Nvidia calmed the capital markets

Last week, with the relative lack of news at the entrepreneurial level, new shocks on the market again provided US President Trump. This time, he directed his finger against the EU, as threatening a 50 percent customs, which is expected to enter into force with 1 June. He was mistakenly disrupted by the dynamics of US and EU negotiations. Two days later, he changed rhetoric and announced that he had postponed the introduction of customs duties to 9 July, which somewhat reassured the capital markets. At an entrepreneurial level, he found a new victim – the technology giant Apple, where he was disturbed by the fact that most of his devices are produced by the company in foreign markets (China and India), not domestic soil. He threatened the company with customs duties of 25 percent if it does not move production to the US.

This also brought a little relief to bond markets, as a reduction in the US -rating rating has raised the required yields of ten years or. 30-year-old bonds for more than 4.5 percent. by five percent for longer maturity. The returns declined again below these two psychological boundaries, which only slightly reduced the alarm in the bond market. The price of gold began to rise again – which in early May reached a record value, and according to information on reducing the tightening of trade measures on the US and their main trade partners, it declined slightly in the second half of May.

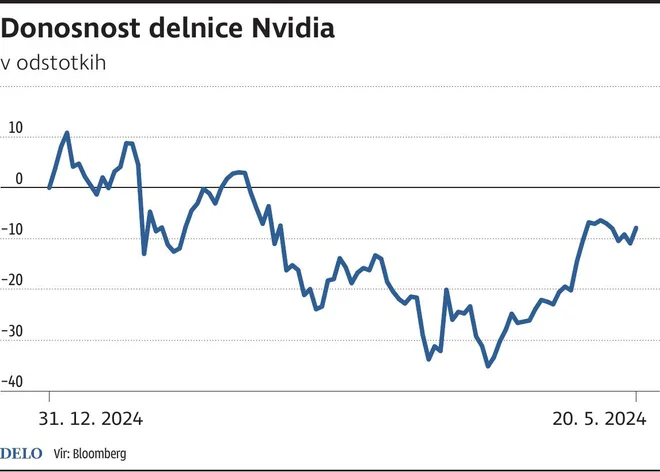

Return nvidia photo gm IgD

All the eyes of the financial markets were on Wednesday night to publish the results of NVidia’s business for the last quartal. More than 95 percent of the 500 largest companies in the US have already published business results – Nvidia traditionally publishes the last ones. The company has published very good results – in the last quarter, the company rose by almost 70 percent compared to the same quarter last year, exceeding the analyst’s announcement. Even with net profit per share, the company was positively surprised by the assessments of analysts. In particular, the estimate of future business was important and the company continues to expect exponential growth. However, they are concerned about the delivery of H20 chips to the Chinese market, worth around $ 50 billion. The limitation of the supply of chips to China deprived them of eight billion dollars in this quarter alone. After the announcement, the stock gained almost five percent of its value.

Janez Javornik, Triglav Funds Photo Triglav Skladi

In China, it echoes the announcement of one of the largest electric vehicle makers byd to reduce the prices of 22 models of vehicles it has on offer by ten to as many as 34 percent. This is the cause of the big stock of vehicles in the showrooms. Whether it’s just a sales maneuver to reduce vehicles or a price tactic of a price war among Chinese electric car manufacturers will show time. As a result, the company’s share has fallen by more than ten percent, and other electric car manufacturers shared a similar fate.

/s3/static.nrc.nl/images/gn4/stripped/data133174244-e67b07.jpg)