Online deposits, where to invest 2 percent net to equalize the accounts with dear life

The offers and promotions to manage excess liquidity with the products that offer a rate to those who bind the money for a period

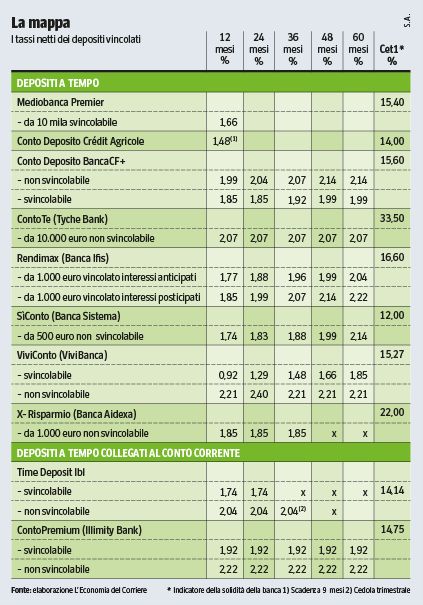

Managing liquidity becomes more and more difficult. As announced, on June 5, the eighth cut of the European Central Bank arrived, now the reference rate is 2%. But the storage accounts seem to resist. After the seventh cut in April, some banks only made read files. We will see what happens after the eighth that took place in early June. Meanwhile, knowing how to choose, it is still possible to bring home a net rate of 2%, with a maximum of 2.20%. Then drawing the accounts with inflation (2% in May).

Comparison

To react heavily to the dark of the president of the ECB, Christine Lagarde, were the government titles. The gross annual performance of the 12 -month bot, beaten in auction last May, dropped to 1.96% (1.55% net) from 2.33% (net 1.88%) of the March issuance. The reductions made themselves immediately felt on the last issue, the twentieth, of the BTP Italia. The most generous and attractive of the family of long government titles. Compared to the nineteenth issue, the duration of the last tranche of BTP Italia has stretched by two years (from five to seven), while the guaranteed fixed coupon dropped from 2% to 1.85%, while the prize for those who will keep the security up to the expiry will be 1% instead of 0.8%.

As for all BTP Italia, the protection from inflation which, however, in the near future should not undergoes (Trumpian duties permitting) confirmed.

The options

It should be added that in the choice of investment solutions, performance is not the only element to be evaluated. For the benefit of the storage accounts there are: the possibility of choosing the duration of the bond, even a few months; the guarantee of capital up to one hundred thousand euros by the interbank fund; the absence of costs, with the exception of the stamp duty of 0.20% on the stock. Cost that can be saved by choosing the institutions that welcome it, as Banca System and Banca Tyche.

The negative sides of the BTPs are the longest deadlines and in the event of the sale of one of the titles dedicated to families before its natural deadline, in addition to losing the loyalty bonus, the saver would be exposed to the risk of capital losses, if the sale price was lower than the purchase price.

Flexibility

To meet private individuals and facilitate the parking of liquidity on virtual salvadanai, the « flexible » lines are increasing, which allow early disadgration without criminals, after notice. Another interesting aspect of the storage accounts are the promotions that banks launch periodically, offering attractive returns.

Here are those not to be missed today. Throughout the month of June, Mediobanca Premier is promoted, with a gross-year-old return of 3% on the new liquidity (minimum 20 thousand euros) made on the deposit account and bound for six months. To those who, by July 19, open the current account and the orange deposit account, without constraints, Ing recognizes 3.50% gross/annual for six months, without the need to accredit the salary. The only required condition is the commitment to spend at least 100 euros with the debit card by 30 September. The offer does not include minimum payments, but a maximum ceiling of 100,000 euros.

And again: to those who, by the end of June, opens the free countercurrent current account, IBL Banca recognizes the free fee for six months and until 31 July 2025 The per year gross promotional rate of 2.75% on average stocks from 20 thousand to 150 thousand euros. In case of exceeding, the 1.50% gross on the entire stock will be applied.

Until May 31, 2026, on the deposit account X Risparmio Flexi (where the early disinvestment is foreseen with a 32 -day notice), Banca Aidexa recognizes a gross annual rate of 3% and until 30 September 2025, on the free deposit account for Savings, the promotional rate of 1.50% gross is applied, calculated on the average stock.

:format(webp)/s3/static.nrc.nl/images/gn4/stripped/data133811978-a9debb.jpg)