The funds that doubled the capital (in 5 years): here they have made

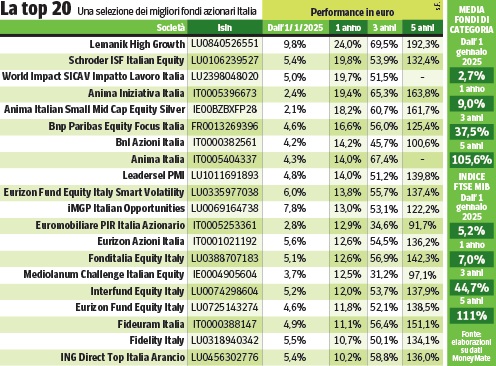

At five years of age, on average, those who focused on specialized products doubled the capital. But the best managers reach up to 192%. Defense and luxury among the objectives. And if the pyrs are back …

Piazza Affari suffers the duties, but even in a context of significant global instability, it could continue to do well. The budget of the funds is good, even in the short term. Those who had invested in the specialists on our list five years ago on average has doubled the value of its assets (105%, but the index made better with 111%). The best funds, however, at the age of five make up to +192% of Lemanikwhile at one year the best results range from 19% to 24%. What pushes the price list? Luigi Dompè, Equity Manager of Italy of Anima Sgr (two funds in the standings that offer over 50% to three years) thinks of the relative assessments of the market, which still remain at a discount compared to the rest of Europe and the US one, the partial implementation of the PNRR, the encouraging signals that come from the labor market, and to the tax turn in Germany of which Italy will be able to benefit as a primary exporter. According to Andrea Scauri, Lemanik’s Italy Equal Manager (9.8% from January and 24% to one year), it is likely that in the short term the bags are characterized by a high volatility that, adds the manager, thanks to a careful Stock Pickingit will allow you to seize opportunities on penalized quality titles. Scauri continues to remain constructive on the defense While on the bank is very selective and is evaluating utilities, penalized in recent years by the trend of rates, with a view to possible sectoral rotation.

Luxury, banks, telco

The utilities and infrastructure sector is considered interesting by Timothy Pedroni, manager of the Schroder ISF Italian Equity fund ( +19.8% at one year, +132% at five years): in light of the recent shock tariff, an additional superperperformance of these securities that are defensive is expected, given the positive correlation with the lowest rates, the cash flows, the very visible dividends and the favorable regulatory context. Pedroni also like the financial sector, especially for generous coupons and promises of buybackwhich should support the prices even in the case of a fastest rates reduction of rates by the ECB, and the IT sector. Dompè follows the financials and on some luxury titlestoday penalized by commercial tensions, but which can benefit from a resilient question and high profitability. It also prefers the companies most exposed to domestic or European business. Among the qualifications that best incorporate the qualities and characteristics sought in the selection of investment Dompè cites Telecom where the entry into the capital of Poste and the open dialogue with Vivendi for a rationalization of the shareholder open interesting perspectives. Among the financials Fineco is currently his first choice, as a better position positioned to deal with the digital transformation that affects credit and asset management. A good example of the application of Pedroni’s investment process is then Leonardo, the main Italian aerospace and defense service supplier. The leaders showed that they wanted to implement a corporate turning point, solving many of the operational, governance and financing problems that had afflicted the company for years.

Deepen with the podcast

An eye to the pyr

Scauri (Lemanik) looks with great attention to necessary, a company that operates in the management of NPL portfolios, a Danieliworld player in the construction of low -emission plants for the steel industry and Newlat Food, a agri -food Mid cap which, after the acquisition of the Englishman Princes, deals with a free cash flow yield Extremely interesting. About small And Mid CapScauri follows the companies that deserve higher multiples, as well as well managed, with winning business models and able to show important growth over time. Dompè is also moderately constructive on the segment of Small-Mid Capeven if the recovery may not be quick or homogeneous. A favorable factor, according to the analysis of the Sgr soul manager could be represented from a possible return of the PIRs, in turn supported by the important tax incentives connected to the instrument, or by further solutions to support the investments in these companies. Finally, Pedroni reports how the positive correlation between the drop in ECB rates and the Small Cap onperformance suggests to seek greater exposure to small companies at this stage.

READ ALSO