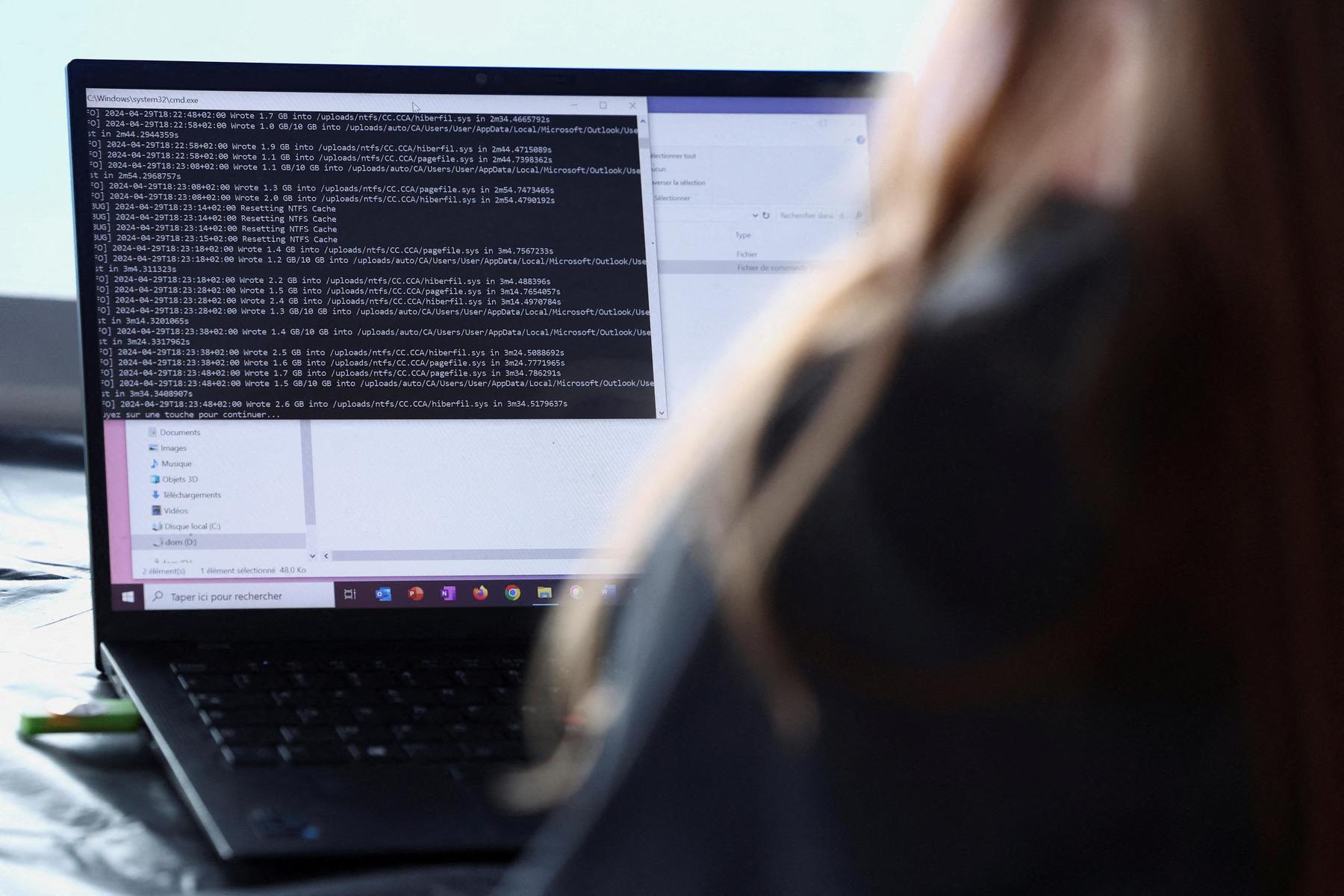

Open 900 large tax evasion folders (graph)

Property sales, tax -free parental benefits and donations, taxpayers with tax refunds, cases that have emerged after prosecutor's order and open cases of the last three years has been fought by the AADE Audit mechanism.

High on the list of taxpayers are 900 large tax evasion cases, which are related to bank account openings, processing seized data and files, issuing and reception of virtual tax data, e -commerce, delivery platforms, VAT fraud and intra -Communication.

To check all cases, risk analysis criteria, an automated final scoring model and elements of internal and external sources of information available to AADE will be applied. Cases that collect the highest scoring are controlled as priority.

According to the plan of AADE, at least 72,400 tax checks will be carried out this year, with the burden falling on « fresh » cases, real estate tax cases and high tax evasion.

In his decision, AADE Governor George Pitsilis gives new instructions asking, inter alia, to check:

¢ Cases of Transfer of Real Estate, Inheritance, Donations and Parental Benefits Taxation on December 31, 2025 and relate to properties that are not included in the objective system of value for determining and the taxpayer has not been accepted by the taxpayer.

¢ Research Reports of Research and Public Revenue Services (YEDE).

¢ Communications reports forwarded to AADE by the Economic Crime Investigations Directorate.

¢ Tax refunds cases.

¢ VAT refunds and undertakings receiving income tax refund, without audit.

¢ Cases resulting from prosecutors.

¢ Intra -Community Transactions cases (VIES) and cases involving reviews of licenses for the operation of offices or branches of foreign companies established in Greece.

¢ Cases of mutual administrative assistance upon request.

The tax mechanism will « dust »:

¢ 485 tax evasion investigations related to bank account openings, seized processes and files, issuing and receiving virtual taxation circuits, digital file processes, etc.

¢ 105 Research Cases of New Information and Data.

¢ 155 cases of special research in the field of e -commerce, mediation platforms in the provision of residence services and online business.

¢ 155 Research Cases, which relate to fraud on VAT intra -Community transactions.

Regardless of their prioritization or not, they are checked:

¢ Cases of multilateral audits carried out by Greek and foreign tax authorities.

¢ Investigations – checks at the behest of the Governor of AADE or the Head of the Directorate -General for Tax Operations (DGF).

¢ Research cases resulting from prosecution orders at the request of the YEDEs.

¢ Investigations for which a special proceedings have been transferred to safeguard measures to the competent authority, as well as investigations for which a document has been transferred to commit bank accounts and assets.

Prioritized Investigations, which are transmitted by operational structure (YEDE), due to the review by the HRSE, for the same entities and for overlapping tax periods, regardless of taxation.

¢ Investigations – Checks that are in a check report.

¢ Cases concerning some on -the -spot targeted audits, as well as other prevention audits to determine the fulfillment of tax liabilities, keeping books and issuance of tax information, in accordance with the applicable provisions, for taxpayers who carry any business.