What is more expensive, Krka’s share or real estate in Ljubljana?

The high growth of the domestic market in recent years is (also this year) attributed to the combination of strong basic factors, a favorable macroeconomic environment and years ago – compared to today’s – extremely attractive « starting » prices of key shares. Companies in the SBITOP index, such as Cinkarna Celje, NLB, Krka, Petrol, Zavarovalnica Triglav and others offered to investors above average dividend returns compared to global markets, which further prompted the demand for domestic shares. Years ago, these companies were an attractive entry point for investors with relatively low values and high fundamental support. The stable and profitable operations of Blue Chips, along with the forecasts of reducing interest rates in the euro area, is also now continuing to create a bold support environment for the growth of the Slovenian capital market. But this is not the end of the story.

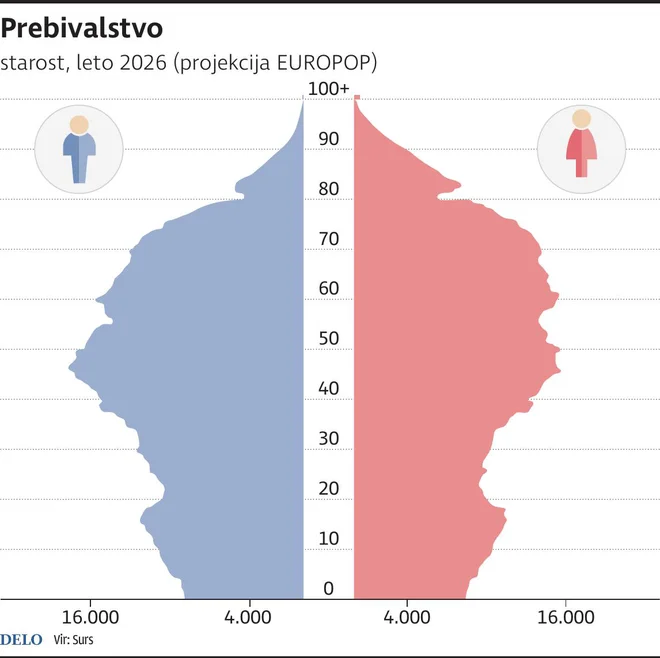

In Slovenia, it is becoming more and more obvious that exclusively investing in real estate brings increased risks in the long run. The age -related pyramid clearly indicates the rapid aging of the population, while the proportion of young people who are more important buyers and tenants are decreasing and will continue to decline. At the same time, the aging process will release additional capacity in the real estate market, as older generations own a large proportion of real estate, and some will be built.

Photo: Jože Suhadolnik

The generation, which is now retiring, has by far the most capital and real estate, while some of them are much less numerous and have significantly smaller assets and much less purchasing power, and this is precisely during the period of life when they should spend the most. As a result, the price of capital will be lower in the long run, as central banks will want to encourage consumption. As a result, future higher returns are likely to be related to more risky investments such as shares. In Slovenia, however, it may be that in the next two decades the quantity of real estate supply, of course slightly differently in quality segments, will increase with probably no significantly higher demand.

Although immigration in a numerical sense is currently much more than emigration, which slightly alleviates negative demographic trends, this flow can also change quickly. Last but not least, central Austria is facing similar demographic challenges, but has significantly more capital it intends to use.

For example, it is worth mentioning that the prices of Krka shares, one of the key domestic stock companies, are currently historically high. But unlike real estate, Krka’s sales potential does not relate to a local demography. The company has no debt, revenues are globally dispersed, sales are stable in markets worldwide, including regions where demography remains favorable. This gives the company additional weight and attraction between investors, as it is less exposed to risks related to exclusively domestic market conditions.

Infographics: Work

In order to safer preserve and noble value of our own property, it is certainly reasonable to consider a scattered approach, rather than being exposed to the domestic real estate market in the long run. Homemade high dividends and other shares, as well as state bills of exchange and bonds, still offer a relatively favorable starting point. As a reasonable approach, with professional assistance, a hybrid strategy, where part of the funds can be thoughtfully selected real estate, part in stable and profitable dividend shares and treasure bills or in bonds, and works in more liquid forms of investments such as ETF and cash reserve funds. Such dispersion provides greater flexibility and enables more efficient response to fluctuations in the markets. In an environment where demographic and economic conditions are changing rapidly, carefully dispersed investment strategy is increasingly a matter of rational judgment and less and less a matter of choice.

:format(webp)/s3/static.nrc.nl/wp-content/uploads/2025/06/10162802/data133473446-7c6f03.jpg)