« Lost in … Savings »: Greek households spend more than revenue

The meager increases in wages combined with the « monster » of accuracy that « derives » the disposable income still remains a great deal for Greek households. In the meantime, the possibility of saving is removed with the elements of the Hellenic Statistical Authority (ELSTAT) to be alarming.

Savings in Greece in recent years has remained low, with households facing challenges due to limited income, high living expenses and structural characteristics of the economy.

Despite the increase in minimum wage in 2024 and average salary, income remains low compared to the cost of living

Characteristic are the IOBE indicators that reflect the predictions of Greek households to rise prices, but also by the high percentage of those who barely bring out the month with his income.

Increased incomes but not savings

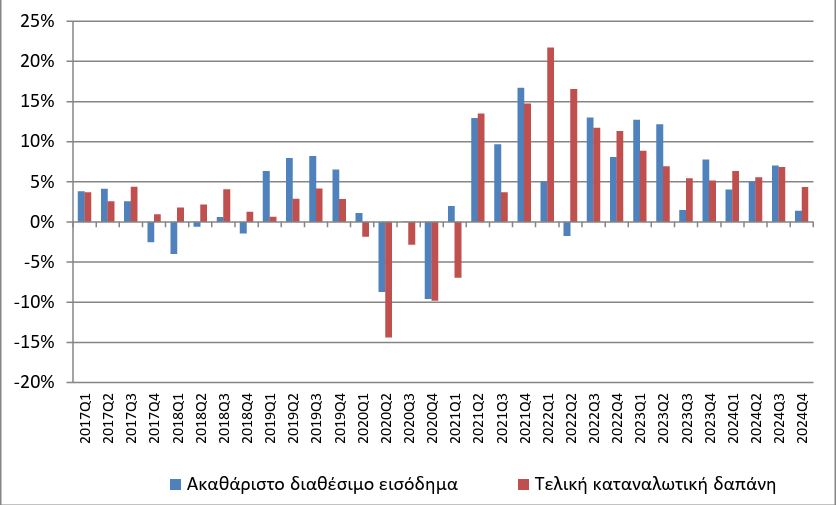

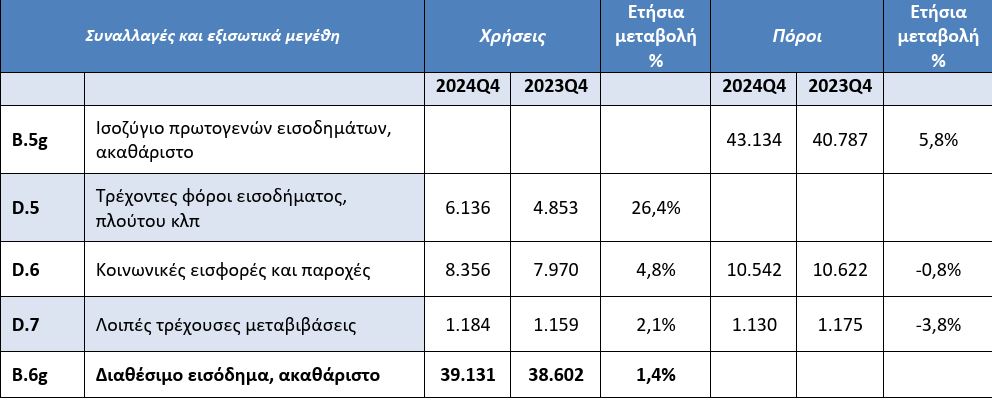

The small increase (1.4%) of household income and non -profit institutions serving households in the fourth quarter of 2024 proved anemic to stimulate the storage process instead of their immediate consumption. Specifically, the available income from the € 38.60 billion in 2023 amounted to EUR 39.13 billion in 2024, according to official data announced by the Hellenic Statistical Authority (ELSTAT).

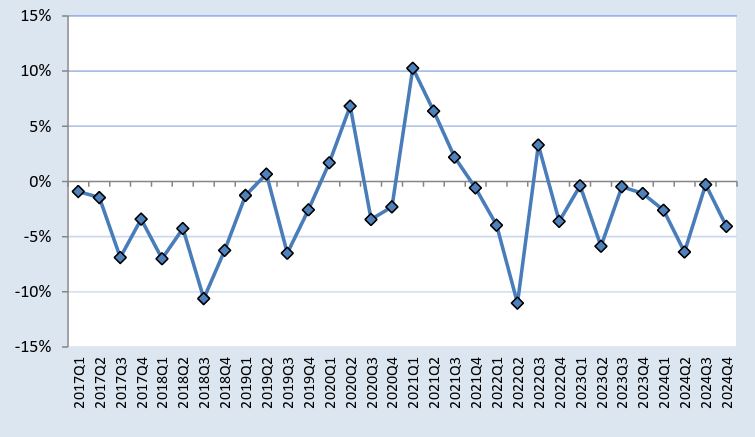

At the same time, the savings rate, which shows the relationship between savings and disposable income, was negative and declined even more than last year. In particular, it was -4.1% for the fourth quarter of 2024, while in the corresponding period of 2023 it was at -1.1%.

Based on European Commission estimates, the savings rate in Greece for 2025 will not turn to a positive sign (-1.3%), making our country unique in the EU with a negative rate. In 2022, the average savings in the EU was 12.7%of available income, with countries such as Germany (19.9%), the Netherlands (19.4%) and Luxembourg (18.1%) pioneering. Greece and Poland were the only countries with a negative rate. In 2023, the EU had an average of 13.5%, while the eurozone 14.4%. Greece remained a skies.

Savings have only been positive in recent years during the pandemic (2.4% in 2020, 3.6% in 2021), due to consumption restrictions.

Looking at the consumer expenditure indicators we see an increase that can be linked and accurately gnawing the available income. Specifically, according to ELSTAT data, consumer expenditure from € 39.03 billion in the fourth quarter of 2023 amounted to € 40.72 billion in the same quarter of 2024, increasing 4.4%.

The fact that consumption grows faster than income suggests that households resort to lending or divestment of property rather than a real increase in economic activity. It is also obvious that citizens’ consumer spending has increased faster than their incomes, which also affected the rate of savings.

Gross investment

In other elements of ELSTAT’s quarterly report, in the 4th quarter of 2024, the gross investment of fixed capital capital of the non -financial companies amounted to € 4.85 billion. The percentage of sector investments defined as gross fixed capital investments to gross value added was 24.1% compared to 22.9% in the 4th quarter of 2023.

The General Government sector in the 4th quarter of 2024 showed net lending of € 1.12 billion, compared to the 4th quarter of 2023 when net loan was € 0.02 billion.

During the 4th quarter of 2024, a deficit was recorded on the external balance of 6.17 billion euros of goods and services, compared to a deficit of € 6.28 billion recorded in the 4th quarter of 2023. In addition, in the 4th quarter of 2024, a surplus was recorded in the external balance of 1,95. billion euros, against a € 0.95 billion surplus recorded last year’s quarter. As a result of the above, the total economy showed net loans of 4.22 billion euros in the 4th quarter of 2024.