Petrol and more dear gas, bags down: how much the Israel-Iran war costs (and the risk of the blocking of the Hormuz Strait)

The reaction of the financial markets to the attacks of Israel to Iran: the worst scenario is the blockage by Tehran of the Strait of Hormuz which would limit oil exports from Arabia, Emirates and Qatar

Financial markets are responding in these hours to Israel’s attacks on Iran exactly in the world where it was predictable that they reacted. The price of oil is growing strongly; that of Natural gas is rapidly increasing in Europe than in the rest of the world markets; Finally, the severe impact, albeit not catastrophic, on all the worldwide squares less than two large alternative oil producers to the Middle East: Russia and (in Futures pending openings) also Canada.

Oil

Iran contributes to this phase to 3.3 million barrels of crude oil per day (largely bought by China through « shadow fleets » that circumvent penalties) on a global consumption of about 104 million barrels. With 3% of the world offer in danger – although Iranian production hardly can Go down a lot under a halving from current levels – it is normal for oil prices This morning they have exploded: plus 8.8% the Brent, at 75.5 dollars per barrel. Despite the concern for the international framework, instead a sigh of relief are the American producers of crushing of a shale rock (« shale oil ») who have production costs sometimes even above 50 dollars per barrel and were seriously entering in crisis.

The impact of Trump’s duties

In fact, it should be remembered that the price of oil this morning is so skating upwards, but for now it is not very high ever: it is well under $ 82 per barrel of a year ago – therefore at the moment it does not really contribute to a surge in the annual inflation rate – and has only made to return to the levels of 30 January. The commercial wars triggered by Donald Trump in fact had depressed the price of oil at least from the « liberation day » of early April, with the announcement of the « mutual » duties.

Perhaps also for this reason the world bags suffer, but for now real collapses are not seen for now: the Ftse Mib of Milan is down by 1.75% in the middle of the day, the Dax of Frankfurt loses a little less, while the future of the S&P400 at Wall Street indicate a half -day in Europe in Europe down just over 1%.

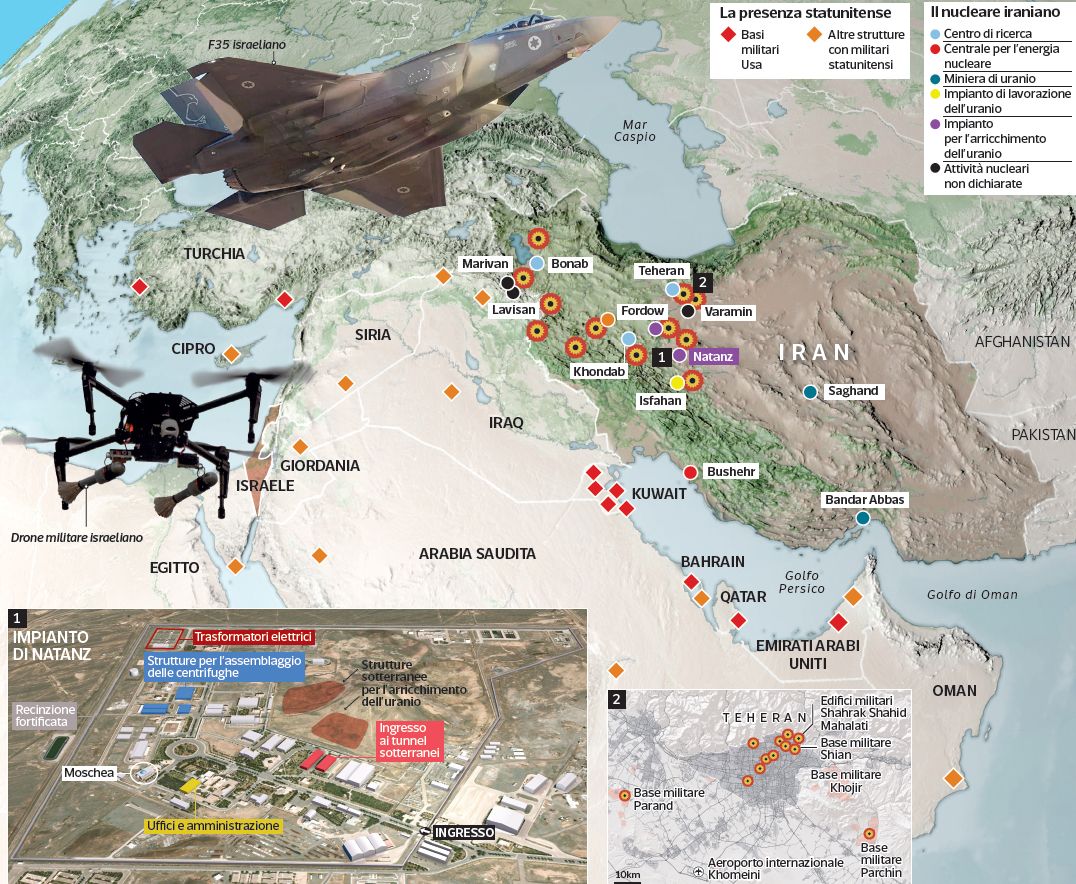

The Strait of Hormuz

Much will depend on the developments of the next few days and the military responses of Iran. If the crisis was really out of control, the worst scenario for the world economy would be that of a block operated by Tehran on the Hormuz Strait. In this case – for now hypothetical – Saudi Arabia would still be able to export at least five million barrels per day, just under half of its production potential, through the East-West oil pipeline that connects it directly to the Red Sea and Suez. Even the Arab Emirates could still continue to export a part of their production. To suffer more would be Qatar, which must necessarily pass all its natural liquefied gas from Hormuz.

Natural gas

It is no coincidence that the price of natural gas in Europe has risen by 5.2%this morning, precisely because most of the Qatarino gas feeds the European market (but also in this case it has now only returned to the levels of the « liberation day » in April in which Trump announces the « mutual » duties). Instead the international gas price is Raised only by 1.5%, because they are mainly fed by American production.

Meanwhile, refuge assets such as gold are strengthened (plus 1.1%, very close to the historic maximums) and the dollar (more 0.6%, but after having lost 8%in six months) on the average of the main currencies. However, it is significant that the American government bonds slip slightly downwards (increase in 0.01%performance), confirming the fact that the market now hesitates to treat them as a real good safe refuge in the era of Donald Trump.

The advantages of Russia

Overall, on a purely market level and in the very short term, someone also finds some advantage in this crisis. The first actor who benefits Russia in the short time: probably Trump will probably be even more contrary to strengthening penalties against Moscow oil within the G7 framework of the next few days, because The American president will not want to raise the barrel prices even more. The second actor who finds some advantage in the events of the last few hours is then the industry of the « Shal Oil » Texana and American in general, which now enjoys prices to which it becomes convenient to produce. And the return to the market of these producers will contribute, at the moment, to contain the surge of the barile prices.

/s3/static.nrc.nl/images/gn4/data133617085-6b0516.jpg)