To calm the tension and the growth of stock markets

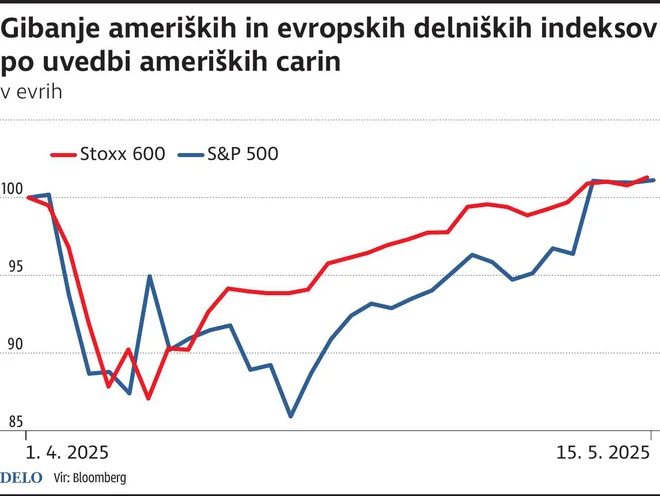

The global equity markets continue, the central US stock index S&P 500 has gained 22 percent from DNA in April, especially on the wings of sectors that have suffered the most in the first quarter, that is, information technology, consumer goods and communication services. Trade war and US and China’s customs deeds, which have abolished customs duties on most products for 90 days, certainly bring benefits and calm tension at global level, but customs obstacles and disorders in supply chains will be slightly less, but still affect the global economy. The consequences of trade disorders will be most significant through higher inflation and pressure on the margins of companies, but due to the strong fundament of US companies and supporting fiscal measures, the central scenarios in the United States are no longer a recession.

US shares have gained additional impetus in recent days when Trump announced the release of exports of artificial motor in Saudi Arabia. On the other hand, British shares experienced growth, mainly due to a new trade agreement with the US and reducing interest rates of the British Central Bank. In Europe, increased infrastructure and defense expenditure is supported by European shares, which are also more favorable valuable.

Comparisons

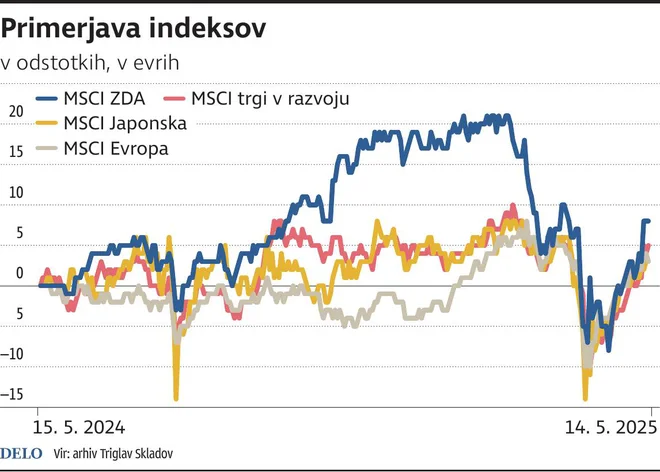

We remain optimistic of developed stock markets, especially to the US and Europe. In the US, investments in artificial intelligence maintain profits in the technology sector, while the Japanese market prospered for returning inflation and accepted reforms related to investment in shares. On the other hand, the economic picture of Japan is slightly worse, as in March the real salaries have fallen for the third time in a row, this time by 2.1 percent annually. This reduces the chances of a « positive circle » in which wages and prices would jointly promote the economy. The Central Bank of Japan has pointed to the uncertain economic environment, where trade tensions and political changes in different countries pose an important risk to economic activity and price stability.

Regarding debt securities, analysts are retained to long -term US government bonds, as fiscal deficits and persistent inflation are expected to cause higher long -term returns. They give priority to shorter maturity and the European credit market due to more favorable returns. The role of gold as a safe refuge was reaffirmed, as in times of greater geopolitical tensions, it exceeded the profitability of both dollars and US long -term bonds, and further increased its attraction that US banks will be able to rank gold as high quality assets.

Mitja Baša, Triglav Funds Photo Jernej Lasic Jernej Lasic

It will also be very important to monitor inflation data, as the effects of new customs duties can begin to show at the prices of basic goods. April information on inflation in the US has shown the slowest price rise (2.3 percent annually) since February 2021, and the effects of the customs of President Donald Trump have not yet begun to be reflected in consumer wallets. Since inflation is still « sticky », we do not expect the US central bank this year to significantly reduce interest rates, as it has to deal with balance between growth and inflation support support.