year, for this year, 2024 incomes.

The refund is tax -free, that is, it is not counted as income next year and does not affect eligibility for other housing benefits.

The rent return

This year in November and every year, a rent annually, whether it concerns a main house or a student house, will be returned to the bank’s bank account.

Based on statements currently being made for the tax year 2024, 1/12 of the annual declared rent – both for the main residence and for the student residence – will be returned to the bank accounts of the beneficiaries in late November.

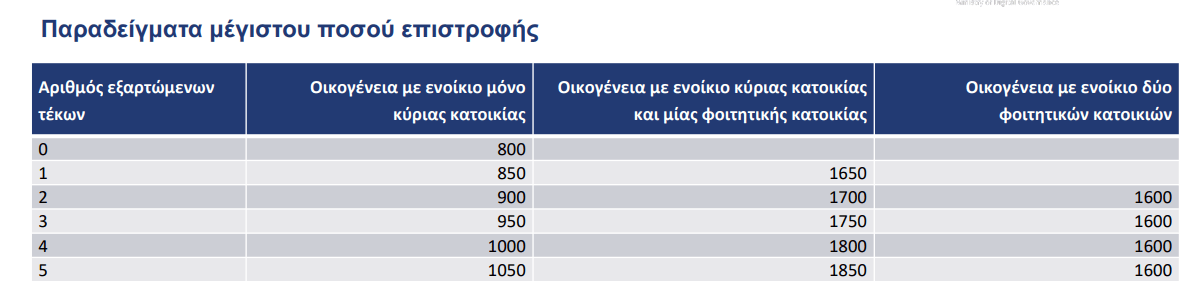

It is worth noting that the maximum refund amount for the main residence amounts to EUR 800 by EUR 50 for each dependent child of the tenant. The maximum refund for the student residence amounts to 800 euros.

Attention! In cases where the residence has been rented for a shorter period within the year, as is the case in seasonal leases or in the event of a change of residence, the amount of the refund will be adjusted proportionally, on the basis of the actual months declared.

The income limits

The income criteria are expanded and correspond to those set for my home II program:

For the single, a maximum income threshold of 20,000 euros is set.

For married or part -time cohabitation, a maximum family income threshold of EUR 28,000 is set by EUR 4,000 for each child.

For single parent families, a maximum family income threshold of EUR 31,000 is set by € 5,000 for each additional child beyond the first.

Example of maximum amount of refund

Assets

Regarding the property criteria for rented rent for a main residence, it is stipulated that the total value of family property, as determined by the calculation of ENFIA this year, may not exceed EUR 120,000 for a single household in 20,000 euros for each additional member of the household.

It is estimated that there will be about 80% of rental households, ie about 948,000 households corresponding to 1,280,000 taxpayers. The annual cost of the measure is estimated at around € 230 million.

A property limit is not set for the rented rent for a student residence.

The reactions

For a measure that will not solve the housing problem, market players refer to the government’s announcements on the reimbursement measure of a rent to tenants every November.

« This concerns the tenants who have specific assets and income criteria, » Attica Median President Lefteris Potamianos tells Mega.

« It concerns rents that are at the highest level of 800 euros and I think it’s a meter, at least so it was heard in the market, which is an anti -economy more than anything else. » « The ministry said it was about 948,000 beneficiaries. There are many who will go out and out, « adds Mr. Potamianos, noting:

« The evil that brings, in quotation marks, this measure is that it will put the renters with the landlords in a fight. » « There is no way to resolve this measure this measure, » he concludes.

Source: ot.gr