Rogoff: « Trump has saggery with China, real problems with markets will arrive in two years »

The former Capoeconomist of the International Monetary Fund: the chances of recession falls, but the United States have lost credibility in the eyes of the world

The dollar is recovering after the first agreement with China on the duties. A little trust is back in the US economy?

«Well the administration of Donald Trump has basically saggery. Did not get anything – He replies Kenneth Rogoff of Harvard, former Capoeconomist of the International Monetary Fund, Grand Master of Chess and now the author of « The Dollar Empire » (Aegea) -. Trump, seen by the markets, now seeks a way of retiring from the stupid policies he had implemented. For the United States it is positive: the chances of recession falls and this is good for the dollar. In my opinion, however, the value of the green ticket is still very high and it is likely that it goes down. It would surprise me if we did not see at least 1.20 or maybe even 1.30 on the euro or more in the future. Other times in the past the dollar has already been overrated, but the Trump administration has accelerated its decline. «

What do you mean?

«The Chinese do not need to be said twice that they have to move away from the American currency. Europeans are now forced to militaries, which is probably the point of greatest weakness of the euro as an international currency. Trump accelerated these trends, but they were already underway. Kamala Harris maybe would have achieved the same result in a different way. I think it was a very weak candidate ».

What basic factors guaranteed its role to the American currency and are now under discussion?

«The credibility of the rule of law, the ability to maintain the or not soft powerthe power to ensure that others also want what America wants. It’s not just a duties problem. But the opening to trade, financial globalization, American universities and their attraction power are pillars of the dollar in the world ».

What did the Trump administration prompted – how do you say – to capitulate in front of China?

«One of the positive aspects of Trump is that it is pragmatic. When something does not work, look for a way out. He did it in the first term and now again. He should not have needed to receive the notice of the markets twice with respect to the idiocy of his policies. The problem now, seen from Europe, is that you cannot trust. With Canada and Mexico he had been the one who concluded an agreement four years ago and now he made him jump. But I don’t think the problem is only Trump, they are the United States. We elected it and we can elect another one. This arrogance is very American, it will not go away ».

Deepen with the podcast

Do you think all this uncertainty will brake business investments?

«You see, one of the great things about the United States is that if you buy something, then it’s yours. We don’t take it away just because you are Italian or another place. As long as she respects our laws and rules, we don’t change them suddenly and arbitraryly. I don’t say that in Italy it is different, but this was a long tradition in the United States. Now, however, with the strong government model and the favoritism in power, you can no longer trust. You are not safer as before. You don’t know if you will be taxed or penalized in a special way because you are Italian or other. It is not the end of the world, but this uncertainty undermines one of the great forces of the United States at the base ».

It surprises how Trump does not even try to hide his personal enrichment thanks to his office. And pass it smoothly.

«It is the most important question. And open. I think Trump will end up massacred in the mid-terre elections and then perhaps the impeachment processes will begin on him at the congress, but now he cannot happen. And do you know why? Because the republican congresses are afraid of losing their place if they put themselves against him ».

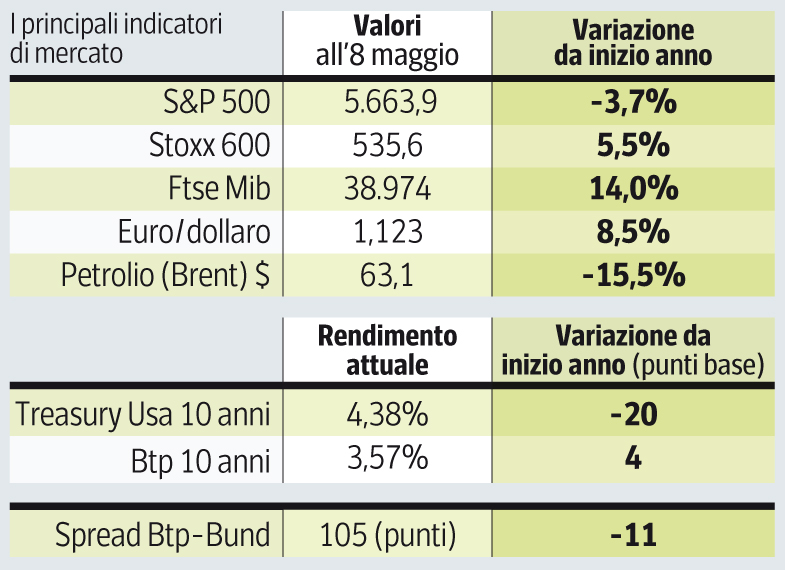

Meanwhile, the public deficit runs by over two hundred billion above the levels of a year ago, around 7% of the GDP …

« In fact, there is no plan to close the budget deficit, but the bond markets will not be so indulgent. We will certainly have problems in the coming years. The yields of the titles of the American treasure at ten years are around 4.4% at this time. But I think that in the coming years it is more likely to see them at 5% or 6% than to 3% or 3.5% ».

How many years?

«In my book I write in five or seven years, but now I believe two. It will take place with Trump again in the White House. We will see inflation, financial repression. It is not difficult to imagine that Trump will try to control prices or capital flows. And the people who really believe that the independence of the Federal Reserve is protected by the Constitution at that point could be forced to change their mind ».

What advice does it have for Europe, in view of the negotiation on duties with Trump?

«To keep calm, do not react in a hurry way and follow their principles. Certainly not to bow to Trump, that would be a mistake. He respects the strength. I would describe it as a coffee chess player, good and aggressive against weak opponents. But the strong opponents who know how to defend themselves and hit against him always win. China has not bent and he did not get anything from China. And also from Europe it will get very little ».