Markets in front of the turning points

Although trade tensions between the US and the key partners have seemed to have subsided, two important turning points are nearing: July 8. A 90-day discontinuation of customs duties with the EU, and on August 12 with China. The extension is likely, but if the decision is made only just before the deadline, it can again trigger fluctuations in the markets. While customs are expected to remain at the present level, with relatively limited direct consequences, the path to stability remains uncertain.

Photo: Jože Suhadolnik Suhadolnik Jože

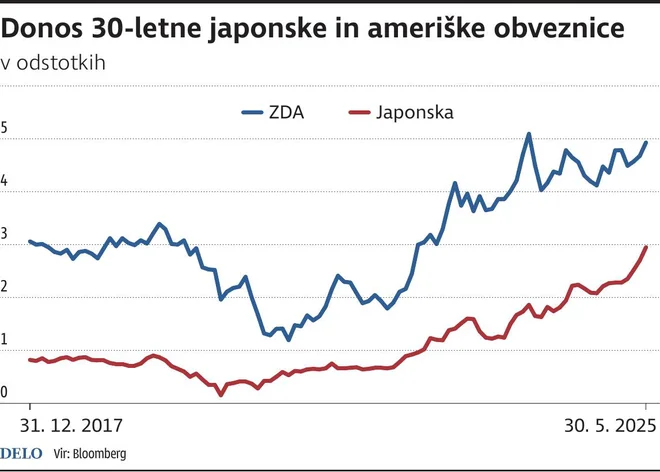

Meanwhile, as a central macroeconomic risk, long -term public debt is becoming more and more popular. The weaker demand at recent auctions in Japan, Australia and South Korea, along with the now-tense expectations ahead of the upcoming US editions of ten- and 30-year bonds, indicates the falling willingness of investors to finance extensive budget plans in higher interest rates.

Investors require a premium

The returns of long -term bonds have already exceeded the highest levels after 2008, despite the fact that most central banks, including the ECB, have been reducing key interest rates for a long time. Investors are increasingly demanding a higher premium, as they doubt that the announced fiscal incentives (from the US to Germany) will actually contribute to the long -term growth of productivity. The overall rise in global profitability is a clear signal that government can no longer afford borrowing to an extent possible during the zero interest, but it can be observed that global policy is not yet aware of it.

Central banks have been carefully responding to these tensions. The Japanese Finance Ministry is considering reducing the editions of super longing bonds. In the USA, however, if a weak demand were to continue, the bond purchases program (QUANTITITIVE EASING) to increase liquidity. But such a measure would probably weaken the dollar, which would impair the conditions for these strategies Carry Tradebased on the differences in the interest rates of state debt in different currencies (eg yen – dollar).

In this context, Japan plays an important role as it is the largest foreign holder of US bonds. In March 2025, it owned about $ 1,130.8 billion in US debt. Any major restructuring of its portfolio would therefore affect global returns and currency markets.

yield of shares of Japan US Photo ZX IgD

One of the key triggers of greater risk is the law Big Beautiful Bill (BBB). If it is confirmed in the US Senate, it is expected to bring in more trillion dollars in additional expenditures in the coming decade and raise deficits boldly, in times when markets are more sensitive than ever after 2008. Financial markets would probably be punished by the law with higher long -term returns, the impairment of the dollar and pressing the Fed.

Deeper system risks

At the same time, the combination of a weaker dollar and higher long -term interest could gradually reduce the attractiveness of Carry Trade strategies, which would further increase the volatility and the possibility of capital turmoil. We have already detected the short overturo of this, to a very limited extent, in August 2024. Although trade tensions may seem at least partly under control, financial markets are increasingly detecting deeper system risks associated with the sustainability of public finances and changes in global debt demand. Any confirmation of the BBB Act and a combination of higher long -term interest and a weaker dollar could become a trigger of larger turmoil on bond and currency markets. Caution, diversification and monitoring of fiscal decisions of the largest economies will be key elements for maintaining the stability of portfolios in the near future.