Trump’s customs break lets share prices ride worldwide

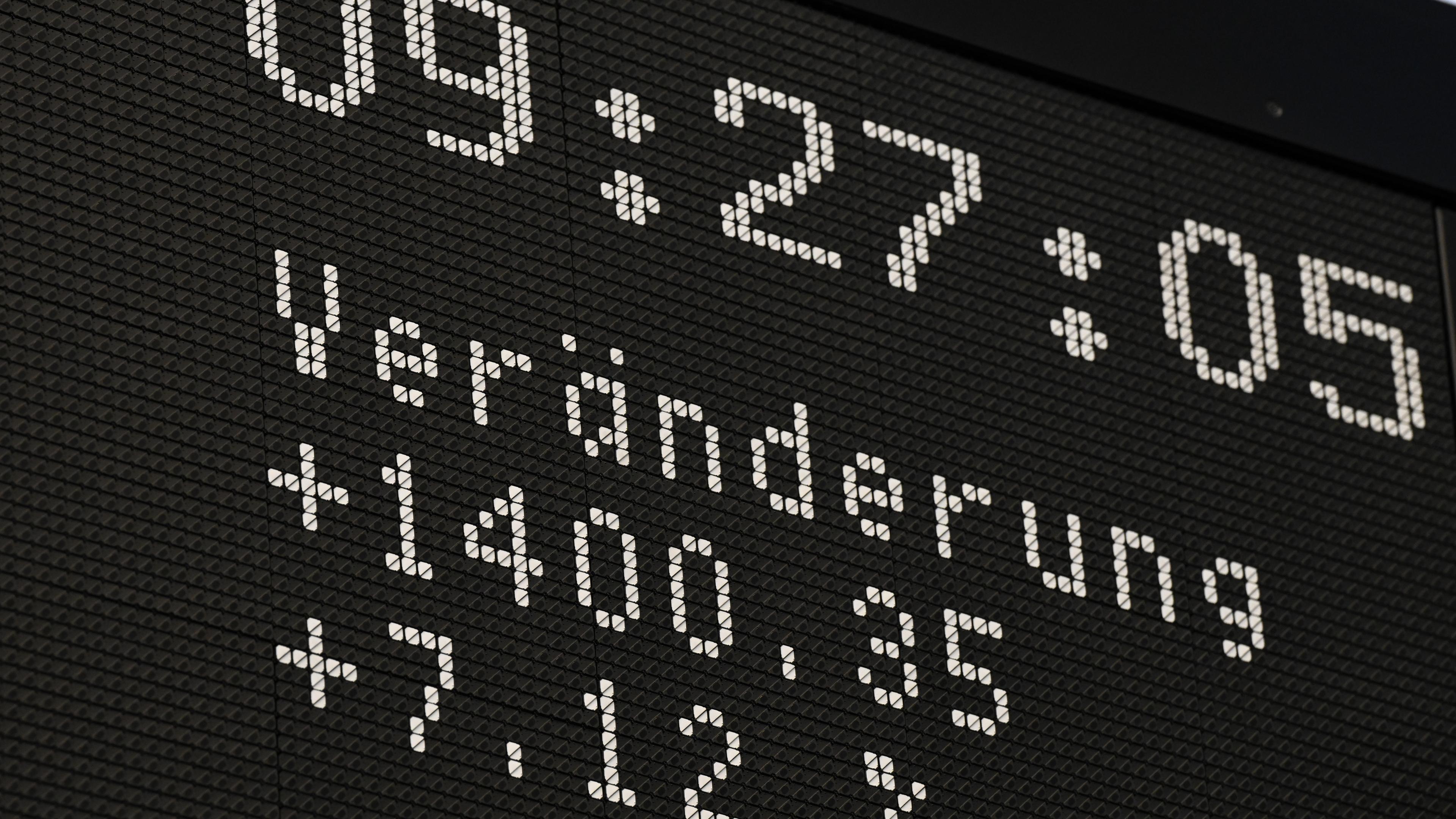

The German stock index (DAX) rose by 8.24 percent to 21,291.15 points at the start of the trade. Investors reacted to the decision of US President Donald Trump to suspend special tariffs for numerous countries. Previously, the stock exchanges on New York Wall Street and in East Asia had already started to catch up.

The MSCI Asia Pacific Index rose by 5.4 percent. The Japanese Topix rose by eight percent, the Australian S&P/ASX 200 by 4.7 percent. The Hang Seng in Hong Kong increased by 2.9 percent. The Shanghai Composite rose by 1.2, the Euro Stoxx 50-Futures rose by 7.7 percent.

The currencies also increased. The euro rose by 0.3 percent to $ 1.0981. The Japanese yen rose by 0.7 percent to $ 146.73. The British pound rose 0.3 percent to $ 1.2856. The cryptocurrencies Bitcoin (fell 1.3 percent to $ 82,098.84) and Ether (minus 3.4 percent) lost value. The spot gold price rose by 1.3 percent to $ 3,121.27 per ounce. West Texas intermediate crude oil fell 0.9 percent to $ 61.80 per barrel.

Trump had triggered a descent on the stock exchanges last week with the announcement of high import duties. After violent turbulence on stock exchanges and financial markets, he changed his course on Wednesday and has just exposed additional duties for 90 days.

Ten-percent-customs continue to apply

For most countries, however, a general import tariff of ten percent should continue to apply. The tariffs for goods from China, meanwhile, increased Trump to 125 percent.

EU Commission President Ursula von der Leyen called Trump’s change of direction an important step towards stabilizing the economy. « Clear, predictable conditions are essential for the functioning of trade and supply chains. » The European Union continues to campaign for constructive negotiations with the United States, with the aim of achieving a smooth trade and advantageous trade for both sides.

US President reacted to unrest

Trump justified his swiveling that the « people » had become a bit restless and « a bit anxious ». Economists had seen an increased risk of recession in the United States in the additional tariffs.

It had also emerged that investors could sell US state bonds – a worrying development for the future of American finances. Market observers guess that this development could have brought about the customs break. Minister of Commerce Howard Lutnick denied this in an interview by the CNBC economic station.

Also skepticism among analysts

The echo with German stock exchange experts on Trump’s swivel was different. « The news shows that the Trump administration reacts to the deteriorated economic prospects and market turbulence, » said investment strategist Ulrich Stephan from Deutsche Bank with behavioral optimism. In his view, the current price level could be interesting in the long term.

The judgment of Markt analyst Jochen Stanzl from the Broker CMC Markets was more critical. « Economy consists of trust and here the US President has smashed a lot of porcelain in the past few weeks, » said Stanzl. Universal tariffs of ten percent would also apply unabated.