USA: How much will the Trump duties cost the average American household

President Trump’s potential plan to impose a 20% general duties on all imports could push households, especially those at the lowest end of the income spectrum, according to his analysis The Budget Lab in Yale.

The Yale Budget Laboratory is a non -party politics research center dedicated to providing a thorough analysis of federal policy proposals for the American economy.

Trump duty plan that has leaked (20% in all imports) could cost the households more than $ 3 thousand

In the analysis published by the Political Research Center this week, the team found that a 20% duty on all imports would bring the average US tariff rate to the highest level since 1872, when it is stacked along with other duties that have entered into force in recent months.

Researchers said the proposal would increase prices somewhere between 2.1% and 2.6%, depending on how other countries would react to Trump’s new duties and the US Federal Bank’s reaction. « This is equivalent to the loss of a purchasing power of $ 3,400-4,200 per household on average in $ 2024, » the team said.

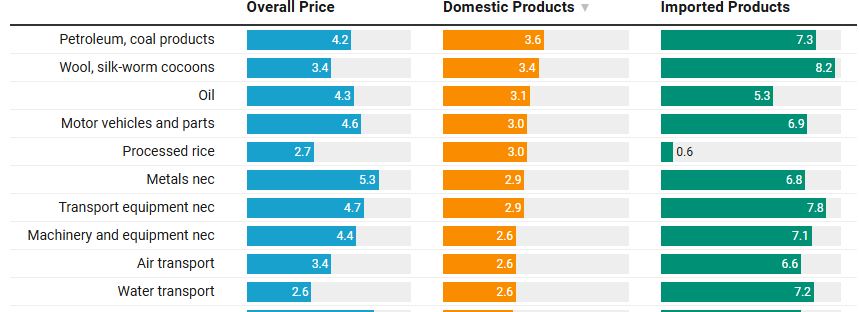

The largest increases in imported products.

The impact on real GDP

The report comes as Trump is preparing to announce hundreds of billions of dollars on Wednesdays on new taxes on imports, such as Underlines The Hill.

The president is allegedly deciding between the imposition of a single single duty on all imports, a single tax on imports from certain countries or adapted tax rates for other countries.

If Trump chooses a single duty 20 percent, the Yale budget laboratory found that it could slow economic growth this year, adapted to inflation, considering that the actual increase in gross domestic product (real GDP) could be 0.9 to 1.0.

Larger increases in US -produced products. The industry will suffer a big blow.

Duties will cost the US economy from $ 90 to $ 180 million

« In the long run, the US economy will shrink by $ 0.3-0.6%, equivalent to $ 90-180 billion a year to $ 2024, » the analysis said, while noting that world GDP could also shrink in the long run, as it was in the long run.

Food prices could also increase, the analysis, as well as the cost of crops, fresh products, oil, gasoline and car prices.

« For the average new car that will be sold in 2024, this would be equivalent to an additional $ 3,700 in price, with foreign cars and high foreign cars being relatively more exposed, » the analysis said.

The 10 +1 larger increases in products regardless of domestic production or import.

What are the profits for the American economy?

The indicative proposal to impose duties of 20% increases revenue by $ 2.7-3.5 trillion in the period 2026-35 with a conventional calculation and $ 200-400 billion less, given the dynamic impact on revenue.

Duties are a type of tax imposed in such a way that the tax rate is reduced as the amount subject to taxation increases. Losses for households with the least available income would range from $ 1,000-1,300.

Clothing and electronics are expected to be disproportionately affected. Medicinal products (first table) will see price increases above average. Correspondingly, imports of metal (especially aluminum), cars and all motor vehicles, spare parts and machinery will suffer large increases.

Why does Donald Trump pursue this policy?

Donald Trump’s long -term plan is said to be the strengthening of domestic production through duties and secondarily the financial justice that is implied. In this regard, it has attracted increased foreign investments with companies already operating in the US.

Foreign companies investing in the US on the one hand will have an advantage, as they will not undergo 20% duties by opening US factories, and some of them may be deducted from these duties precisely because of investment in the US. The new job balance as to those to be abolished (redundancies of workers) is not yet known.

The confident fall of the purchasing power of the citizens (and voters) and their reactions, which has been the spearhead of the Trump election campaign along with the immigration, is expected to judge along with the reactions of the countries to which the duties will be imposed.

More specifically financial statistics and the You can find a complete survey of the Budget Laboratory here.

/s3/static.nrc.nl/images/gn4/stripped/data133212332-41b949.jpg)