Shares made up for a loss – is trade war over?

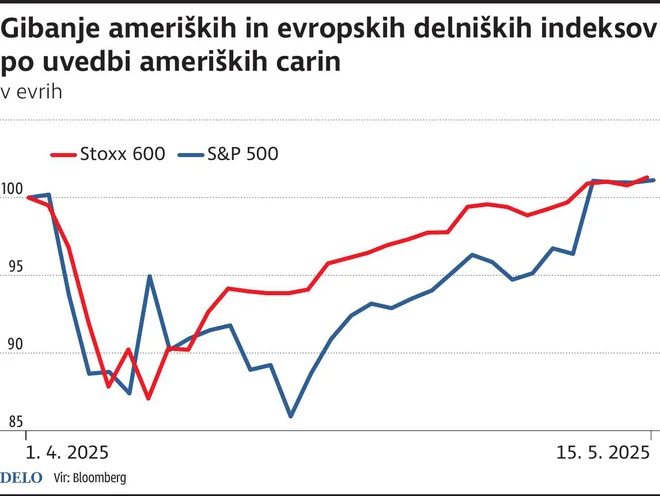

Of the lowest values in mid -April, global stock indices have grown heavily. If, in the first days of April, financiers stared at stock exchange rates, which have declined extremely day by day and lost more than ten percent in just a few days, today we can be similarly surprised by the high growth in shares since then. By mid -May, both the European and the US stock index had made up for all the losses caused by April 2.

The US and China trade confrontation

The US President was already 90 days off to the Customs on April 9. In April. The European joint stock market has taken a breather and grew up heavily. American, however, at least measured in euros – not even. Donald Trump After deferring customs duties to European goods, he greatly raised customs duties to Chinese goods, which China then returned. In doing so, these two world superpowers stopped the mutual flow of goods and goods and entered the trade war. If such a situation lasted, it would certainly have serious consequences in both economies. The mood of American consumers, especially the middle and lower income class, was rapidly and extremely much worse.

American European Photo DK IgD

Chinese dresses, toys and many other products that are widely available and cheap are simply accustomed to American consumers. In recent years, direct Chinese Internet sales have also greatly contributed to this through smartphone apps (Shein, this, Alibaba …). A strong price increase as a result of 145 percent customs duties or even the abolition of the offer of Chinese goods, logically strongly showed the mood of US consumers and also the work of the economy relying on Chinese semi -finished products and other input raw materials. Both countries also tightened the trade war by banning exports of strategic products and raw materials. China has limited the exports of rare ore and metals, and the US side banned the export of advanced chips and other technological equipment. Capital Markets have not really pleased China and the United States at the trade field. Investors were selling US investments and withdrawing money from dollar investments. The value of the dollar has dropped heavily, as did the value of US state bonds. Safe shelter was searched by investors in other world currencies, including euro, and gold.

Sedation

In the second half of April, the capital markets have partially calmed down and came to terms with a new reality, which also produced signals after calming customs tensions. The first leaders traveled to the US president and their tone of the conversations and mood worked more conciliatory and respectfully than the announcements of customs and unilateral statements. Capital markets have revived that the aggression of the US side may be just an aggressive negotiating tactic, which should slip the opposite side and bring it to a serious purpose for the negotiating table. Stock markets have been strongly recovered in the last week of April and the first week of May.

The beginning of the end of the trade war?

On May 8, the US and the United Kingdom announced that the countries have reached a historical trade agreement. Despite numerous incomprehensions, both sides have labeled the agreement excellent. The US president emphasized that the deal opens the door to US meat and other agricultural produce, and the English side emphasized the withdrawal of an additional 25 percent of customs duties per hundred thousand English cars exported in the United States. Capital markets were received by only slight approval, as the general ten percent customs duties to all from the United Kingdom in the United States remained exported products. Considering that the US and the United Kingdom have a strong connection and close economic and political relations historically, the preservation of ten percent of the general customs duties to English mildly disappointment was preserving.

Bury the battle ax

In the following days, we learned that American and Chinese representatives will meet in Geneva during the week and try to calm the trade war. The markets received the news skeptically, as the sharpness of the rhetoric on both the American and the Chinese side did not promise a breakthrough or. an important agreement. But this time, the outcome was positively surprised. Customs are 145 percent (US customs) or. Reduced 125 percent (Chinese customs) to 30 percent (USA) or ten percent (China) for the next 90 days and announced that they expect additional agreements to complete the trade agreement. He positively surprised the outcome. The US shares and the US dollar gained value. The decline in the value of the shares caused by the customs was introduced on 2.

Much of the load will be worn by the end buyer

Judging by the stock markets, we could almost conclude that this is true. Yet the fact is that customs for now remain – at least ten percent of all in the US imported goods and at least 30 percent of all Chinese goods – and that individual state and sectoral customs are still valid. This is still a drastic increase in customs charges, which will also be known on US shelves, either in the form of higher prices or in a less diverse offer. For the time being, the consequences of April have been introduced by customs officers in the everyday life of the consumer. In the first months after the November victory of Trump in the US elections, many companies have strengthened imports and stocks of imported products in caution. But these supplies are empty, and it is only a matter of time before they will sneak on American shelves.

The management of the US chain Walmart has estimated that the first rise in Chinese products would be inevitable and that they would be visible on the shelves in late May. They explain that 30 percent of customs officers do not withstand their business or their Chinese suppliers operating and that they are forced to transfer much to the final US buyer. Part of the offer, based on Chinese products, such as toys, sports equipment and clothing, will consequently go up by ten percent and more.

Jamie Dimondirector of the largest US bank, JP Morgan, estimated that the likelihood of a recession was still present and significant. The trade war has calmed down, but it is not over. And even if it remains frozen, in the current state it is extremely damaging to the global economy. Damage, with this condition, is rising exponentially from week to week. In addition, Trump and the nature of trade war are unpredictable. Surprises are possible, both positive and negative. It is in the interest of the global economy and capital markets to end trade disputes as soon as possible and fully end. The longer the customs duties are present, the higher the economic damage and the higher the likelihood of negatives, including in the stock markets.