Investors in favor of Musk’s « return » to Tesla

On Tuesday, April 22, after closing the stock market, US technology giant Tesla published quarterly business results, which were a great disappointment for investors. The company, for example, has experienced a nine percent decline in revenue (20 % in the automotive segment) and achieved significantly lower net profit than expectations already reduced, which was the least profitable for the company since 2021. The causes of poor outcomes can be attributed to strong competitive pressure from Asian manufacturers, burdened supply chains due to the introduction of customs duties and the impact of the brand’s reputation due to controversial political engagement of the Executive Director and the « Technology » of Tesla (this title was named in 2021) Elona Muskwhich with the US president Donaldom Trump It cooperates through this government efficiency service.

Shared photo GM IgD

Nevertheless, the publication of the results was followed by the rise in the price of Tesla, as it gained a good five percent in prolonged trading. It seems that analysts and investors have paid more attention than numbers to Musk’s announcement that he would move significantly with May from working with the US government and again focus more on running Tesla (still a day to two a week devoted to government debts). Many have seen this role as a distraction from Tesla managing, and at the same time as a risk to the reputation of the brand, especially considering that liberal customers responded to it with a boycott and even protests.

It is true that only Muskov’s departure from Trump’s administration will not be enough to be eliminated, but the response on the market nevertheless indicates that the extra time and focus that Musk could devote to Tesla may have a positive contribution to turning the company’s business back to the old ways of growth. Musk’s « Return » is definitely welcome for the company to a key period when, with all the difficulties in selling electric cars, he is trying to position himself as best in autonomous driving (including robotaxis) and robotics and to obtain new customers with upcoming cheaper models, while Teslo One of his main competitors, Chinese electric car manufacturer by car.

Darjan Pavšič, Triglav Funds Photo Jernej Lasic Delo

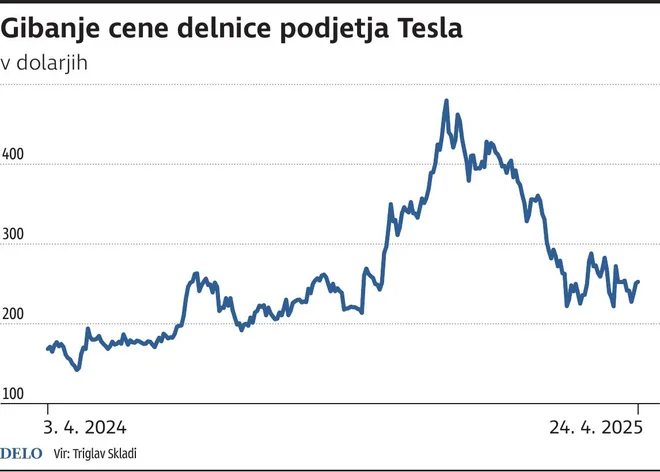

Company problems are also visible in the price of shares. From the record price she reached in December 2024, in less than three months it lost almost 54 percent of value (and thus a company more than $ 800 billion in market capitalization), and since then gained a few percent. With this, Tesla’s share, which is one of the magnificent seven, this year one of the largest losers of the US S&P Stock Index and is currently moving around the level from the period before Donald Trump’s election as US President in early November last year.

What Musk will prepare this time and whether he will be able to save Tesla from the conundrum will show time. The task will not be easy, but it may offer us the answer to the question of whether Musk, as a true superstar leader, is a really worthy premium, which, according to many, is welcomed in the price of the share.