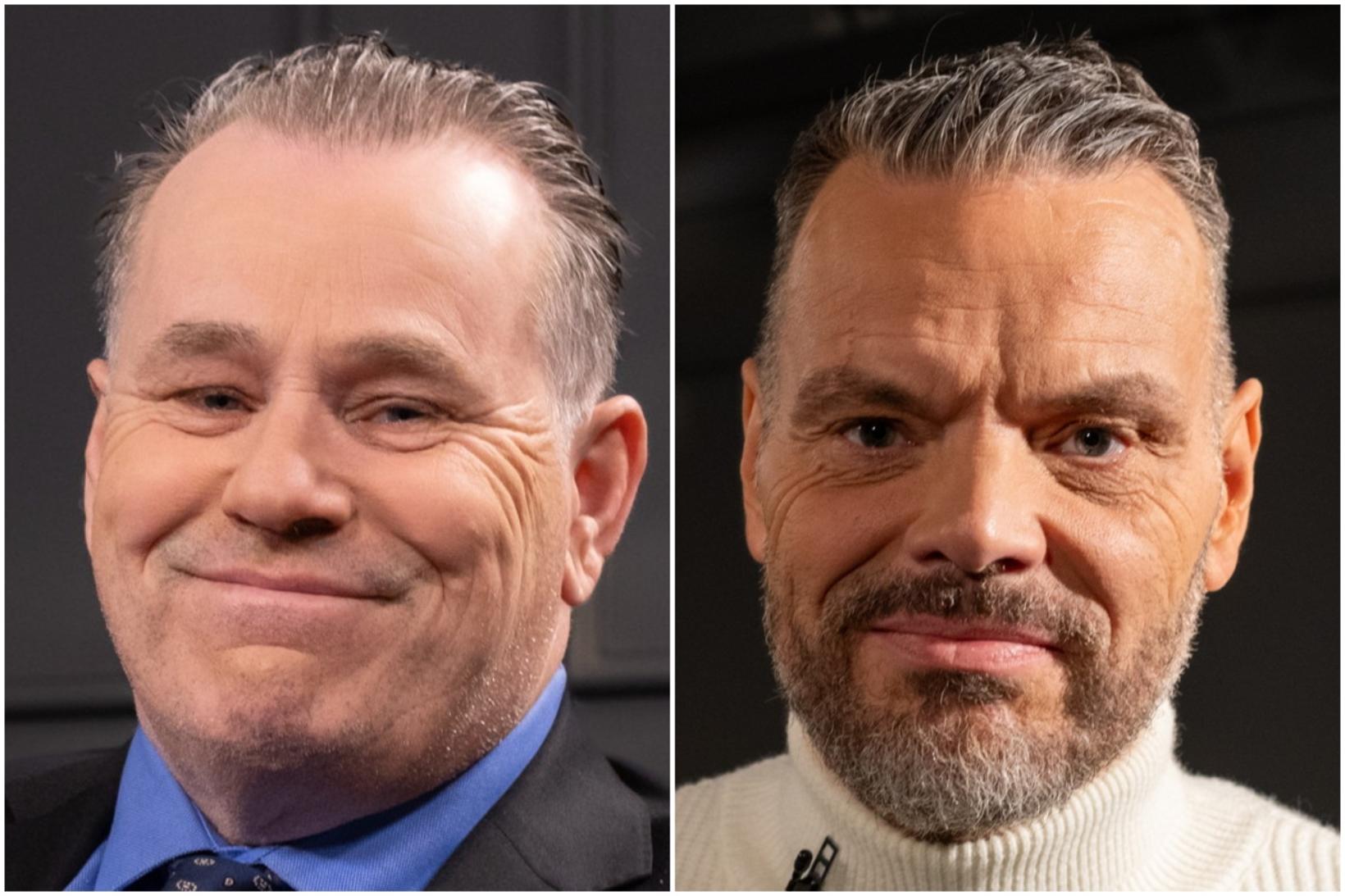

« We're not going back to zero or negative growth »

Central Bank Governor Ásgeir Jónsson says he expects inflation to continue to subside when it comes in in the spring, but it now measures 4.2% and 2.7% without housing. However, he says he fears that the last meters will be difficult, ie. that inflation becomes persistent and that it will be difficult to reduce it below 3%. It is a problem that banks around the world now look forward.

Said both Asgeir and Þórarinn G. Pétursson, Deputy Governor of Monetary Policy, that if they had known what they knew about economic growth in 2022, then interest rates could have been raised faster to respond to inflation and thus also falls down.

This was among what was stated at an open meeting of the Economic and Business Committee today.

Asgeir pointed out that in Europe, about 4% of service inflation was now measuring and that all the world's major central banks were concerned that even though inflation has fallen in recent quarters, it will not reach the goal and become persistent. It would be more likely that interest rate hikes could be found abroad than further declines.

Lending does not allow lower for 30 years

Ásgeir pointed out the interest rate differential of bonds for 10 and 5 years, saying that although the policy rate in many places had fallen, the interest rate differential had remained steady. « It reflects to some extent changed the landscape of the world's finances, » he said before warning that people had expectations of very low interest rates. « We are not going back to zero or negative growth as it was before. »

Ásgeir said that in this country, various measures had been taken to exercise caution, including the Financial Stability Committee on restrictions on lending in the real estate market and retained by debt and limited speculators of foreign investors.

This, according to Ásgeir, has returned that household lending has not been lower for 30 years, both based on GDP and household disposable income. In addition, there are small signs of payment problems and the current account balance are in relatively balanced, and thus the króna is fairly stable.

Ásgeir said that this position would be likely to have a soft landing in the country to reduce interest rates and inflation.

Skagfirsk proverb at the top of Asgeir's mind

Skagfirsk proverb seems to be high in the mind of Asgeir, as he subsequently repeated comments that he dropped just under a year ago at a meeting of the Financial Stability Committee. « As they say in Skagafjörður: » It is never possible to praise a semi -ironed horse, « said Ásgeir at the meeting this morning, saying that it is not appropriate to boost success in the fight against inflation until it is able to reach it to the Central Bank's goal.

Changed focus of the United States concerns for Iceland

He next reviewed the situation abroad and changed the focus in the United States. He said open economies such as Iceland dependent on foreign trade and therefore these changed emphasis was very concerned for Iceland.

« We believe we have been over all the risk factors that are indoors with us, but we are a small country dependent on what the larger countries do, » said Ásgeir about the preparation of the Central Bank.

He said he concluded that monetary policy had been successful and that Iceland was in a fairly good place and no signs of problems in the financial sector or in households.

However, the main concerns would be to get the last few meters down to 2.5% inflation target and then from the position abroad that could affect in this country.

Pawel Bartoszek, a member of the Tour, asked the Governor if inflation could be reached sooner if it had been faster.

mbl.is/hákon

« It was clear that we could have reached inflation faster down«

Pawel Bartoszek, a member of the Tour, asked Ásgeir at the meeting if the Central Bank could have reached inflation faster and referred to monetary policy rules and that inflation should be reduced as soon as possible. At the same time, whether the bank had looked at things other than just reducing inflation, such as economic growth, household debt, etc.

Asgeir said this good question and could have been hard to respond. « It is quite clear that we could have reached inflation faster by using tougher action. Raise interest rates more and I mention that if we had abolished precautionary rules in the foreign exchange market, if we had opened the country and said: « Dear speculators you are welcome to come » and the exchange rate would have risen. Then we would have reached inflation sooner, ”he said.

Would have been able to raise interest rates faster

However, the Monetary Policy Committee would have had other issues in mind. « This has taken too long, but there are other points of view that we have had in mind about macroeconomic, regarding economic growth, regarding value creation in the system. »

In 2022, economic growth in Iceland was 9% and 20% over the years 2021 to 2023. Ásgeir said these were figures that the bank did not know until afterwards and if they had realized that such great economic growth was in progress. « It is clear that we would have raised interest rates faster if we had known what was happening. »

Thorarin agreed with Asgeir. « Had we known what we know today, we would have raised interest rates faster, » he said.

Thorarin had some concerns that inflation expectations had started, saying that the consequences of cost increases were now increasing after inflation expectations had lost his ballot.