Trump duties: What are the challenges for the Greek economy (graph)

Following the disorder caused by the pandemic, the Greek economy is recovering from the many years of debt crisis in the midst of an unfavorable international economic environment: energy crisis, war conflicts and geopolitical tensions, as well as strong protectionism policies today on the part of large economies. In general, the strengthening of domestic economic activity in Greece is based on: (a) on the postpandedemic rise of tourism, (b) on the resources of the Recovery and Ruration Fund (TAA), (c) the credit expansion of monetary and financial institutions (NGI) (Recovery of an investment grade from the 5 credit rating agencies accepted by the Eurosystem).

Although it remains uncertain what will be the new regime of trade relations between the world’s major economies (USA, China, EU-27), the challenges facing the Greek economy are intensifying. The demographic problem, the low participation of the economically active population in the labor force, the investment gap, the low labor productivity and the deficit of structural competitiveness preceded the disorders that can cause new protection policies in international trade. Therefore, the need to promote reforms that can mitigate the above problems and improve the medium -term prospects and resilience of the economy is reinforced. In the short term, the economic situation indicators for the first quarter 2025 broadcast positive messages for the performance of the Greek economy at the beginning of the year. The first effects of protection policies internationally are expected to be imprinted in the following quarters (they are an upward risk to inflation and a downward risk for growth).

The climate for the economy in Greece

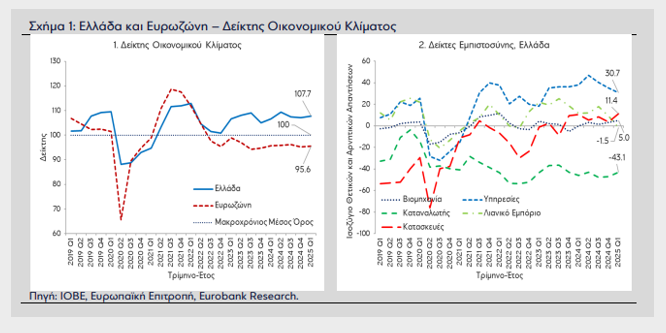

The average of the economic climate index in Greece (Source: IOBE) recorded a slight improvement at 107.7 points in the first quarter 2025, remaining higher than the eurozone for 11th quarter in a row (see Figure 1.1). (1)

This qualitative trait reflects to some extent the over -performance of the Greek economy over the eurozone in terms of real growth. In terms of the 5 indices of trust that make up the economic climate index, 3 moved up and 2 downstream.

Improvement was recorded by the trust indicators of industry, consumer and construction, while the corresponding indicators of services and retail trade (see Figure 1.2) were worsened.

The economic climate remains positive

The above evidence shows that the economic climate in Greece remained at relatively high levels in the first quarter of 2025 (far exceeding its long -term average). The Industry Industry Industry is resilient, in the construction is in the recovery phase, while in the services, despite the decline of the last quarters, the prices it receives are relatively high.

Nevertheless, the retail -trade confidence index has again returned to negative territory (more negative answers than positive), while the consumer remains strongly negative without a tendency to improve.

The latter is linked, among other factors to the effects of accumulated inflationary pressures (based on ELSTAT ETK, in the 5 years 2020-2024 the total increase in food prices exceeded 30%).

Finally, it is worth noting that the next observation of the economic climate index, namely Apr-25, will incorporate the first effects on the level of economic situation and expectations of the new US Timoty Policy (USA).

Accelerated the improvement of processing

The S&P Global Supplies Index for the manufacturing sector in Greece increased to 55.0 points on MAR -5, from 52.6 in Feb-25, indicating the acceleration of the improving rate of operational conditions in the processing sector.

This improvement, the highest of the last 11 months (see Figure 2), reflects the highest levels of production, new orders, input purchases and employment of manufacturers involved in the survey.

At the same time, due to the strengthening of raw material prices and transport prices, the charges have been uploaded at the highest pace from Feb-23 (businesses passed on part of the increased production costs to customers).

For the total quarter of 2025, the PMI processing index in Greece was reinforced to 53.5 points, from 51.8 points in the fourth quarter 2024, interrupting the downward track of the previous 3 quarters.

In addition, as recorded in the economic climate index, as in the PMI processing index, the Greek economy is over -running over the eurozone. This is clearly imprinted on the level of national accounts.

In the 3rd year 2022-2024 the actual gross added value of the manufacturing sector in Greece increased by 14.4% against a marginal reduction in the eurozone by -0.2%.

Source: ot.gr