KEPE: increased to 33.6% of the « fear » index in April (graphs)

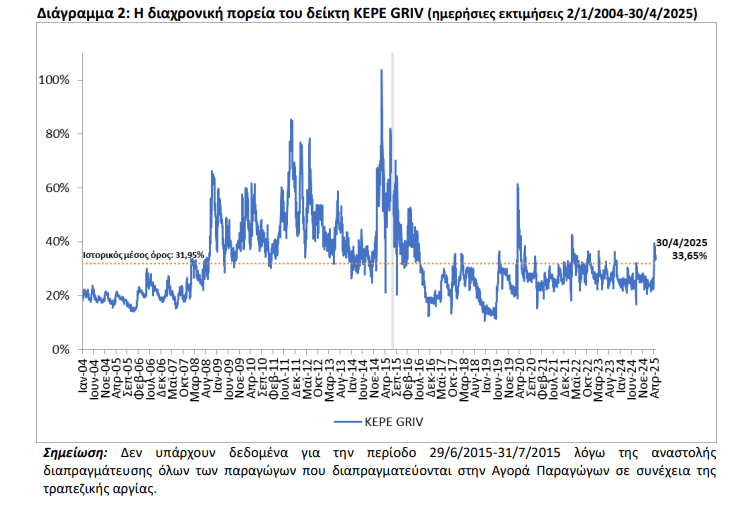

In March 2025 the « fear » index of the programming and financial research center (KEPE), reaching 33.65% on April 30 from 23.01% in late March.

Kepe Griv’s imputed volatility index or « fear » index reflects the uncertainty of derivatives market for the expected short -term course of the Greek market and is calculated on the basis of the prices of the FTSE/XA Large Cap.

The price of the Kepe Griv index increased in April 2025, reaching 33.65% on 30/4/2025 from 23.10% to 31/3/2025.

In addition, the average daily price of the index increased compared to the previous month, reaching 33.92% in April 2025 from 24.28% in March 2025. The index moved to a level higher than its historical average (since January 2004) for the Greek market, which is 31.95%.

The evolution of the index reflects an increase in uncertainty about the expected short -term course of the Greek market compared to the end of last month, with fluctuations within the month.

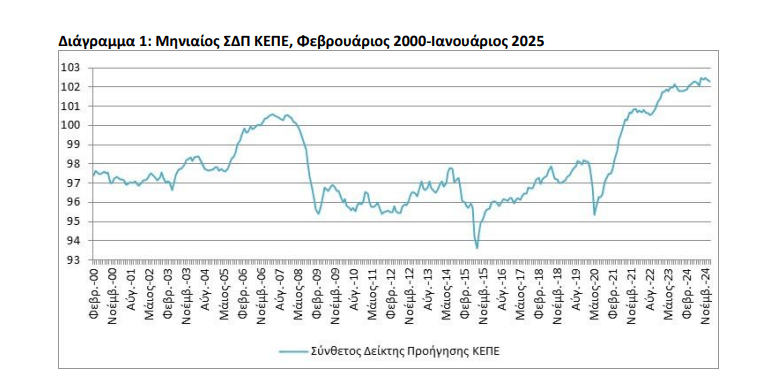

Complex indicator of KEPE Promotion

This is a complex of a promotion indicator (CPS) based on a dynamic agent model, manufactured using six selected monthly financial variables with

Charges of appeal. Provides precursor indications of the course and transformations in Greek economic activity, before they are imprinted in its current sizes

total economic activity.

According to the most recent observation for January 2025, the SDA fell for a second consecutive period, and remains high for the whole exam period. If this development is not part of the intermediate volatility of the CPA, it may mark an adverse conversion of the expectations and estimates of participants in economic activity.

In this case, it may provide a first precursor indication of intermediate deterioration of future economic conditions, possibly linked to inflationary pressures and geopolitical dangers. With the aim of obtaining additional indications, it is necessary to reassess the GPA. The incorporation of new data is expected to demonstrate the continuation or not of observed trends in terms of the course of future domestic economic activity.