The share of non -distributed housing in the new buildings of the metropolitan region increased to 6%

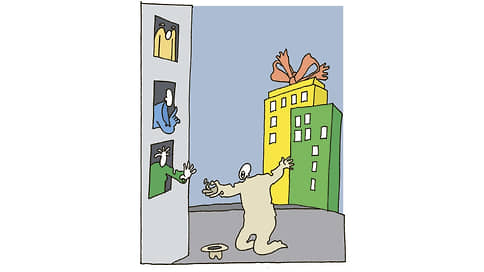

Over the past year, the number of apartments and apartments in Moscow and the Moscow Region, which developers cannot sell by the time the construction construction was completed, has doubled. It is especially difficult to implement illiquid lots on sale for more than a year after renting a house. The problem in high rates on mortgages and a decrease in solvent demand.

In May 2025, the share of non -gowned lots in the new buildings of Moscow and the Moscow Region, completed more than a year ago, increased by 3.5 percentage points a year to a year, to 6% of the total supply, follows from the calculations of URBAN analysts. Unfamed lots in the houses surrendered more than a year ago are already considered a non -excess, says Olga Khasanova CEO. The volume of such an offer doubled, up to 6 thousand apartments and apartments with a total value of 195 billion rubles, she said.

In general, the volume of non -expedient housing in all ready -made new buildings in Moscow is 8.6 thousand apartments and apartments with a total value of 400 billion rubles, and their share in the total exposition of the primary market is 14%, calculated in the Metrium.

According to the head of the analytics department of the Ricci Residential Real Estate, Marina Zhukova, the main reason for the growth of the volume of non -distributed lots is to reduce solvent demand. It, in turn, is explained by the general increase in prices, the abolition of the mass program of preferential mortgages and high rates on market programs, explain in BNMAP.PRO. According to Dataflat.ru, in April 2025, sales in the new buildings of Moscow and the Moscow Region decreased by 14% of the year, to 515.5 thousand square meters. m.

The share of unsold apartments may increase, for example, due to delays with the withdrawal of lots to the exposition by developers, noted by Mangazei sales director Fedor Ushakov. In conditions of barrage market rates on mortgages, developers can reduce prices or take a wait -and -see position, accumulating the exposition. Most companies choose the second path, says Anatoly Batalin, commercial director of the Garden Ring Group of Companies.

Unfamed apartments in the rented buildings become a burden for the developer: the company spends funds for maintenance of facilities in the form of utility payments, taxes, the shareholder of the RKS Development Group of Companies Stanislav Sagiryan notes. However, these costs are completely leveled by the highest cost of ready -made apartments, says David David David David, CEO of Optima Development.

It is less profitable to sell apartments in already rented houses than before the project.

High rates of implementation before commissioning allow you to reduce the project financing rate to a minimum possible level of 0.01%, said Larisa Maslyukova, sales director of Granel Group of Companies. In addition, a list of available tools for sale is reduced: installing installments in ready -made houses is more risky for developers due to shortcomings of current legislation, explains David Harriyan. In the case of apartments, commercial squares, pantries and machine places, the developer will be required to pay 20% of VAT when making a transaction in a finished facility, Marina Zhukova recalls.

The volume of non -distributed apartments and apartments will grow by the time the construction of facilities will grow, the market participants say. According to the NAMADOM.rf information system, in 2025, 9.6 million square meters are planned in Moscow and the Moscow Region. m of housing, of which only 69%are sold. In Russia in Russia, the situation develops even more pessimistic: in new buildings in the country, only 55% of the lots of 36.6 million square meters are sold. m, preparing for entry in 2025. So far, mortgage rates will not be reduced, and demand will not be restored, the share of non -elapsed lots can reach 8-10% of the total supply, predicts Stanislav Sagiryan. Developers, which, on the one hand, slowed down the withdrawal of new projects, and on the other hand, accumulated a fund of unrealized assets, risk losing a significant part of customers, which even less without this, Olga Khasanova concludes.