The Government proposes a 25 % tax of profit from cryptocurrency trading

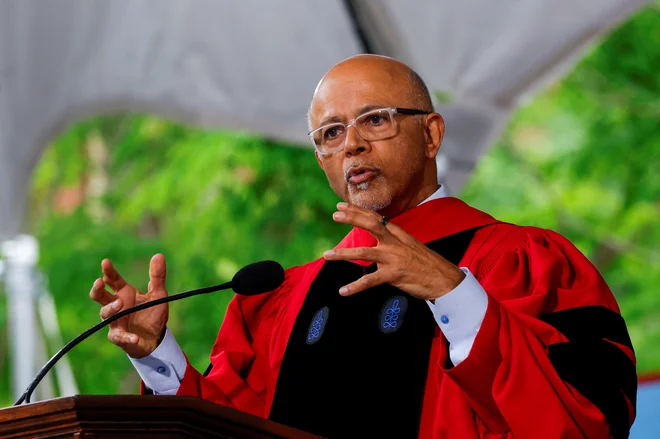

The Government gave a public hearing of the Law on Tax on Tax on profit from disposal today cryptocurrencies and amendments and amendments to the Law on Tax on Recification from the disposal of the implemented financial instruments, the Minister of Finance said at a press conference after the government session Klemen Boštjančič. Both are works of package of promoting the capital market in Slovenia, he added.

Namely, cryptocurrencies are not taxed at all, but at the same time the financial instruments were above average taxed at 40 percent. They want to equalize this tax at 25 percent.

The laws will be in public hearing until May 5, when they receive public responses, will prepare the final text. If the law is passed, profits from cryptocurrencies will be taxed from 1 in January 2026. The divestment is considered to be a cryptocurrency exchange for traditional currency or cryptocurrency transfer in exchange for goods or services or any other cryptocurrency transfer to another person, but does not include exchanges for other cryptocurrencies and not even transfer between the same holder.

Taxpayers will have to keep records of obtaining and disposing of cryptocurrencies, in common for all holders, and submitting it to the tax authority at request. Each year, they will have to submit a tax return to the financial administration and pay any tax. The proposal also introduces the possibility of a voluntary simplified calculation of personal income tax from the activity for five years ago. In this case, the tax base is determined in the amount of 40 percent of the amount of cryptocurrencies at 31.

According to Boštjančič, the bill also proposes a simple way of calculating personal income tax. « So we give people available to apply for themselves, » the minister said.

The government does not have estimates how much money could be started in the budget by these assets, because they are also very rough about how many are loaded. “It is quite clear that we do not cover this in any projections of the budget or revenue at all. The goal for taxation is not related to tax inflows, but mainly to consider that it is illogical and pointless that one of the most speculative financial instruments is not taxed at all. In some ways, this is an incentive for investors to invest in instruments that are significantly more regulated and also safe, « said the minister, who also owns cryptocurrencies.

Crypto -prone control is expanding in the world. The OECD has prepared a framework for reporting about them or the Carf standard, according to which they collect, report and exchange information about clients of service providers in relation to cryptocurrencies. The proposal also summarizes the provisions of the European Directive, which covers the reporting and automatic exchange of information between the EU tax authorities on income from transactions with financial cryptocurrencies.

The proposal for the amendment to the Tax Act from the disposal of implementation financial instruments fulfills the commitment in the Capital Market Development Strategy in Slovenia for the period 2023-2030.

What about taxation of excess assets?

Meanwhile, the Government of Changes in Taxation of Excessive property, which was designed as the starting points of last year as a Taxation of real estatein which the owner does not reside, according to Boštjančič, she has not yet gave off the table – and it is also unknown whether the BS project continued.

The government approved the proposal for the taxation of excess assets, accompanied by possible co -operation for relief of work, on 23 last December and made them public hearing. This has expired at the end of January, and since then despite some prime minister’s announcement Robert Golob There were no new steps regarding these tax changes.

Boštjančič said today that they received many comments in the public hearing. To obtain a wide range of opinions and views, the minister was also the purpose of the ministry in the preparation of the starting points.

Comments have been expertly analyzed in recent weeks and conducted quite a few meetings. According to the minister, the ministry has a solution that responds to these comments. He has not yet been able to give a clear answer as to whether the government would continue this project.

Changes in the taxation of excess (immovable) assets go primarily in the direction of support for housing politics, he once again stressed. According to the starting points, taxpayers could greatly reduce the tax burden in the case of the declared rental of the property into a long -term lease.

Boštjančič remarked that in analyzing the comments in the public hearing as a major problem exposed to the public, they detected inadequate legal protection of homeowners or landlords, and on the other hand, even lessons. This problem needs to be solved, so talks with the Ministry of Justice are underway, he said.

They want to encourage population investments

The government has also today confirmed the bill on individual investment accounts. « This account is intended to promote long -term savings of natural persons in financial instruments, » said Boštjančič. He added that they want to extend the possibilities for investing population savings, strengthen the Slovenian capital market and expand the sources of financing the economy. The key advantages of this account are simplified billing and payment of tax liabilities, more favorable tax hearings, great flexibility in investment management and emphasis on investors’ protection, he said.

The account is designed as a special form of trading account that allows investment in a set of financial instruments under certain conditions. It can be opened by a natural person who is a tax resident of Slovenia, but only once. In the first year, the holder can put a maximum of € 20,000 on him. Each subsequent year, it can invest a maximum of $ 5,000 and an additional $ 5,000, but only if it is invested in financial instruments of Slovenian issuers. The total sum of the payment must not exceed € 150,000.

A 15 % tax rate and exemption from payment of tax on the first payment from this invoice after 15 years, if there were no payments in the interim, are foreseen for promoting long-term savings.

The bill will go to the National Assembly, and at the Ministry of Finance, they expect it to be adopted by summer. It will start to use in nine months for the new system to be prepared by both individual investment account providers and the Financial Administration and the Securities Market Agency. Thus, these accounts are expected to come to life in the spring of next year. The holders will also be able to transfer the shares of the Mutual insurance company to them.