Tax evasion, hunting at 100 billion but only 18% collect

We need a reform of the financial registry. While the collection arranges, the scrapping fruit less than estimates

Not everything is lost. There is a part of tax evasion ascertainedvery small if compared with 1,273 billion euros accumulated in the unveiled credits warehouse, but still important, 100 billion, which could be recovered by strengthening collection. Is what emerges from Auditions in the Finance Commission of the Senate who is carrying out an investigation into the management of the tax warehouse, the mountain of folders sent in the last 25 years and collected only for the slightest part. Listened, among others, the leaders of the Revenue Agency, of the Court of Auditors, of the Parliamentary Budget Office, of the Accounting, of the Guardia di Finanza.

1,273 billion in stock

In the theoretical warehouse of the taxes to be collected, As of January 31, 2025, there are folders that are part of 22 million taxpayers,For a value of 1,273 billion. Theoretical value why About 560 billion are no longer recoverable (death, failure, etc.) For another 570 billion, precautionary and executive actions are underway so far without success and for about 34 billion installments is underway. 100 billion remain, « that is, the amount of the folders with a higher degree of collectability », observes the Budget Parliamentary Office.

How to accelerate recovery

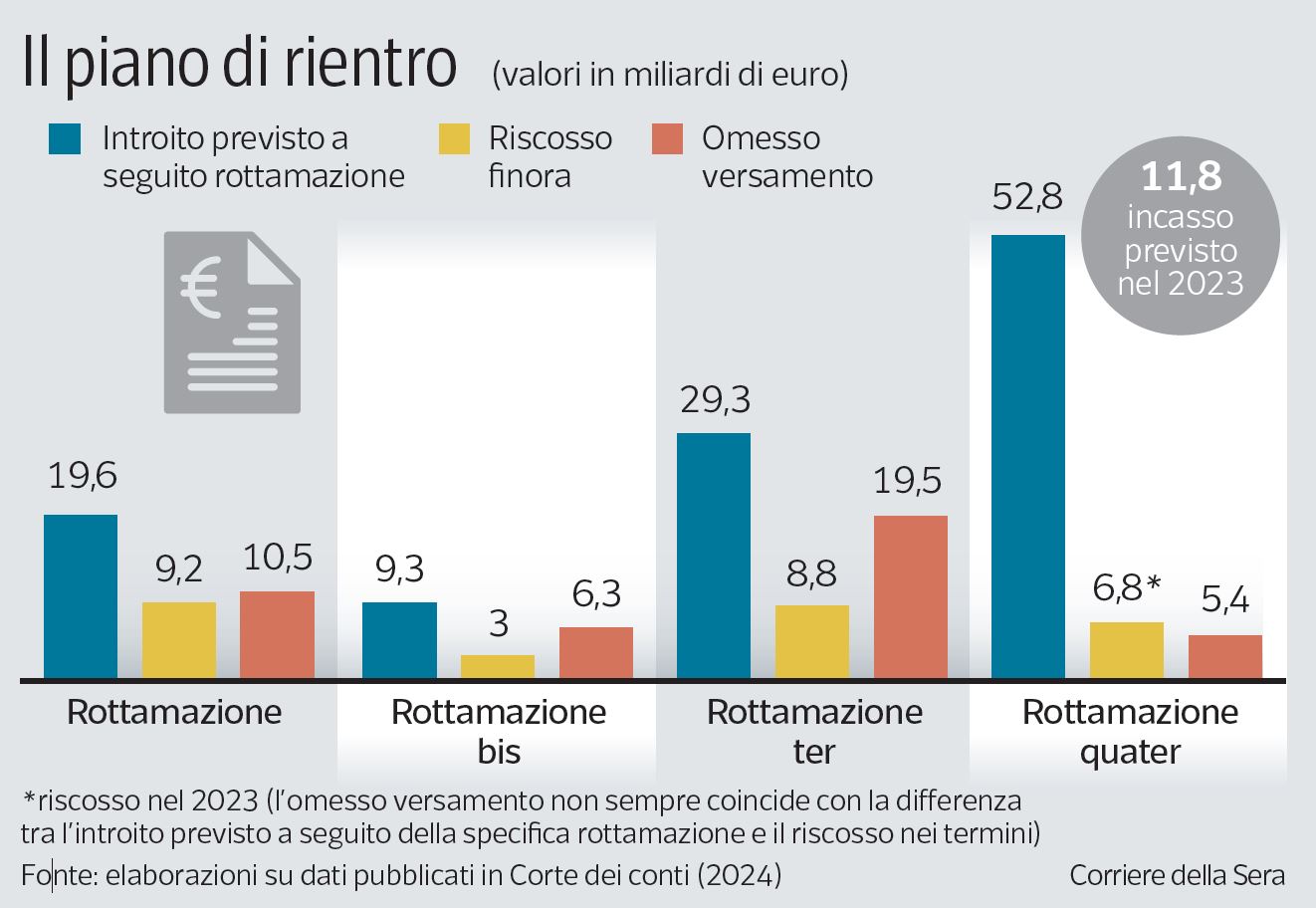

How can you get them? It is necessary on the one hand relieve the warehouse from credits that are no longer due and on the other to enhance the tools of collection on attacked credits. The president of the Revenue Agency, Vincenzo Carbone, underlined that 43% of the 22 million taxpayers have folders for less than a thousand euros, equal to 0.2% of the 1,273 euros of the warehouse while 87% are 1.3 million taxpayers with folders for over 100 thousand euros. We should focus on these. But there are databases that do not communicate with each other (paradoxically collection does not know the data in possession of income on income and electronic invoices) or they do it inefficient. The current accounts registry is updated once a year, it should be done every monthproposed the Guardia di Finanza, to mark « a significant step forward in terms of timeliness of execution of the investigations ». Otherwise it will remain that, on average, out of about 80 billion entrusted every year to the collection are recovered to a maximum of 15 (18%) while 65 go to increase the warehouse. Except then to launch scrapping from poor results: so far the 3 decided by the governments Renzi, Gentiloni and Conte1 have yielded collections for 21 billion compared to the 58 billion expected. And the Quater (Meloni), in progress, will reach a maximum of 38.5 billion on 52.8 expected.

/s3/static.nrc.nl/images/gn4/stripped/data132852687-3c5e5d.jpg)