Restless or stable markets, investments require thoughtfulness

Capital markets have been under pressure in recent weeks. However, after a long time, changes in the global trade arrangement are coming to the fore. In such an environment, many investors ask themselves the question: What should I do? I retreat to safe? Where should I divert funds?

One of the common answers in such times is « Turn to defensive sectors », that is, industries that are usually less sensitive to fluctuations in the economic cycle. These include the sectors of emergency consumer goods (such as the food industry), healthcare, telecommunications, energy supply and utilities. These sectors are considered more stable, as their products and services remain demanded during recession or economic congestion.

In the US, where the focus of many global investments, many defensive shares (especially within the S&P index) are already quite expensive. Their p/e ratio (the ratio of the price to the share and the profit per share) is almost historically high. Photo Charly Triballeau AFP

But the picture is not black and white. In the US, where the focus of many global investments, many defensive shares (especially within the S&P 500) are already quite expensive. Their relationships P/E (the share of the price of the share and the profit per share) are almost historically high, which means that investors are already paying a high price for alleged security and stability today. This reduces the expected return and increases the risk if the downhill corrections occur. In addition, in the event of an improvement in the situation, a high opportunities may be shown if the applicant is not fast enough to divert funds. In addition, the US consumer is currently under pressure, from inflation burdens, high mortgage costs to a declining consumer self -esteem, which could also affect companies in otherwise stable sectors.

All this is also imposed on an additional layer of uncertainty: the possibility of recovering inflation pressure due to the possible introduction of new customs and trade obstacles. Although customs are political weapons, they are an economic burden that is often borne by consumers and businesses. If realized, they could cause a new inflation wave that would force the Fed to reduce interest rates, leave you alone for a long time or even raise them, causing job loss and recession. Therefore, higher value -added industries, such as industry and information technology, may be interesting at the moment, which in the event of a recovery or structural changes in the economy can ensure higher growth and greater flexibility. More importantly, it is like a car to a mechanic, when we hear an unusual sound or see a loss of performance, even when investing, it makes sense to take more time and seek the help of experts. Not because we would not know anything ourselves, but because experience, knowledge and insight into the whole picture can mean the difference between making a mistake in times of uncertainty or finding opportunities.

In the course of falls, investors, who recognize long -term opportunities in such circumstances, are entering the markets, both between natural persons and institutional investors, usually with more knowledge, data and professional analytical support. In particular, less experienced investors with lower -tolerance or investors with unique or unrealistic expectations are retreating.

As in other areas, those who better understand the operation of the markets and know how to judge the risks are priority in investing, so those who know what they do. Therefore, it is always useful and crucial for any investors to seek professional help at one or more ends.

The current events clearly show that deposits cannot be easily compared to investing in shares, let alone equate them. Equity investments are related to risk, but deposits are safer in principle, but at the same time they do not bring a worthy return, which, with the inflation present, means actually loss of purchasing power.

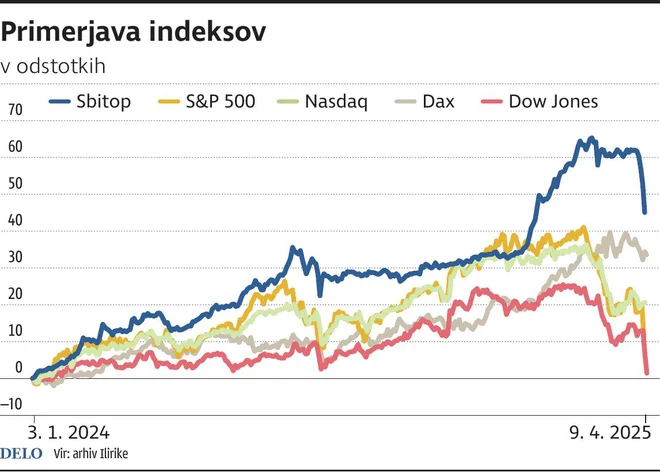

Comparisons

It is certainly reasonable to think about a scattered portfolio when an individual has a property distributed between different investment classes, shares, bonds, deposits and the like according to his time horizon, goals and tolerance to risk. Falls and shocks will always monitor the growth of the market value, so the long -term horizon is crucial. Here we come to the professional products of the management of the property and the types of savings provided by the brokerage houses.

Look at the home market

Also, the domestic stock market is not immune to global events, which has encouraged many potential investors to reflect on which domestic stock investments are suitable for more tumultuous times. The Krka Krka is again coming to the fore.

Krka can be a great candidate for the core of the investment portfolio, as it has been detecting revenue and profit growth for a decade, whether they are calm or turbulent times. These are companies with above -average stability and quality, which is confirmed by many key indicators: extremely geographically scattered sales, zero long levels, very strong balance balance and high operational efficiency.

In addition, Krka regularly pays investors to high dividends, which further increases its attractiveness, especially for those looking for stable and predictable returns. Even in periods of greater uncertainty, Krka remains a reliable player, as it expands its presence in international markets, increases revenue and profit, and maintains a relatively low business risk.

Medicines are also often exempt from sanctions and customs duties, which further contributes to the resistance of business in more demanding conditions. Due to all of the above, Krk is right to be one of the highest quality companies on the Ljubljana Stock Exchange and beyond.

:format(webp)/s3/static.nrc.nl/wp-content/uploads/2025/06/05163439/data133217982-f902a2.jpg)