Supermarket: Is the private label the antidote to accuracy? What do the items show

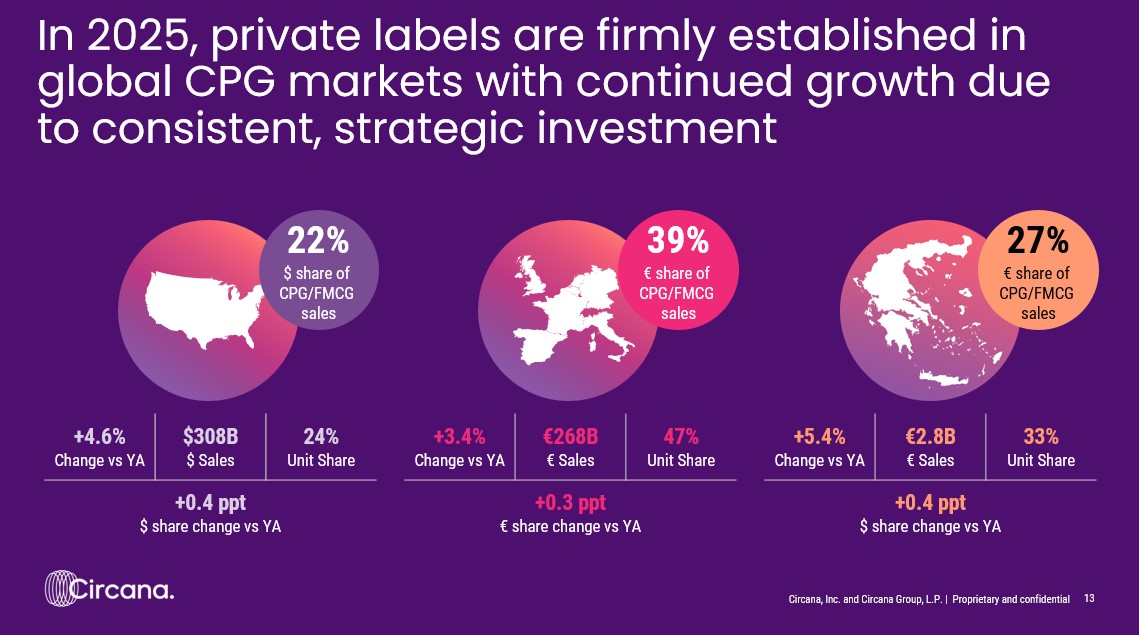

The rise of the private label (Pl), which in 2025 appears to be firmly established in the world markets CPG with continuous growth due to consistent, strategic investment.

Consumers in recent years have been in front of a market where the PL product portfolio is constantly decorated as organized retail players are investing steadily and according to trends in the field.

What do consumers see

According to Circana’s « The Re-Shaped Consumer Behavior » survey, in the rise in inflation and reduced consumer income, supermarkets have created distinct private label brands, which they are constantly enriched, resulting in buyers asking it.

The beginning was made by AB Vasilopoulos and then in the same logic – although at lower and more careful rates – the other large chains of the industry, Sklavenitis, Metro, Masoutis, Galaxy and Cretan were included.

Each similar product follows the development strategy of branded species, now: specific codes are aimed at specific common, new series with innovative materials such as proteins make their appearance, while now starting organized retailing companies NEI invest in branding, changing the profile or logo of a product.

The transformation

Evidence showing that supermarket chains are in the process of commercial « transformation » focusing on the category of private label.

It is indicative that while PLs are planned to have a share of 22% in total sales of packaged foods of $ 308 billion, in the Greek market this figure is increased to 27% of total sales with sales reaching € 2.8 billion, while in the rest of Europe it reaches even € 39%.

It follows a growth course, despite the fact that mood prices are rising in relation to what is currently prevalent in branded products. Even so, the difference between them often reaches 30%, making PLs still attractive.

My expensive, pl

As Circana shows, according to the week data from 4 to March 10, the weekly price change per code of private label products was – on average – 4%, while the branded products were 1.4%.

Last week this week was 7.2% versus 3.5% – but this week may be out of comparison as it includes Clean Monday. But even a week before Clean Monday, private label products increased per code by 2.9% versus 1.9% of the names. All the previous weeks since the beginning of January have moved at the same rate.

However, the highest increase per code per code is observed during the last two weeks. This development is interpreted by the fact that by implementing the new bidding framework, which leads to a reduction in the number of bids, consumers have been « shocked ».

Like 2018?

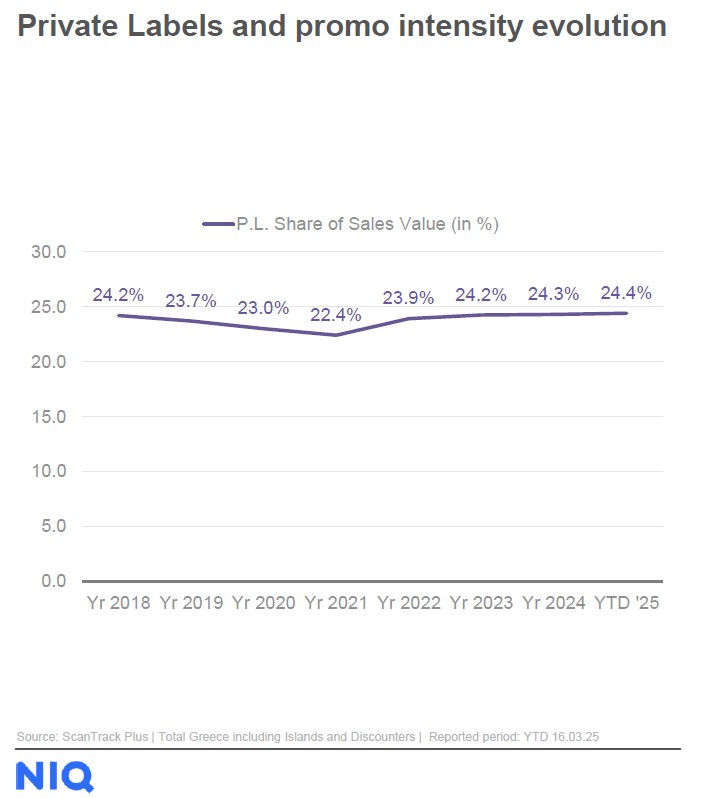

The trend is also recorded by Nielseniq, who in the study « Private Label & Branded Products Report Global Survey, 2025 NIQ Greece Consumer Outlook Greece », captured the reinstatement of sales value at the same level as 2018.

It was then recorded that 24.2% was a private label, a year later to fall to 23.7% to get down to 23% with the appearance of the pandemic. This period saw the private label reach the low eight years, to 22.4%, to start rising slowly and stabilize over 24% in 2023 (24.2%, 24.3% in 2024 and 24.4% in 2025).

Source: OT