Out -of -court mechanism: In force or improved platform – new settings

The improved platform of the out -of -court debt settlement mechanism that incorporates recent legislation by the Ministry of National Economy and Finance is in force. Through the mechanism, debtors are able to regulate all their debts by ensuring an automated solution and avoiding judicial procedures.

The aim of the new arrangements is to expand the perimeter of the beneficiaries, facilitating not only our vulnerable fellow citizens but, for the first time, the middle class.

Specifically, the platform has been incorporated the following change:

– Doubling the financial criteria of the beneficiaries who will obtain a compulsory proposal from all creditors and have a debt of up to € 300,000, which are delayed at least ninety (90) days.

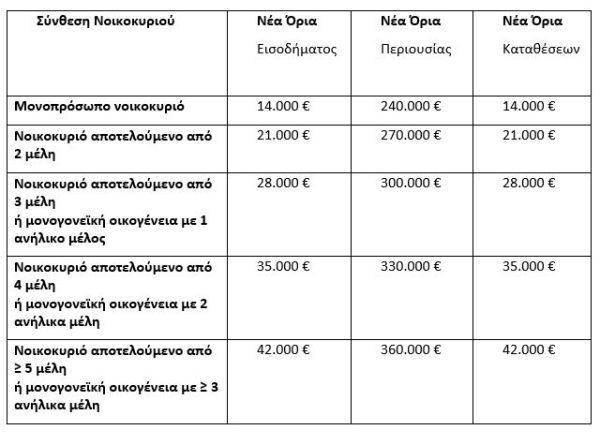

The new limits are shaped as follows:

How the new limits of out -of -court mechanism are shaped

The benefits of integration

As stated in the announcement, the out -of -court mechanism is a holistic and sustainable solution for natural and legal persons with debts of more than 10,000 euros to the State, Social Security Bodies, Banks, Servicers as well as for debts and in favor of third parties collected by the tax administration. The benefits of integration into the mechanism include, inter alia, as follows:

– Suspension of individual and collective enforcement measures against the debtor if the arrangement is respected.

– The debt restructuring proposal for vulnerable debtors is firstly accepted by banks, services and the State.

– The creditor’s obligation to submit a written proposal to the debtor three months before the auction.

– Issuing evidence of tax and insurance information.

– Regulation of loans that guarantee the Greek State.

– Possibility of deleting basic debt, interest, fines & surcharges.

– Partial debt write -off while avoiding appeal to judicial solutions. The prerequisite is the proof of real financial weakness on the part of the debtor, the borrower and the guarantors.

– Creation of a long -term repayment plan of debts reaching up to 240 installments for debts to the State and Social Security and up to 420 installments to financial institutions

Source: ot.gr

:format(webp)/https://content.production.cdn.art19.com/images/17/af/46/b9/17af46b9-6bcc-441c-b5e0-db3ffa876a3e/ba8b2d50a8e2873b5508c25ac7fb60b9fdfe673813521c1f45746a0a15d41a4df28d6156eb40bbd1515b59cee5bd298890e0ad7dad7954e894d41ca48939c6e9.jpeg)