This solution is a shot for yourself in the leg

The wrong time

Alexander Izgorodin, chief economist at Citadele Bank, believes that time to raise the country’s taxes is unsuitable for two reasons. « The first aspect is already the first signs that the Lithuanian economy is slowing down: Lithuanian exports to Germany are no longer and most importantly that the expectations of Lithuanian consumers are falling quite rapidly.

According to him, another argument that encourages tax reform is related to the global conjuncture: « On the one hand, the US President Donald Trump’s administration seems to reduce tariffs, but as long as there is no specific step, there is a relatively high uncertainty about what will happen next.

« The rates that deteriorate consumer expectations, export to Germany – all of these things are very clear that the tax reform is currently a very unfavorable time. In this case, it is best not to do anything, wait for the economy to intensify, and then maybe return to tax reform, » the economist concludes.

According to Kaunas University of Technology (KTU) Faculty of Economics and Business (EVF) Professor Rytis Krušinskas, tax transformations are not convenient time. « If we talk about the economic cycle when it is at the carpet stage, it is argued that reforms can slow down growth. The decline stage argues that the economy is still shrinking, and this will also result in taxes and they will be even more than the economy itself, » says Krušinskas.

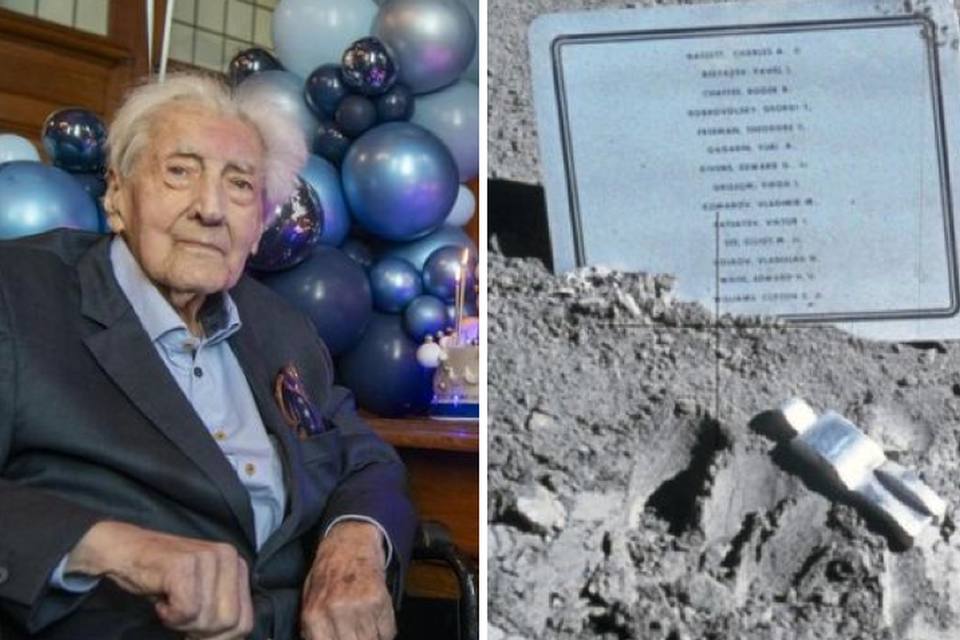

Insights: A. Izgorodin notes that the time to raise the country’s taxes is inappropriate. / P. Peleckio / Photo by BNS

However, the economist is convinced that the public should understand the need for tax redevelopment for the state. The problem he sees citizens’ distrust.

According to R. Krušinskas, the mandate of confidence to the current government, which was granted in advance during the election, is gradually decreasing.

He misses the consensus of the ruling with the public and the business, as well as the strategic thinking and purpose. « It is the wording of the goal in this situation that is very strange, » says R. Krušinskas. part of what society, its concentrated approach to a common goal and breaks down. I think it was a big tactical mistake. ”

KTU EVF prof. Vaidas Gaidelys recalls that the need to change the tax system for Lithuania, introduce some new taxes, such as real estate (real estate), the language of the international organization has long been the language, so the news is not here. However, he also admits that the situation is really complicated at the moment: « Now there is a lot of uncertainty about actions independent of Lithuania. In addition, we are not the only ones to do so, other countries, the Baltic States.

Tariffs, deteriorating expectations of consumer, export to Germany – all of these things are very clear that implementing tax reform is a very unfavorable time.

« Lithuania, according to the competitiveness index, is in fifth place. With taxes ascending, we can fall to the ninth place, but it will also depend on what other countries will take on the tax burden. taxes payable, ”says V. Gaidelys.

Parallels with 2008

During the geopolitical and economic uncertainty, some experts turn to previous shocks, such as the global financial crisis in 2008-2009. Critics of the reactions of then -decision -making makers say that in the event of a crisis, the economic recovery would have been faster if instead of the belt’s strap policy, an economic promotion of anti -cyclic policies had been chosen.

Currently, the new German government, which has begun the US and partners in the US and its partners, are sending a message that the fiscal German conservatism will remain back in the challenges: Coalition of Chancellor Friedrich Merz intends to reduce part of tax, energy prices, and 100 billion euros in the country’s infrastructure and defense.

However, economist A. Izgorodin says that anti -cyclical economic policy should be viewed very carefully as it always increases the budget deficit, especially during the crisis, as the country’s GDP is falling and budget spending is very rapid: “ There would be no reforms that can further worsen consumer expectations.

Important: R. Krušinskas misses the consensus of the ruling with the public and business, strategic vision and purpose. / E. Ovčarenko / Photo by BNS

Instability and flexibility

According to R. Krušinskas, after 2008-2009. The prediction of the global financial crisis economy and factors that may have one way or another have been very distinguished. Now it seems that the economic world is facing new challenges that are hardly possible to provide for readiness.

According to the economist, today Lithuania really needs freedom, but not freedom from taxes, but more freedom to act. « Then business will pay more to the budget with the same taxes, » Krušinskas doubts.

The country also needs a flexible approach and ability to prepare for different standards, which costs and is not easy to implement. Mr Gaidelys says that his agreement on the viability of the economy could also be contributed to his aforementioned agreement on non -raising the basic taxes for a period of time, value added tax (VAT) in favor of high value -added sectors – information technology, biotechnology, green technologies related to sectors, etc. There are also additional benefits for research and experimental development, the modernization and simplification of the business environment regulation, and of course the promotion of investment.

Although R. Krušinskas agrees that the Lithuanian economy has demonstrated good resistance in the context of recent crisis, it is not guaranteed that the ability to adapt will allow to achieve the growth as predicted. « The economic forecasts of all major agencies are adjusted to the side of a decline, as the world of international trade has been a breakthrough in the world. It is so bold to say that we will only reach our desired goal from economic growth alone, » 5-6 % of the set. R. Krušinskas speaks the BDP defense budget. He has a hard time imagining the collection of the intended defense budget without borrowing.

Time: V. Gaidelys reminds that the need to change the tax system for Lithuania has long been talked about, so the news is not here. However, he also admits that the situation is really complicated at the moment. / Photo by J. Šuminaitė

Other effects

Mr Izgorodin points out that the indefinite situation and dangerous taxes can also cause other effects: in Europe, he equates a higher reward to the Personal Income Tax (PIT) in the background of the talent, equates to a shot at the foot. « I do not know what arguments the government wants to increase PIT, but first and foremost, this is a tax that brings a very low benefit to the state budget, because about half of all money is VAT and about 20 % of excise duties.

That « defense » becomes part of the secondary plan, what society, its concentrated approach to a common goal and breaks down. I think it was a big tactical mistake.

V.Gaidelys agrees that increasing PIT can actually lead to leakage of some professionals, such as the biotechnology sector. « However, according to the tax burden, we were in the EU as if in 17th place. The tax burden in 2023 in Lithuania was 32.6 % of GDP, and the EU average of the European Commission is 40 % GDP.

According to Mr Gaidel, the PIT fee will only rise significantly to persons receiving a significant higher than average salary, so the return on these changes will be extremely low and the financial injections of the defense budget are already required.

R. Krušinskas takes a similar approach – he says, even if tax correction is introduced from 2026, they will not show their true face until 2027. in the beginning of the 19th century, when all financial statements for the previous year will be submitted. « Do we have such a luxury for so much time to wait for the effect of the reform? », The economist raises the question. According to him, it was VAT raising by 1 %. The state budget would soon begin to fill in.