Middle East again in the focus of world stock exchanges

The escalation of the conflict on Israel-Iran neutralized all gains in the American market last week who followed a favorable report on inflation and the new appointment of China and the United States around the customs.

The S & P 500 index fell 0.4 percent and lowered below the border of 6,000 points, while technological actions, measured Nasdaq, lost weight of 0.6 percent.

Geopolitical tensions from the Middle East were returned to the large door last week. Alternating attacks with rocket missiles and drones have led to growing tensions and in global frameworks, especially when conflict has expanded to oil and gas infrastructure goals.

Iran owns others in the world’s natural gas reserves, while in crude oil reserves it is in fourth place.

Iran threatened to reach for the decision to close the Hormhuskye Seacome that represents the vital point of transport for a third of world oil production.

The price of American crude oil WTI jumped on Friday more than seven percent to $ 73 per barrel, which is her highest level in the last four months.

Some analysts indicate that further escalation of the conflict, in the form of destruction of oil infrastructure or closing of the Hormum Seafood, could inflict crude oil at the level of 100-120 dollars per barrel.

The growth of crude oil prices could also thwart the expected gradual return of American inflation into the limits of the Fed’s goal of two percent. The growth of crude oil prices, such as jumps from Friday, could bring 50 additional base points in inflation growth.

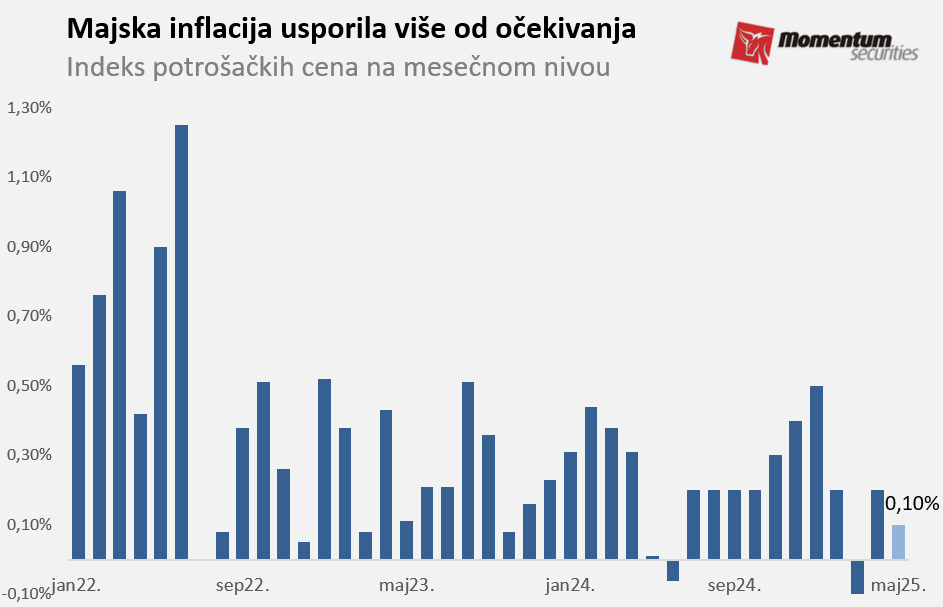

It is a continuous weakening of energy prices contributed to lower mayare inflation from expected, given that the decline in energy prices neutralized some price increase, while individual items were expected to rise due to larger customs recorded, such as clothing and vehicles.

American inflation in May rose 0.1 percent on a monthly basis, below the consensus of 0.2 percent, while the annual rate of 2.4 percent was in line with expectations. Base inflation, which excludes food and energy, increased by 0.1 percent per month or 2.8 percent per year, below the consensus of 0.3 and 2.9 percent, respectively.

After the latest inflation report, the market expects the reduction of interest in September, with probability of about 70 percent, and is more than certain that this week’s session will result in an unchanged interest that has been ranging 4.25-4.50 percent from December.

Before escalating the situation in the Middle East, in the focus of investors, there were talks of High Chinese and American officials in connection with the trade policies of these two countries.

Donald Tramp said on Wednesday that the agreement was reached and that the final approval of both parties was just awaited. According to the same allegations, China will renew delivery of rare minerals, while the American side will not close Chinese students access to universities.

Customs will remain at the level of 55 percent for China (counting initial 25 percent) or 10 percent for the United States.

Winner of the week

The actions of the American Software Company, Oracle (Orcl), jumped almost 24 percent last week after the company published quarterly business results above expectations and announced « dramatic higher income » in fiscal 2026. Years.

Oracle recorded the best trading week since 2001. After the company announced revenues in fiscal 2026. Year of at least $ 67 billion, which assumes a growth of 16.7 percent compared to an earlier expectation of 15 percent.

Since the beginning of the year, the company’s shares in the plus are about 29 percent.

The loser of the week

Software manufacturer’s actions for creative professionals, Adobe (Adbe), fell on Friday by publication of more than five percent after investors increased skepticity to increase the results of artificial intelligence (AI) into software tools.

Investors did not encourage the increased forecast of administration in terms of annual revenues that are now expected in the range of H2D2,50-23.60 billion in relation to 23.30-23.55 billion dollars.

After this correction, Adobe shares from the beginning of the year in the minus are about 12 percent.

The author is the main broker of Momentum Skuritiz.

Follow us on our Facebook and Instagram page, but also on X account. Subscribe to PDF List release today.