Projects of tax amendments submitted for the discussion

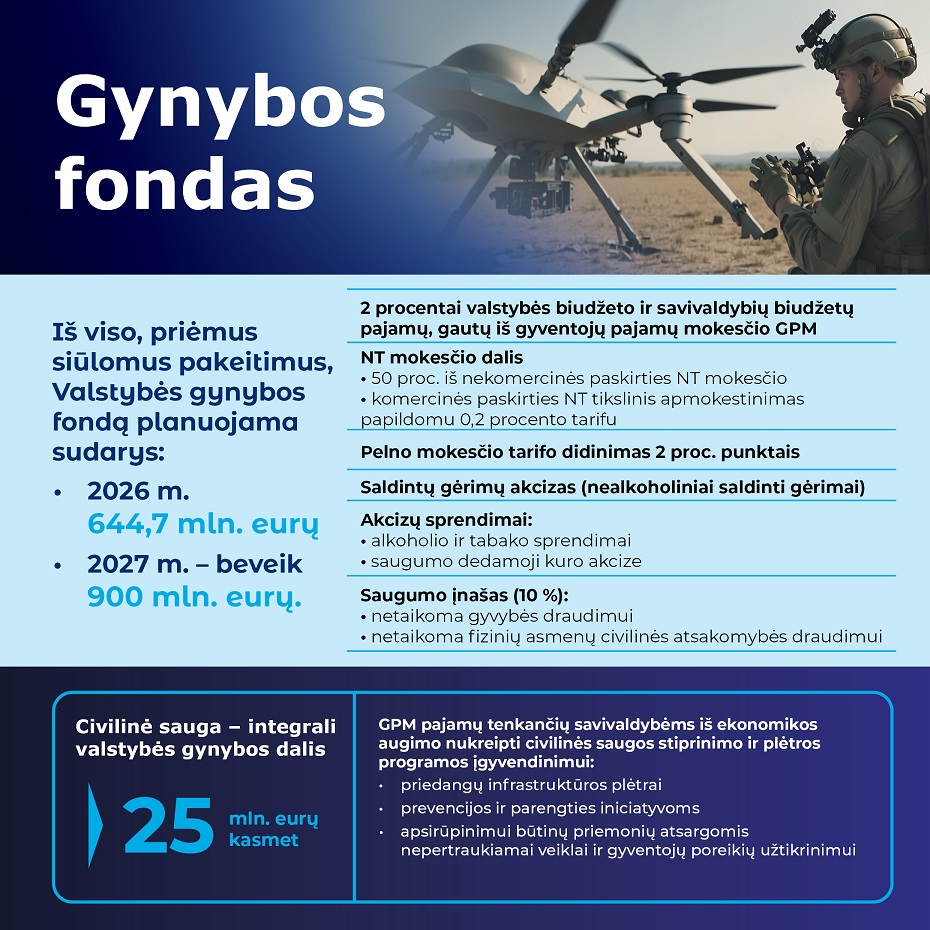

Kristupas Vaitiekūnas, Vice -Minister of Finance, says that the most important purpose of these changes is to strengthen the country’s defense financing and respond to the geopolitical situation, but the smaller part of the tax changes will be given to other areas.

« The main goal is to increase the defense budget and to implement new defense obligations. The other part of the funds raised will enter the municipal budgets and the treasury of the state, » the Vice -Minister noted. According to him, tax changes are discharged throughout the areas consciously – to avoid drastic impact per specific society or business group.

The Vice -Minister emphasized that the proposed tax changes are to be made in such a way as to prevent financial stress, ie low -income tax burden almost unchanged, and more earnings will pay a little more.

Photo by the Ministry of Finance

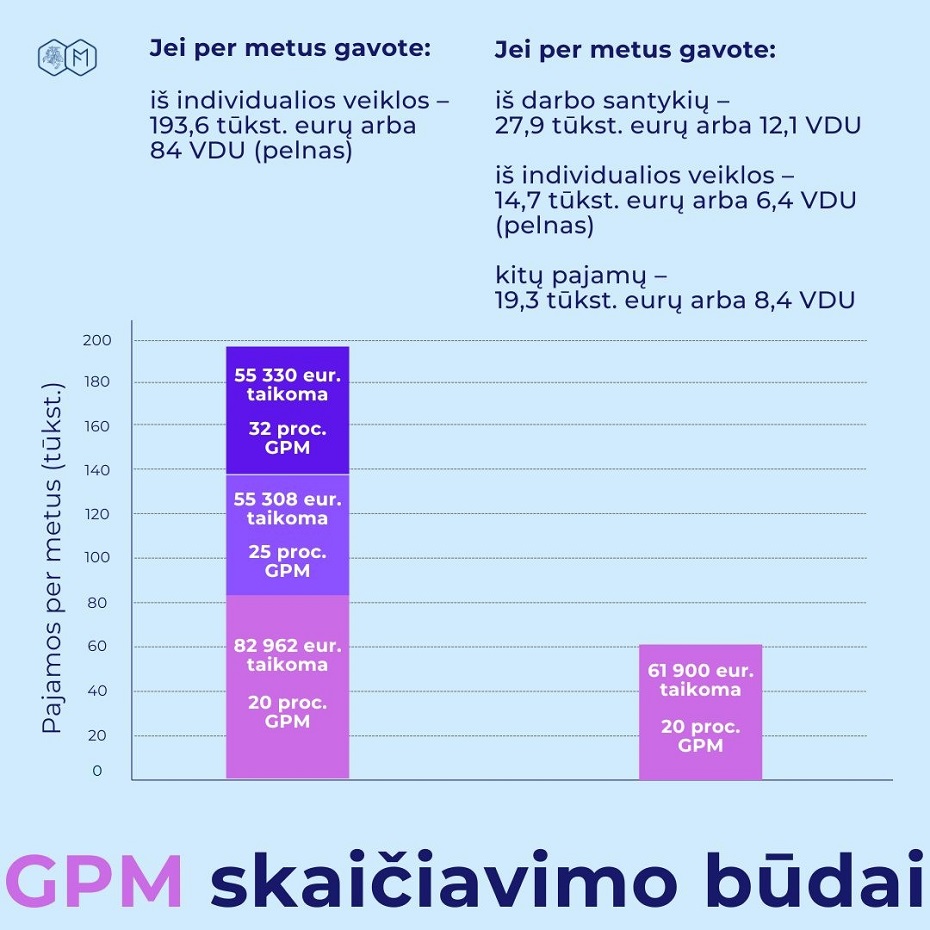

The biggest change is the united PIT for the high income

Until now, the PIT has been calculated separately by type of income – wages, individual activities, rental income, etc. are now planned to sum up all these sources and apply the overall rate.

« If a person receives income from an employment relationship, leases property or engages in individual activities, all this income will be taxed together, not separately, as it has been, » explained the Vice -Minister.

Personal income, regardless of the source, would be subject to progressive 20, 25, 32 and 36 %. at rates. The most important change is 36 percent. PIT rate for those with income exceeding 120 VMU per year (more than € 276.5 thousand per year). It is focused on higher and very high income residents, and lower -income new order, according to K. Vaitiekūnas, will hardly feel.

Photo by the Ministry of Finance

Income tax rates are growing but with preferences

Business will also contribute – both the preferential and the main income tax rate will be increased by 1 percentage point.

However, measures are introduced at the same time that will allow or reduce tax payment in some cases. For example, companies will be able to take advantage of instant depreciation, which will allow certain assets to be written off faster, thus reducing the profit tax due. In addition, it will be possible to deduct scholarships to scientists – a promoting measure in the field of science and innovation.

The aim is social justice

According to the Vice -Minister, these tax changes seek to balance fiscal sustainability with social justice. « We want no group of society to have a sudden shock. The most will have to contribute to those who will not financially cause problems. Meanwhile, low or middle -income people will almost do not feel change »– said K. Vaitiekūnas.

This is especially true in the current geopolitical context, where the state’s priority is to ensure national security. This reform is the first step to the long -term growth of the defense budget, while trying not to damage the social balance of the population.

By May 2 Everyone can make suggestions for tax changes. More information – www.finmin.lt;