Portuguese despair with lower reimbursements

IRS reimbursements regarding last year’s income are leaving the Portuguese on the verge of a nerve attack or being lower than previous years or because they are required to pay, which leads many to complain to the finance offices, as admitted to sunrise, the president of the tax workers union.

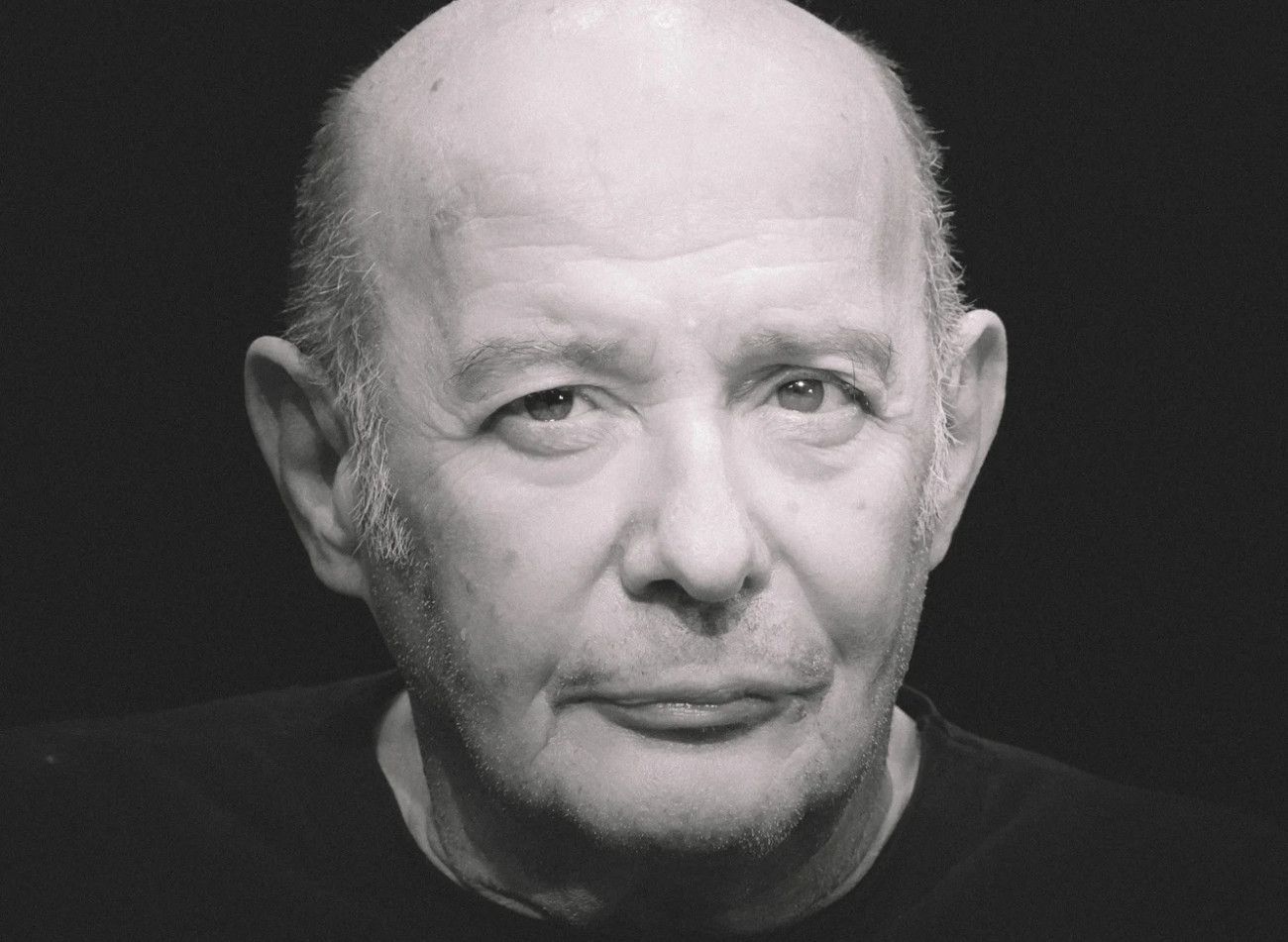

« Every day we are surprised by the increase in the number of people who go to offices displeased with the situation and ask for explanations, » explains Gonçalo Rodrigues. And it admits that the problem gains higher contours for taxpayers who have to pay. « People were said to receive an XE value now come across a lower value, but while receiving the problem is lower is more complicated when they have to pay » and gives an example of a lady who used to receive 100 to 150 euros and now has 400 euros to pay. «It makes him a difference and the main problem is the surprise effect. It’s the shock ».

Alongside the discontent, the union leader also draws attention to the fact that these complaints further clog the services. «We have few people to do the service. Finance workers spend the whole days to receive Portuguese taxpayers and immigrants who want to know what happened, causing an increase in work. And as they were already overwhelmed, this situation further increases the stress work. We have the idea that we practically only give bad news, is the burden of our function, ”he confesses.

Admittedly, this reckoning was already planned. Sol Nascer had advanced in September last year that the new IRS -based retention tables would give a fiscal relief in September and October – when a transitional period was applied to corrected the extra taxed tax from January and that for many taxpayers were seen as a taxpayer – could lead many workers and pensioners to be called to pay tax in 2025. now confronted.

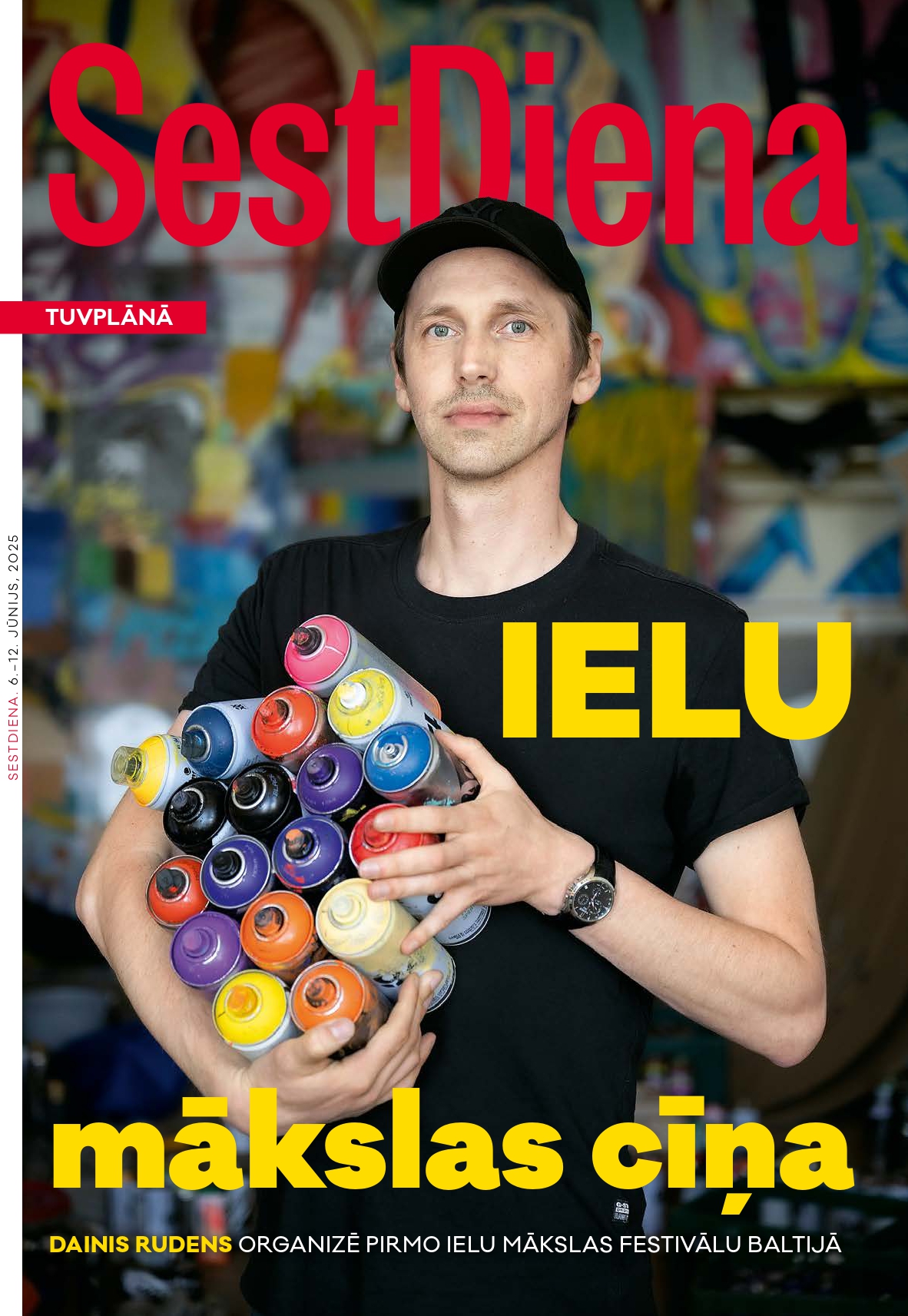

At the sunrise, the enthusiasts of the certified accountant order acknowledges that he has taken many by surprise, despite the warnings that had been made earlier. « Many years ago an expectation has been created, since we met as contributors, which there are always high reimbursements and the change in the formula for retention at the source that is the advance we make to the state to be in the last two, three years to change and to decrease this advance has caught a bit of unprepared taxpayers. »

A reality that was heard by our newspaper with those who have already delivered the income statement and account technicians. “I’ve delivered statements from some customers and there is no doubt that the surprise effect has caused some shock. I have several cases of taxpayers paying 300, 500 euros, ”says one of the professionals.

Paula Franco, however, draws attention to the fact that taxpayers are not being harmed. « They simply got the money earlier in their pocket and were waiting for this refund that it was a kind of forced savings that made it on the side of the state. » But he leaves a message: “In practice, many taxpayers complained of this forced savings, now that they stopped doing it are also surprised and feel that their expectations have been defrauded. Taxpayers already have the money on their side because taxes dropped by 2024 ».

Misleading table

Gonçalo Rodrigues also recalls that for two months there were lower discounts and admits that « technically this reduction was well intention so that the money would be on the side of the taxpayers and not to be on the side of the state coffers. »

However, it recognizes that the problem may be related to the table has been poorly calibrated. “There should have been care not to create such large differences in the face of what they were used to. At this point, the difference is to pay before or pay more to receive later because even if the person is refunded has paid his part with the retention he did. In the end, the account would be the same »

According to the billing accounts, you will only pay tax who would have close to doing it or who had low reimbursements. « In September and October, dependent workers received a lot more money because they delivered less money to the state and stayed at that time with more money available, but as they have spent a few months, taxpayers do not remember, » he says.

Pay more to receive more

According to the president of the tax workers union, one of the tricks to avoid these surprises is to make greater monthly discounts, as provided for in the IRS code. «Any of us can choose to make a higher retention and can change the amount to discount every month. If I thought I was going to pay or if you prefer to receive more at the time of the refund you could have chosen to retain more every month and then have a half foot at the end. The problem is that people don’t know this and how the reductions were in September and October didn’t give much reaction time, ”he says to our newspaper.

Another of the care to be concerned with the way of filling the IRS statement. Paula Franco acknowledges that the automatic statement may be an option, but for those who did homework before. « It is a good solution for those who have the situations completely controlled, both at the level of income and at the level of expenses, » he says.

For those who did not validate the invoices, did not check all expenses and for those who are not sure if the automatic statement contemplates all this data then, the responsible advises to be careful and opt for the normal statement.

Another caution to be concerned with delivery in the early days, especially for those income from other categories. And explains why: «Settlement may not be adjusted and the simulation that is made may change by any of the situations have been introduced in the meantime. You need to be careful in confirming the data ».

In relation to Youth IRS, the president believes that we will not watch large starters, since the system contemplated for the delivery of the declaration concerns the rules that were in force in 2024: it applied until 26 years and depended on a study cycle. « The system is not yet as open as it applies in 2025. It only contemplates those who have cycles of study and, as such, there is great control over these situations, » he concludes.