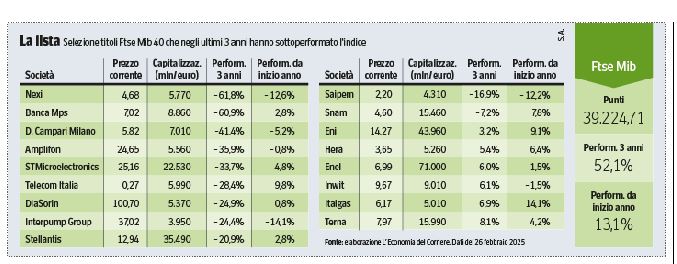

Piazza Affari, will the rally continue? Here are the « latecomer » titles that can now amaze

The upseal of the MIB Aftse (52% in three years) did not involve everyone. From Nexi to Telecom up to STM, the actions that have several recovery chances

Over the past three years, the FTSE MIB has recorded an increase greater than 50%, reaching the maximums since 2007, one step away from the threshold of 40 thousand points, and positioning itself among the best world indexes for performance, contending for the leadership at the’s & P 500. A rise, however, mainly driven by financial securities, whose weight on the index is historically relevant, thanks to highly high margins and generous remuneration policies for shareholders after years of lean cows.

However, not all Italian blue chips have benefited from this growth; Some, such as Nexi, Telecom Italia and Stmicroelectronics, among the leaders in the reference sectors, have submitted the index, while maintaining fundamental solids and a positive flow of news also on a strategic level. In an evolving market context, influenced by the duties imposed by the Trump Administration and a possible sectoral rotation, these securities could have the opportunity to recover land even for extraordinary reasons. According to an analysis of the Corriere economy, a good slice of the blue chips recorded lower performances compared to the general market. The results are shown in the table alongside.

Nexi and Telecom

Nexi, leader in the digitization of payments, has undergone a decline of over 60% in the last three years, due to growing competition and regulatory uncertainty. Despite this, the digital payments sector remains strategic, supported by the expansion of ecommerce and the digital transition. The most recent analyzes of the offices Study indicate an average target price per nexi of 6.9 euros, suggesting a 30% rise potential compared to current levels. Last Friday, the Company finally announced a capital return plan to shareholders for 600 million euros.

Telecom Italia has lived complex years, characterized by reorganizations, high debt and uncertainties related to the single network, recording a decrease of over 28% in the same period. Despite these challenges, analysts maintain a positive vision on the title, with an average target price of 0.35 euros, highlighting a 28%appreciation potential. Last February 21 it was Equita SIM who confirmed the « Buy » judgment, with an objective price of 0.36.

The STM and Nvidia case

Stmicroelectronics, a European semiconductors giant, has resentful of the cyclicality of the sector and of greater competitive pressure, with a flexion of about 34% in the last three years. But The company continues to invest in innovation and maintain an important position in the global semiconductor market and looks with interest to the changes in progress in Asia, which could question the leadership of the US giants such as Nvidia. Banca Akros has recently confirmed the Neutral Recommendation with an objective price of 23 euros after the Italian government, and in particular the MEF, would have started a dialogue with the French government to find a common solution to replace the CEO Jean-Marc Chery. In addition, analysts remember that the competitor Onsemi has decided to cut 9% of the global workforce, confirming that the collapse of demand in the semiconductor sector will not be reabsorbed soon.

Diasorin tests

Diasorin, specialized in diagnostics, suffered a 25% contraction due to the downsizing of the demand for pandemic tests. Despite this, the company boasts a solid financial position and continues to invest in new market segments, which could favor a recovery of the title in the medium term. In fact, Mediobanca Research provides that it will report a good series of results for the fourth quarter 2024 with growing sales at an average figure and an EBITDA margin greater than 33%, a level that should lead the company to achieve its objectives for 2024 of about 1.19 billion euros in sales.

Experts confirm the outperform recommendation on the title, still considered with a discreet development potential, favored both by a positive evolution of the underlying business and an acceleration of the penetration of some products.