The billionaires run away from London (also towards Milan): who are the « non-ten » and why Labor taxes are a flop

From the Indian Mittal, king of steel, to the Egyptian Sawiris, patron of the Aston Villa. Already 11,300 millionaires have decided to abandon the English capital after the decision of the Starmer government to abolish the tax breaks on « foreign » assets

Is London losing his nail polish? First Brexit, then the pandemic have the effervescence as dampened of the only global metropolis on European soil capable of competing with New York: and now to turn off the light before going out are those ranks of super rich people who do the suitcases to move to more welcoming latitudes towards them.

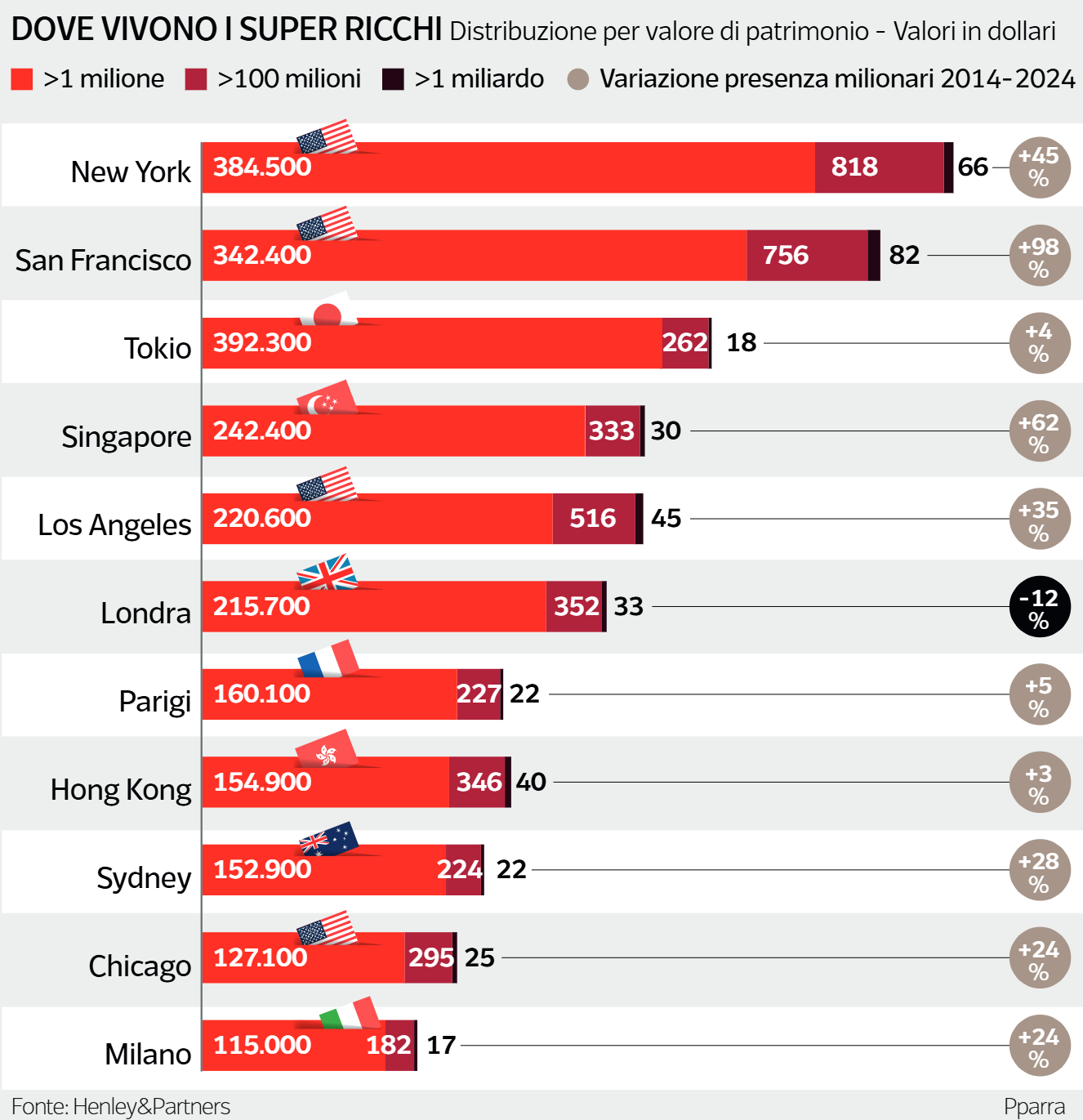

It is a downgrade that has aroused bewilderment and caused more than an examination of conscience in Great Britain: Its capital came out of the list of the top 5 cities with more millionaires in the world, calculated on the basis of liquid wealth, therefore excluding real estate properties. In fact, there are 11,300 « paper for the Thames that in the last year have gave up the moorings, a second exodus in proportion only to that immediately from Moscow and first in the world in absolute terms.

The main reason lies in taxes imposed by the Labor government: Keir Starmer abolished the tax regime of the « non-ten » (not domiciled), a 225 year old institute according to which those who, although residing in Great Britain can claim an origin abroad who consider « home », are authorized not to pay taxes on income produced outside the border.

This is the reason why 74 thousand « non-ten » are recorded in London, generally rich foreigners who have settled in Great Britain in order to keep most of their assets out of the scope of the tax authorities. In addition, the Labor Government has imposed the succession tax also on the assets held abroad, So far exempted: and it is a 40 percent stone.

Among those who are thinking of packing there are well -known characters like Lakshmi Mittal, The Indian King of steel, already owner of the Ilva of Taranto, whose family has a heritage of 15 billion pounds (about 18 billion euros). On the starting foot as well as Nassef Sawiris, The richest man in Egypt and patron of the Aston Villa football team, while Frédéric de Mévius, of the family at the head of the Giant of the drinks AB INBEV, he has already moved his residence to his native Belgium.

In general, the fleeting nabbia are heading above all to the Arab Emirates, between Dubai and Abu Dhabi, But very attractive for them from a fiscal point of view are also Portugal, Switzerland and Italy, with Milan destinations of thousands of ultra-rounds: The flat tax of 100 thousand euros, then brought to 200 thousand, throats many that can count on multimillionary incomes.

Who will pay a tear for them, in times of crisis of the middle class and commercial wars? Actually, In London they began to worry: We can detest or deride them, they wrote the English newspapers, but we need the Scrooge, because it is thanks to them that the British capital has probably become the most interesting place in the world to live, with a mix of museums, galleries, restaurants, private clubs, shops that has few rivals elsewhere.

Or at least until yesterday. The change of season is felt precisely in the most fashionable clubs: by Arlington, the former Caprice, The favorite restaurant by Lady Diana Giusto behind Ritz, now there is no more problem to book a table even at the last minute, so much a place is found. Of course, the atmosphere remains effervescent, the elegant audience dinner on the notes of the live piano, but the room is not full even towards the weekend, so much so that the patron, the legendary Jeremy King, The 25% discount for those arriving after 9.30 had to be invented.

Because this London in the undertone is now going to bed early, Finding meeting places still open after midnight is a business. Also at the Donovan Bar, the sophisticated local inside the Brown’s Hotel named after the legendary fashion photographer (and whose erotic images decorate the Naughty Corner, the corner of the Birichini), after 9 the desert is made. And a few passed from there, on Piccadilly, At Wosleley, an epicenter of the London Power Breakfast where the painter Lucien Freud once had his fixed table (who left empty, with a bright candle, the day of his death), now you can present to the booking without being sent away with a look.

It is not only the nightlife that is suffering from the deflating of London, it is the whole economy that accuses the blow. Only in 2023, it was calculated, the 74 thousand « not domes » have paid a total of almost 9 billion pounds of taxes (over 10 billion euros), with about one million euros each only of VAT. These super-rounds invested on average in Great Britain 140 million euros and every 7 million in philanthropic causes each: their departure, it is estimated, could lead to the loss of 44 thousand jobs.

And it is a chain effect. Only last year the shops in Central London, due to the exodus of the rich as well as for the decision to eliminate the duty-free for tourists, have accused a drop in sales of 750 million euros. And in the first months of 2025 The percentage of foreigners who bought home in London has dropped to 1%, the lowest level since it started to keep the account, In 2008: last year the value of the houses in Knightsbridge and Belgravia, the most high concentration of wealth, dropped by 5%. But Scroogers do not just buy houses: they restruct them, they take drivers and staff, put on a « family office », thus giving work to a lot of people. An « induced » at risk.

The alarm

The cultural sector also cries. The alarm on the Times was launched by the director of Victoria & Albert Museum, Tristram Hunt (of Labor Fede): thanks to an ecosystem of private funding and philanthropy, he has pointed out, in London in the last decades a free museum network has arisen that has no equal in the world. But now Those sources of income risk drying up, endangering exhibitions and acquisitions, especially after many large company sponsors have pulled back due to the disputes by the environmental groups.

And in the same way, if in the British capital you can browse for free in the wonderful art galleries that dot Mayfair and St Jamesit is because there is someone who can afford to buy that stuff: but if the rich buyers leave, the galleries risk closing and the normal audience also remains dry mouth.

The fiscal move of the Laburists therefore proved to be a boomerang: Instead of bringing more entries to the state coffers, as they hoped, the result will be a clear loss. Although, paradoxically, there are those who continue to create excellent business in all this: first of all the specialized agencies that help the nababbi to move abroad. They have never been so active and among them there are those who saw requests increase up to 200 percent compared to last year.

Then there is the private jet sector: The super rich people who leave do not cut the bridges with Great Britain, many keep their children in the exclusive English private schools and need to return often to treat the interests left on the shore at the Thames. So these Scrooge dirt between their new residences and London: In the last twelve months the volume of private flights between the airports of Dubai and Abu Dhabi and the London airports (at a cost of 90 thousand euros one way) has practically doubled.

Because not everything is lost: in reality those nababbi are looking at, many go away but they don’t decide to sell their homes in London. The British capital continues to be appreciated for what it can offer better: culture, social life, schools, language, legal certainty, time zone, connection with the rest of the world. A mixture that is practically impossible to reproduce in other cities.

In short, we are faced with a separation rather than a definitive divorce: and there are those who believe that it would be enough a backward march on succession taxes To return to London, an attractive residence for the most wealthy on the planet. If the wind changes, they would be ready to return to the Thames. And to rekindle the lights.

/s3/static.nrc.nl/wp-content/uploads/2025/05/12094428/web-1205ECOBLOGgeneve-1.jpg)