The temptation of the super billionaires: goodbye to London, better Milan (where there is the flat tax for the Scrooge): Arnault ready to transfer the residence

After 30 years, the hairdryer magnate is preparing to emigrate to Dubai, Switzerland or Italy to pay less taxes. The king of luxury Arnault meditates to transform the historic home of the Atellani into his main residence into the heart of Milan

The escape of the billionaires from London continues. The Indian groove of steel Lakshmi Mittal He would be considering leaving the United Kingdom, after the Labor Government has decided to abolish the tax regime of the « non-tales » (or « non-ten »), which allowed wealthy businessmen road men, residing in Great Britain, not to pay British taxes on foreign income. Mittal, who has lived in the United Kingdom for thirty years and who was last year with his family In seventh place among the major English fortunes, with an estimated assets of 14.9 billion pounds, about 17.5 billion euros, according to the Sunday Timesconfided to his entourage that he will probably leave the country, moving to a jurisdiction with a more favorable tax regime, in response to the narrow on the tax authorities of the new Laborist government, reveals the Financial Times. But the Indian group did not comment on the indiscretion.

The steel group that bought the Ilva

The Indian entrepreneur seventy -four years old, who is headed by 40% of Arcelrmittal, Second world steel group, now led by his son Aditya, protagonist in Italy of the unfortunate story of Ilva, now it could therefore « emigrate » in the United Arab Emirates, in Italy or perhaps in Switzerland, the most popular destinations by those who leave the United Kingdom after the government’s tax turn led by Keir Starmer.

He does not miss the choice: the Tycoon has a chalet in St Moritz, on the Swiss Alps, different properties throughout Europe, in the United States and Asia and is buying some properties in Dubai. In the United Kingdom, where he has numerous properties, he stands outTo his London residence in Kensington Palace Gardens: when he bought it in 2004 from the then patron of Formula 1 Bernie Ecclestone for 67 million pounds, It was considered the most expensive house in the world. A price of approximately 98.5 million euros at that time and which would be equivalent to around 121.5 million today, taking into account the current exchange rate and the inflation accumulated in the period.

The turning point of the Labor Government

THEthe non-ten regime, introduced over two centuries ago, allowed residents in the United Kingdom who declared their permanent residence abroad not to pay for income tax generated outside the country. This legislation has attracted numerous wealthy individuals in the United Kingdom. Its abolition, one of the workhorses in the political campaign of the Laborists, confirmed with the financial law presented last October by the Chancellor of the chessboard Rachel Reevespushed many of them to look for more advantageous tax alternatives. Also because at the same time the government also placed term to the use of trust offshore to avoid paying the British tax on successions, equal to 40%.

The Italian Flat Tax

Italy, and in particular Milan has become a privileged destination for these « luxury migrants » thanks to a tax regime introduced in 2017. According to Marco Cerrato, partner of the Maisto and Associati studio, on around 4,500 people who use the flat tax on income, about half chose their Lombard capital. This regime provides for an annual flat rate of foreign income for new residents, which was initially set at 100,000 euros and subsequently doubled to 200,000 euros in 2024. Despite the increase, Italy continues to attract an increasing number of high equity individuals.

But the significant increase in these new residents, who seek attractive locations to settle, paying less taxes, begins to have a relevant impact on the local real estate market, with an increase in luxury properties prices It is a growing pressure also on the non -luxury real estate market. As the flow of ricconi grows, the criticisms of the inhabitants therefore grow.

The king of luxury and the house of the Atellani

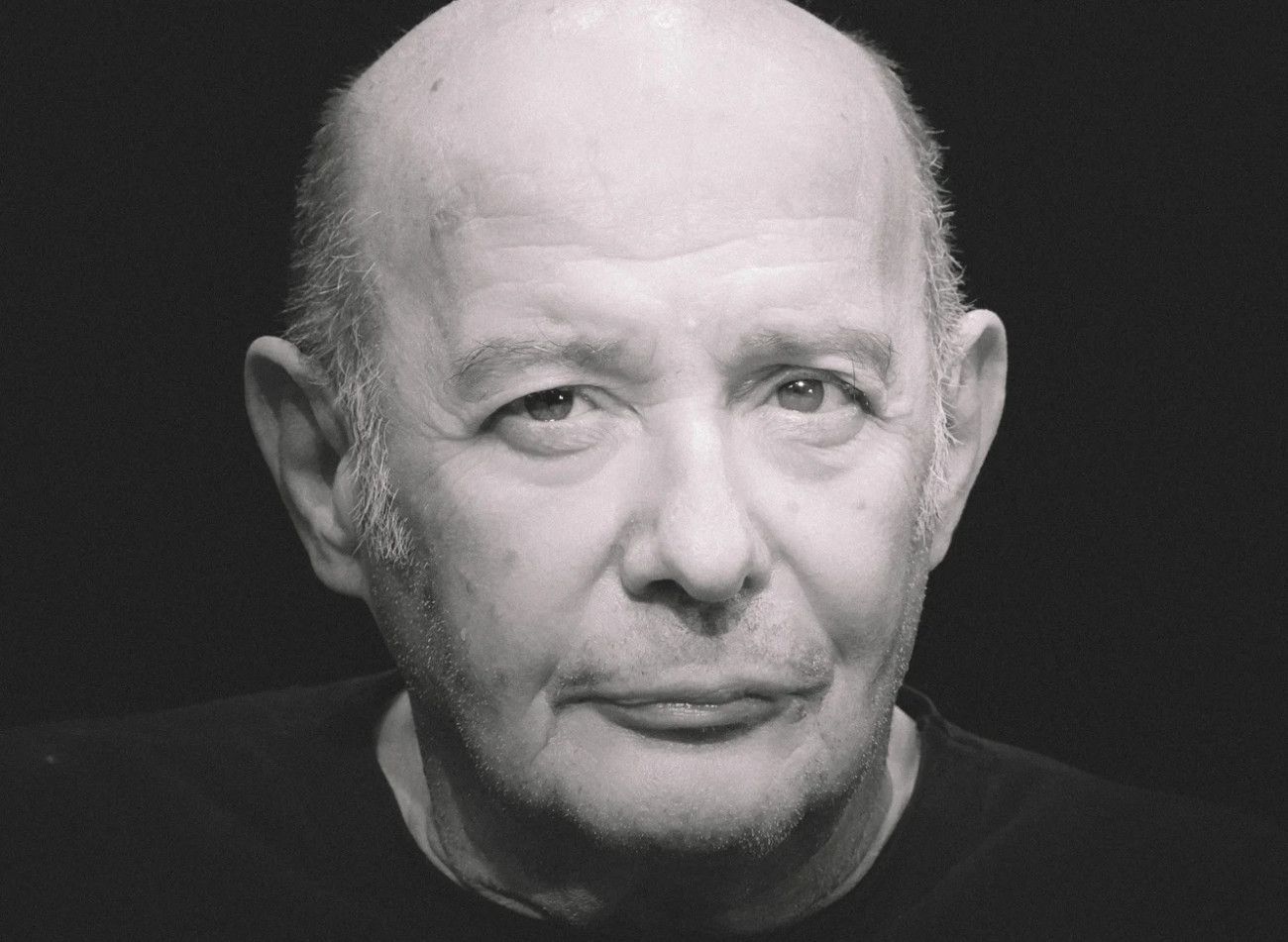

Bernard Arnault, 76 years old, founder, president and CEO of Lvmh and fourth richest man on the planet, with Lvmh, with an estimated assets in 176.7 billion from the Index of the Bloomberg billionaires.

The king of French luxury acquired the historic in December 2022 House of the Atellani In Milan, in Corso Magenta 65. This Renaissance residence, restored in 1919 by the architect Piero Portaluppi, is famous for hosting the vineyard of Leonardo, a vineyard originally donated to Leonardo da Vinci by Ludovico il Moro in 1498.

After considering several options for using the Atellani house, the idea of transforming it into an accommodation facility would have been set aside, to make it its main residence. A choice that could be influenced by the tax advantages offered by Italy to the new residents.

It is true that in January of this year Arnault denied the rumors about a possible transfer of the LVMH group. While underlining that the tax measures proposed in France could encourage relocations, the entrepreneur explained that no company is foreseen. But it would not be a matter of transferring the group’s seat, but his personal residence and tax domicile.