Wall Street and the paradox of discordant data: pessimistic surveys, positive economic estimates

Although the rates remained still, the stock exchange recovered over 14% from the minimum, the European ones rose more. However, the army of those who see black grows, even among small businesses close to Republicans

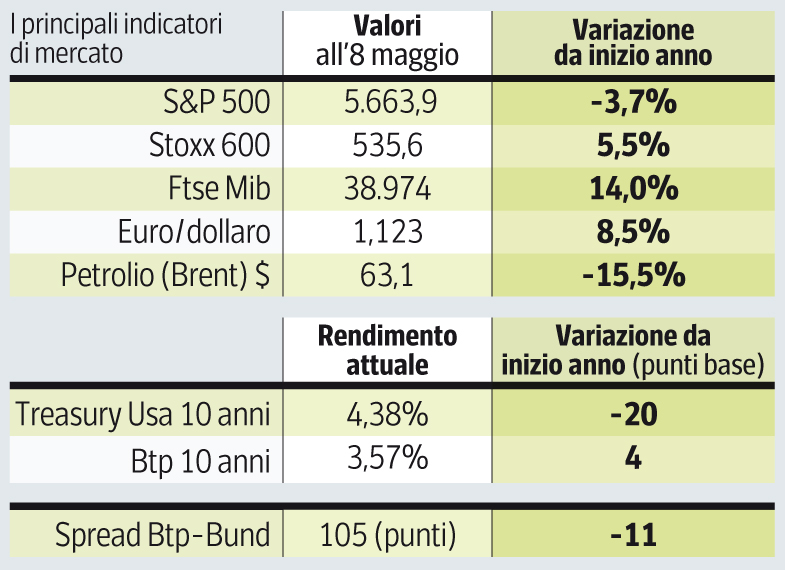

Nine ragzes in a row at Wall Street have not been seen since 2004 to demonstrate that the « exceptionalism » of the American stock exchange is far from finished. Between April 21 and May 2, the S&P rose by 10.2% (+14.1% from the relative minimum of 8 April). But, (approximately) in the same period of time, the Stoxx 50 of Eurozone flew by 14.3% and the German Dax of 18.7% And the sessions in (almost) continuous ascent were 13: proof that the newfound interest in European actions, which began in January, is not a straw fire. From the end of December to 7 May, the Stoxx 50 marks a 7.4% rise, against a 4.3% reduction for the S&P 500 index. To find a waste of over 11 points in just over 4 months in favor of Eurozone bags you have to go back 19 years.

The reasons for this new and relative optimism rest very little on fundamentals of the economy. If in this phase of profound uncertainty, growth estimates have some, we should conclude that a Eurozone GDP expected on the rise of 0.6-0.8% this year is less than half of that estimated for the United States (about 1.5%). And, if we want to believe that the profits of the’s & P will increase by 8.9%, against just 2% of the Stoxx 600 (LSEG consent), we should think that Wall Street is a little more interesting.

But Wall Street is dear, since it expresses a price/profit ratio of 21.3, according to consent, and 22 according to Goldman Sachs estimates. Instead the P/S of the Stoxx, at 13.5, would be just over half. But above all in Eurozone the inflation at 2.2% (2.7% the core component) is lower than the US one (2.4% in March, but estimated to grow in April) and, consequently, the ECB would have more room for maneuver in cutting rates.

Comparison

The competitive advantage of European bags would therefore be in the lowest assessments. The problem is that nobody knows how things will go, let alone in America. It has been made to justify the leaps of the indexes in the last three weeks with the alleged change of tone of Donald Trump, apparently more reconciling on universal duties.

But it was only a pretext, caught by the army of small investors to buy on the discounts, which triggered the covers of the hedge fund and then the purchases of quantitative management and ETFs: Because, with the triumph of automatic management, the upsiders generate other rises. But the duties remain and, although reduced by ridiculous 160% to 60%, as in the case of China, are destined to do the same damage. Of course it is difficult to quantify them.

At first glance the scenario painted by S&P Global sounds alarming: « The risks remain strongly oriented downwards, » writes the research company. And then it turns out that that trepidation is resolved in an estimate of the US GDP reduced by 0.5 points to 1.5% and filled with a decimal for the Eurozone one (0.8%). And, with other such predictions, the group of those who, in words, prospect the recession, is ingredged. The chances of such an event range from 45% estimated by Goldman to 90% of Apollo GM. A survey of the WSJ at the beginning of April gave them to 45%, against 22% of three months earlier.

The « sentiment » of economists

There is the impression that the group of pessimists has grown in the last few days, although many economists have remained to openly propose a recession, so as not to make mistakes as in 2022, Observes Mike Feroli by JpMorgan. In fact, a graph of WSJ shows how the percentage of those who shout at the recession is under 50% against 63% of October 2022, when nothing serious happened. But, in a more recent graphic graphic by Unicredit, the probability has risen over 60%. Perhaps JPM’s economist is right in saying that the situation is today much more serious than three years ago, if only because today the Fed rate is higher and because the treasure has no more money to spend in subsidies.

Above all, the perception that the rest of the world has towards America has changed. Real data do not authorize so much (declared) pessimism. The American economy is showing itself very resistant. The occupation grew in April 177 thousand units, well beyond expectations; The consumption, although reduced a little, increase to the rhythms of 4% per year, the real estate market holds, the orders of durable goods grew by 9% in March, when even inflation seemed to have cooled. But the polls have described a completely different situation: consumer confidence for the minimums for years, PMI indices and Ism manufacturing in contraction, detections of the regional Feds that would foreshadow the disaster.

Small businesses worried

Even the optimism of small businesses (NFIB), traditionally close to the Republican Party, has clouded, after the initial euphoria for Trump’s victory. Above all, inflation seems to fly, both in the unreliable surveys between consumers, and in the most reliable ones of the directors to the purchases of large companies.

The gap between hard data (real numbers) and soft data (polls) has expanded dramatically. It is assumed that the latter can foreshadow the former with an advance of 3-4 months. And usually so it was; But not between March and June 2023, when the pessimism of the polls clashed with real data in clear progress. Today the gap is being proposed again and since March it is increasingly wide. Goldman claims that the two curves should reconcile within two or three months, so that the positivity of the real data should somewhat attenuated. But, in the uncertainty generated by Trump’s economic policy, everything becomes difficult to decipher and very distorted, starting from the apparent good growth in consumption up to the unexpected contraction of the US GDP in the 1st quarter: Numbers both conditioned by the desire to grab assets before the arrival of the duties.

/s3/static.nrc.nl/images/gn4/stripped/data132130047-fe30e0.jpg|https://images.nrc.nl/W2hWMrilgePskd_q_jCmkruDQCM=/1920x/filters:no_upscale()/s3/static.nrc.nl/images/gn4/stripped/data132130047-fe30e0.jpg|https://images.nrc.nl/SSHJlO6HdeyOQSc8CGuQLapz-rM=/5760x/filters:no_upscale()/s3/static.nrc.nl/images/gn4/stripped/data132130047-fe30e0.jpg)