Supermarket: expensive sports online shopping

A question about supermarkets that can be different, depending on the point of view from which it is considered, is whether online sales are for them.

Although the tendency of consumers to make online shopping, the cost in relation to the benefit to the chains seems bridging.

It is noteworthy that, according to Aristotle Panteliadis, head of the Metro Group, electronic sales in supermarkets are very expensive sports and rarely leaves profits. He stresses that Metro managed to limit the loss to zero after six years, stressing that the online store will never become as profitable as the natural. Currently, online sales participation range between 3% to 4% in total retail sales.

A percentage, which, while clearly seeing very small compared to penetration rates in other countries, cannot be ignored by domestic chains.

How do consumers shop in supermarket

A recent Convert Group survey shows that in any case, e -commerce development continues in the supermarket sector with consumers spending online at 2024 335m euros at retail prices including VAT, ie 9% more than 2023.

Also noteworthy is the average value increase of 6% to EUR 85, mainly due to most of the pieces it contains (on average 34.3 pieces compared to 32.8 in 2023) and not inflation, since the increase in the average online value of goods was 1% compared to 8% in 2023.

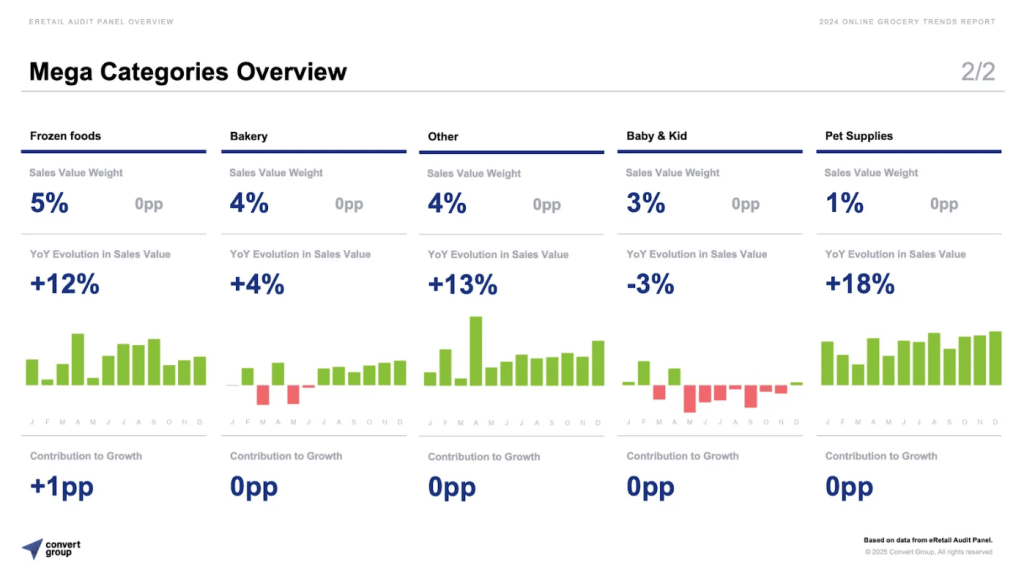

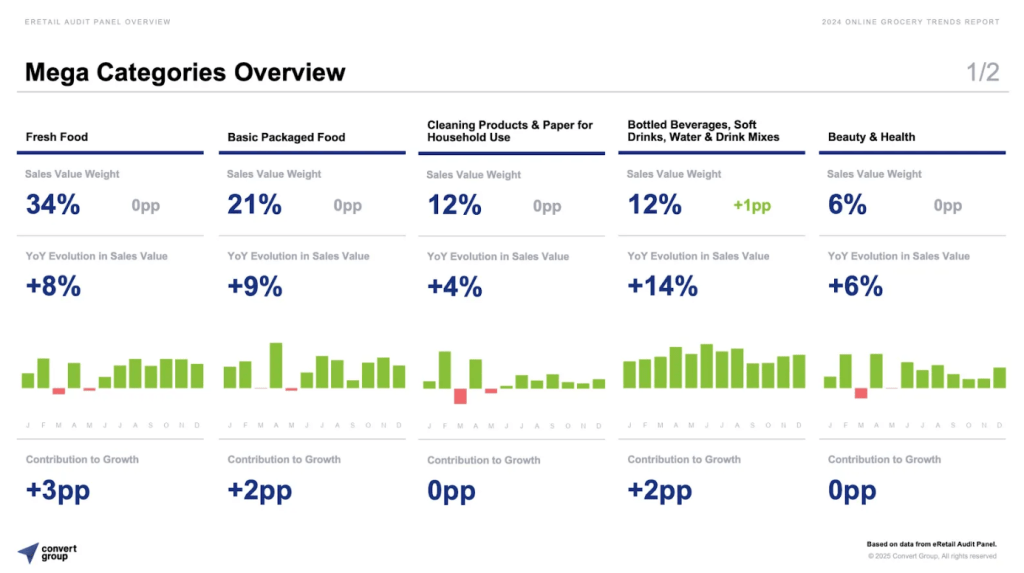

Compared to 2023, the categories increased in online shopping value in 2024, based on Convert Group data, were: +18% in pet products, +14% in drinks and soft drinks, +12% in frozen foods while packaged foods increased in value (€) online shopping by 9% and fresh foods by 8%.

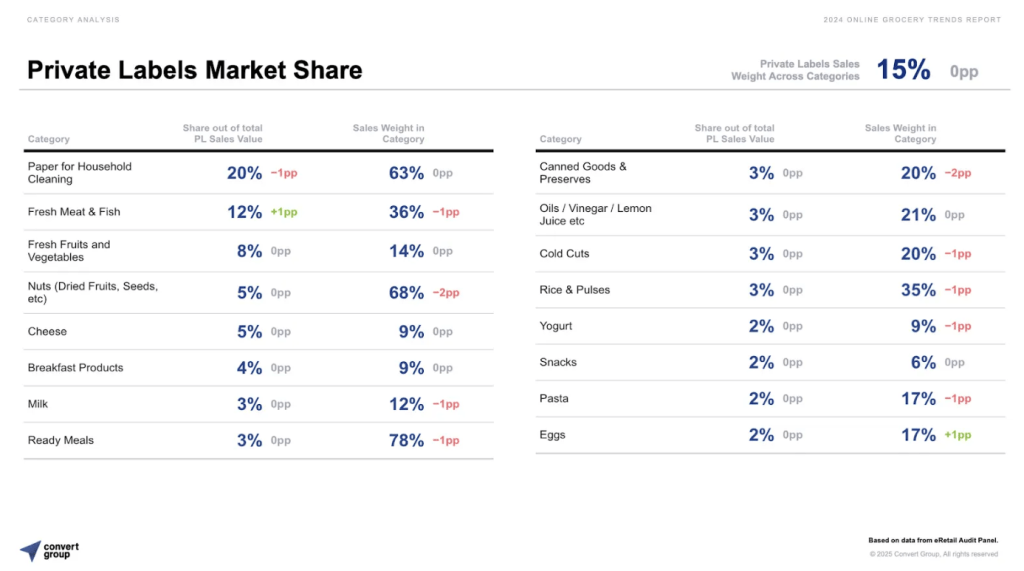

The conclusions of the survey also stands out, the element that the rate of expenditure going on private label products accounts for 15% of all online purchases in the first half of 2024.

Finally, Friday was the most popular day for household online shopping, as 16.8% of total orders were made on that day.

Regarding the dynamics of e-commerce and online shopping, some first indications can be drawn from recent Nielseniq Greece surveys that have been presented recently about the profile of online buyers and their relationship with online chains.

Among other things, they show that their demographic profile is no different from the main buyer of the offline channel. She is a woman, 35 – 49 years old, married to family, consisting of 2 to 4 people. Buying navigation is mainly aimed at the basic refueling of the household or even the « relief » of specific products, which are probably on offer, and to a lesser degree buys low -value baskets to meet daily needs.

The species now of the products that the online buyer chooses most, at large categories, compared to offline, is mainly food & beverage categories, and also chooses comparatively more categories related to household care.

In contrast, the contribution of fresh and weighted products to the online basket is significantly smaller than that of the offline (14.4% versus 25.4%), which is obviously linked to the consumer’s sense that it will shop fresher products through livestock, but also with its « need » to be able to see the product and can see it.

Also, 46% of consumers prefer to buy products from companies that show social responsibility and environmental consciousness, while a notable percentage of 23.5% of internet users buy food online each week.

Finally, for the 3 most important criteria, which potentially differentiate online chains and mobilize buyers to choose them are low prices, to have high quality ready meals, and to have unique/exclusive products that are not available in other online stores.

Speaking at a recent conference, Eliza Hadjiioannou, Client Business Partner of NIQ Greece, emphasized the importance of understanding consumer needs on the part of companies and creating a differentiated proposal on the digital shelf, which offers added value.

He also referred to the importance of visibility of products in the search and use of SEO strategies to enhance organic search.

Source: OT