The escalation of customs measures has a major impact on capital markets

The unexpected amount of Trump’s customs duties introduced provided an exceptional fluctuation in the capital markets. Chinese retaliatory customs duties have further contributed to this. In doing so, stock exchange rates around the world have swung. What was exactly happening and how did it affect the capital markets?

Newly promised customs duties

The US President, Donald Trump, announced the introduction of a general 10 percent customs duties on all imported products from all countries with the beginning of April 5 in April. For some countries, it has announced even higher customs duties with a validity of 9. April, 20 % for the EU, 24 % for Japan and additional 34 % for China (54 %).

This began the escalation of customs measures between the US and China-by 7. April, the US introduced a total of 104 % customs duties to imported products from China, and China responded on April 9 by introducing 84 % customs to US products. On this day, Donald Trump announced a 90-day detention by customs for most trading partners, and China raised the total customs duties to as much as 125 percent.

Impact on capital markets

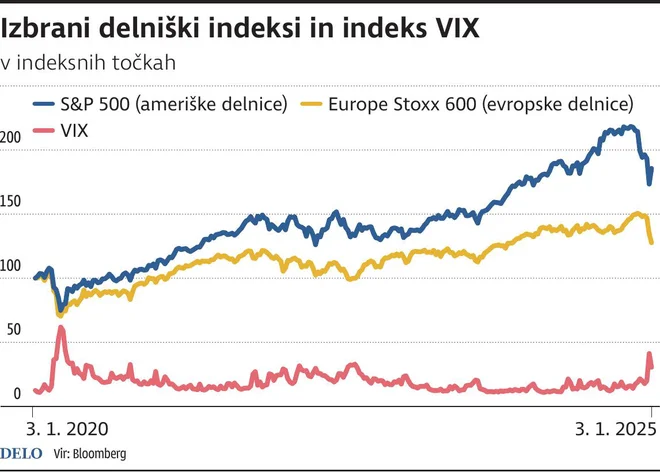

Chosenidelnskindksiininksvix photo TT IgD

At the time of Customs, 2 April, the next two days were followed by a sale in stock markets. The US shares were chopped by -11.4 percent and the European one by -11.7 percent. The indexang seng, which is a reference index for Asian markets, has dropped by -15.0 percent in two days. At the same time, the VIX index, which shows the expected future fluctuation based on the US market (S&P 500), climbed 45.3 on April 2, and 8. April even exceeded the value of 52. Vix over the value of 30 indicates considerable fear and panic among investors, which historically indicates a good time for sharing investments.

In the period from the announced customs duties to 8. April, US shares suffered losses of -12.7 percent. American shares in the energy sector (–19 percent) were most cheaper, and the least in the consumer goods sector (-7 percent). On April 9, the announcement of the 90-day deferral of US customs for most trading partners encouraged a remarkable jump of shares-in one day, US shares went up by + 8.6 percent, the biggest jump since October 2008.

Look forward

The weighed average of customs duties at 22.4 percent (prior to the disposal of customs) are the highest US customs duties in more than a hundred years. Customs are also the most important cause of panic in the markets as they cause fear of recession and increased inflation pressure. Representatives of the US Central Bank (Fed) have repeatedly emphasized that they are ready to maintain reference rates at the current level (in the range between 4.25 and 4.50 percent) in order to reduce the risk of inflation pressure recover from declared customs.

At the same time, they exclude the possibility of reducing reference interest rates due to the slowdown in the US economic activity, which could be caused by customs, even though the labor market is slightly softened and the unemployment rate increases slightly. With the current 90-day delay of the entry into force of customs duties, we (for now) avoided the most pessimistic scenario-the Global Trade War. Still, it is very difficult to predict in the short term what will happen. The EU also decided to delay the introduction of customs duties on steel and aluminum for 90 days, as they want to give the opportunity to negotiate.

If the situation is tightened and the high US and retaliatory customs duties of other countries are introduced and consequently followed by a recession, further strong reductions of shares and high fluctuations can be expected. Lastly, Trump has invited all the countries, targets of customs, to negotiate, and the direction of movement of the stock markets depends on the outcome of them. If moderately good arrangements are achieved, stock markets have the potential for strong growth.

Source: Bloomberg

* All returns are euro.