Is the new energy arrangement an opportunity?

US President Donald Trump After re -election as president in 2024, he began to implement extensive changes in energy policy, which focuses on the increase in fossil fuels, in particular coal, and reducing support for renewable energy sources. Trump has signed an executive command that declares coal as a « critical mineral » and promotes its use for the supply of data centers that support artificial intelligence (UI).

This measure involves the opening of federal land for mining and delaying the closure of older coal power plants. About 70 coal power plants were approved by two years of exemption from the Bidn’s administration period. This measure was adopted for increasing the reliability and accessibility of electricity. In short, the new US energy policy represents an important change compared to the previous administration, as it prefers fossil fuels over renewable energy sources. This approach has triggered a number of discussions on long -term environmental and economic consequences and the impact of global climate goals.

Protectionism

At the same time, Trump runs a protectionist trade policy that inhibits international exchange and creates uncertainty for global economic growth. Due to customs and uncertainty around world trade, the demand for energy is reduced, which further pressure on prices. The International Energy Agency (IEA) has already adjusted its forecasts, and the world will consume less oil in 2025 than expected.

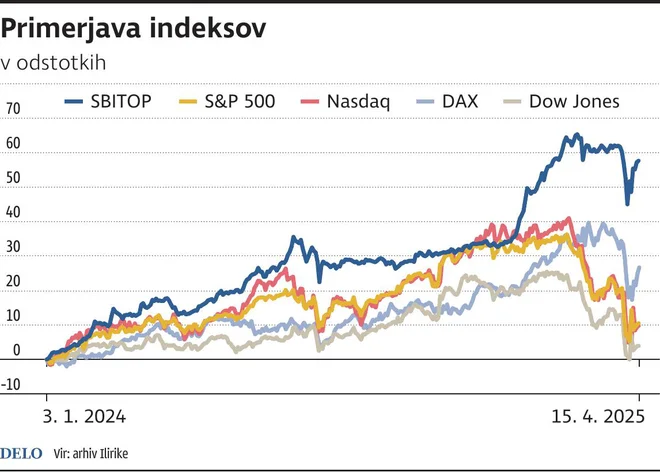

Comparison of indices for 28. 4. Photo GM IgD

But the US is not the only ones that increase its energy self -sufficiency. China strengthens its energy safety in parallel in its own way. It builds more than a hundred new coal power plants this year alone. Although it is committed to reducing emissions in international forums, it puts the reliability and growth of the economy from environmental goals in practice. This puts the West ahead of reality, where the energy transition will be slower than Brussels or Berlin wanted, as two of the world’s largest economies build energy on coal.

The Geopolitical match between the US and China is also increasingly tightening in the energy field. The Trump administration is striving for the re -industrialization of the United States to re -become an industrial superpower, as it was in the 1950s. It therefore promotes domestic production of fossil fuels and reduces regulatory barriers, which is expected to increase the energy independence and competitiveness of the US industry.

As a result, the historical influence of the Organization of Nafta exports (OPEC) can be increasingly poor. The world’s largest consumers and manufacturers of energy, USA and China, are increasingly arbitrarily tailored to the rules of play in the global energy market. It is becoming more saturated, energy prices more volatile, and energy policy is becoming more and more and more about the instrument of political and economic influence.

ETF with potential

What does this mean for investors? At first glance, it seems that over time in these changes, US industrial companies, those that will directly use a more favorable energy structure, redeploy global value chains and political support for domestic production. Effective exposure to these processes can be obtained through the ETF XLI US, followed by the Industrial Sector SPDR Fund movement. It covers the largest US industrial companies, including leaders in production, defense, transport and mechanical engineering.

The XLI US Fund is purchased and sold on the stock market through a trading account that can be opened by natural or legal persons at brokerage houses. Alternatively, exposure through individual asset management (IP), also provided by brokerage houses, often in combination with consulting and tailored portfolio, is also possible.

For investors who believe in the « return of industry » and strategic energy diversion of the US, XLI represents a logical and targeted investment.