Trade Estates: Consolidated Financial Results of Use 2024

Trade Estates AEAP (Bloomberg: Trestate: GA – Reuters: Trestatesr.at – Isin: GRS534003009) announces the consolidated financial results of 2024.

- The A total of 46.2m euros in revenue was 46.2m compared to EUR 26.7 million (increased by 73.1%) compared to 2023.

- The Revenue from rent amounted to 37.5 million euros compared to EUR 23.9 million (increased by 56.9%) compared to 2023.

- Customized profits before taxes, interest and depreciation (Adjusted EBITDA) amounted to 30.1 million euros compared to EUR 18.2 million (increased by 64.9%) compared to 2023.

- Net profit, not including profits from adjusting the fair value of investment in real estate, amounted to € 13.1 million compared to € 7.5 million (increased by 75.2%) compared to 2023.

- The Chapters from operational activities (Funds from Operations) amounted to EUR 15.2 million compared to EUR 8.9 million (increased by 70.9%) compared to 2023.

- Total assets of 605.1 million euros 31.12.2024 versus EUR 543.8 million (an increase of 11.3%) compared to 31or December 2023.

- The mixed fair value (Grass Asset Value) on 31.12.2024 stood in 541.5 Million of EUR 486.0 million at 31.12.2023 (increase of 11.4%).

- The internal accounting value (NET Asset Value) 31or December 2024 rose to 311.9 million euros (€ 2.59 per share) versus EUR 298.4 million (€ 2.48 per share), with an increase of 4.5% compared to 31or December 2023.

- The Board of Directors will recommend to the regular general meeting of shareholders to convene 13or June 2025, the distribution of a dividend of EUR 12.052.877.10 (which corresponds to a net amount of € 0.10 per share) for the use of 2024. Company Council, the balance for distributed dividend is € 6,302,931.55 (ie € 0.052294 per share).

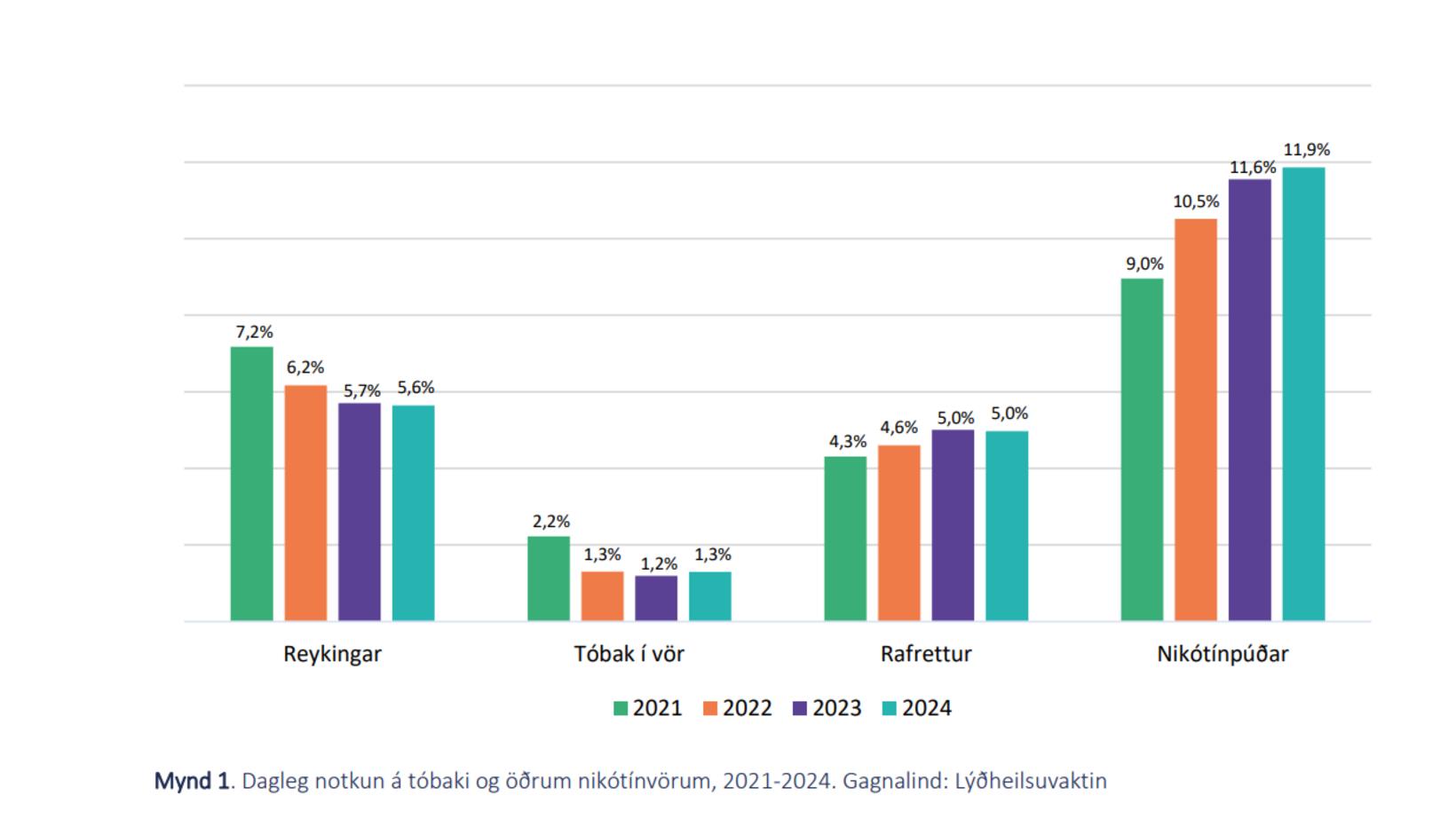

The basic financial sizes and the key indicators on a consolidated basis are presented as below:

| Basic financial sizes (amounts in thousands of €) | FY 2024 | FY 2023 | % |

| Set of revenue | 46.194 | 26.688 | 73.1% |

| Adjusted ebitda(1) | 30.078 | 18.238 | 64.9% |

| Profit after taxes (not including profits from affordable value adjustment) | 13.083 | 7.469 | 75.2% |

| FUNDS FROM OPERATIONS(2) | 15.227 | 8.910 | 70.9% |

| 31.12.2024 | 31.12.2023 | % | |

| Cash and cash equivalents | 26.881 | 19.080 | 40.9% |

| Loan obligations | 265.568 | 220.071 | 20.7% |

| Loan obligations to mixed fair value | 49.04% | 45.28% | 8.3% |

| Loan obligations minus cash -available in gross value | 44.08% | 41.35% | 6.6% |

| Internal Accounting Value/Per share | 2.59 | 2.48 | 4.5% |

- In 2024, consumers who preferred to visit Trade Estates trade parks amounted to 21 million, recording an increase in 2023 by 11.2% while store sales increased by 7.4% compared to 2023, reaching € 480 million. Non -Brand IKEA related from 41% to 31.12.2023 to 57.8% in 31.12.2024, confirms the successful lease management strategy.

- The agreement on the creation of Trade Estates of the Inter IKEA International Distribution Center in Aspropyrgos, while work on the property on which the Interikea International Logistics Center are being erected are proceeding with intensively and evolving on the basis of the project schedule.

- Referring to the construction of a new Logistics Center in Elefsina to be leased to Kotsovolos, urban and building licensing is evolving.

- On October 14, 2024, a divisive horizontal owner was signed with the company of HELLENIC MAE. (subsidiary of Lamda Development SA), for the implementation of a retailer (« Retail Park ») at Commercial Hub, where « The Ellinikon Mall » will also be developed.

- On November 30, 2024, the Top Parks commercial park of Patras with 100%lease is started.

- On December 2, 2024, the merger procedures for the subsidiaries « Rentis Investments of Property SA » and « Bersenco SA » from the company were completed.

- On December 23, 2024, the payment was made for the financial year 2024.

In the field of commercial parks, the construction activity of the new commercial park in Heraklion, Crete, is intensifying with an integration plan in the second quarter of 2025.

On 31.07.2024 an agreement was signed between the company and TEN BRINKE HELLAS SA to acquire all of the ‘personal development and exploitation of immobilized public limited companies’ (after the cumulative fulfillment of the defined conditions), which holds a plot of surface area of 50.882.52.52. In the Heraklion Regional Unit, in which a new commercial complex will be developed with a total leaseable area (GLA) of 14,770 sq.m. about.

On February 4, 2025, the Fourlis Group successfully completed the mood through private positioning of 16% of Trade Estates AEAP’s share capital in a limited cycle of institutional investors, resulting in a reduction in the participation of the Fourlis Group below 50%.

This development leads to the remuneration of Trade Estates from the financial results of the Fourlis Group, remaining 47.3%of its largest shareholder, followed by Autohellas Atee (12.88%), Latsco Hellenic Holdings (8.11%) 0.97% and free dispersion at 30.72%.

Mr. Dimitris Papoulis, Managing Director of Trade Estates AEAP, said in this regard: « In 2024 it was an excellent year for Trade Estates AEAP as our financial performance has significantly exceeded the Guidance of the year, for the benefit of the company and its shareholders. The over -performance of our commercial parks, the launch of the Top Parks of Patras in 2024 and, in particular, the complete integration of Smart Park have contributed to a strong increase in all of our sizes. We continue to implement our investment program seamlessly, with the delivery and operation of the Top Parks Trade Park in Heraklion in Heraklion and the Interikea International Distribution Center in Aspropyrgos, while considering new investment in the trade in commercial real estate and logistic centers.

With the completion of the private placement of 16% of the share capital by the Fourlis Group, it was achieved the expansion of our company’s shareholder with the entry of new powerful investment schemes, while existing key shareholders increased their participation, giving us strong vote.

The proposed recommendation of the Board of Directors to the upcoming Regular General Assembly to distribute the highest dividend (€ 0.10/share) to date, confirms our strategy and dedication to the creation of value for our shareholders. «

Trade Estates SA

Department of shareholders and corporate announcements

(1) Customized earnings before interest, tax and depreciation, earnings prior to interest, tax and depreciation (Ebitda), now/(minus) of net loss/(profit) from adjustment of investment properties to reasonable values and now the non -cash output for shares concession programs.

(2) As funds from operating activities (Funds from Operations), the period profits are now defined the depreciation of assets, minus/(now) the adjustments for entry into the net position, minus/(now) the net profit/(loss) of adjustment of investment property to reasonable, minus/(now) adjustments for investment companies and non -investment companies.