Insurers increase the presence in new territories and in Crimea

A number of participants in the insurance market plans to expand the presence in the Crimea and new regions of Russia. According to experts, for insurers, these territories are attractive due to the additional volume of business from both retail and corporate clients and relatively low competition. At the same time, lawyers indicate possible legal risks when resolving losses.

Insurance companies (SK) expand the presence in new territories and in Crimea, follows from the Kommersant survey of market participants. So, Sogaz plans to open a client office in Sevastopol. In addition, the insurance group consistently develops business in new regions, including the DPR, LPR, Zaporizhzhya and Kherson regions, and until the end of the year plans to open a representative office in new territories. In April, Sogaz opened the first retail office in Simferopol. The plans of Rosgosstrakh for this year are the opening of its own offices in the Crimea, as well as in new territories. “PSB Insurance in 2024 began working in the Republic of Crimea and the DPR, opening representative offices in Simferopol and Donetsk, and we plan to expand our activities,” Kommersant said in the company.

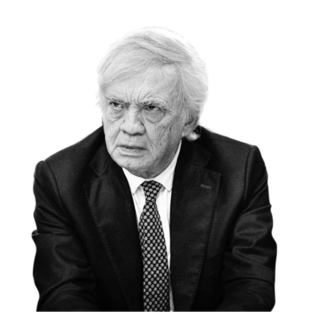

Anton SiluanovMinister of Finance, October 18, 2024:

“New regions are actively integrated into the financial and economic life of Russia. All services and financial services that residents of the rest of Russia use are already available here. ”

The very idea of providing insurance services in the Crimea and new constituent entities of the Russian Federation is based on a multiple of business growth potential, as well as the expansion of product supply and sales of contracts, said independent expert Andrei Barhota. In addition, as one of Kommersant’s interlocutors in the insurance market notes, the companies are under sanctions and do not risk anything.

In general, according to Mr. Barhota, the current volume of the insurance market in the Crimea and in new territories is 30-50 billion rubles, and after a few years can reach 135–175 billion rubles. The total number of insurers’ offices in the Crimea and new regions is no more than fifteen, not counting the Offices of the GPB and PSB that sells affiliate sales, including from associated banks, Mr. Barhota notes.

Today in Crimea and in new territories, smaller insurance companies also work, in particular, Astro-Volga (31st place), Gaide (42nd place), Hathor (not presented in the Ra Ra Rating, see. « Kommersant » dated September 9, 2024). At the end of last year, also plans to enter new territories in the OSAGO segment were reported by Sberbeling and Adonis.

The insurers present in these regions already close a number of needs of both legal entities and private customers. Sogaz works in the segments of the property and responsibility of legal entities, including mandatory species (Osopo and OSGOP), as well as voluntary medical insurance and accidents insurance, the company said. The Rosgosstrakh of the legal entity has the opportunity to insure objects in construction and installation risks and civil liability, and individuals to arrange OSAGO online or through insurance agents and partners of the company. PSB Insurance offers residents of Crimea and the DPR, property insurance of individuals (including collisions in the case of mortgages) and civil liability, insurance of children and adults from an accident and travel, as well as pets. For business, the property complex, civil liability, cargo transportation with military risk coverage, as well as additional medical insurance are available. At the same time, liability insurance in Crimea and in new territories is more profitable rather than in the main territory of Russia, and property insurance – before the end of the armed confrontation – has a relatively higher loss -making coefficient, Mr. Barhota believes.

According to experts, depending on the scenarios of further development, insurers in new regions may assume a quick expansion in the liability insurance segment, property and life. To win in attractiveness, customer orientation, brand strength will be large companies due to recognition and more resources, explains Alexander Tsyganov, a professor at the Financial University under the Government of the Russian Federation.

However, lawyers remind of risks. The legal uncertainty is a significant difficulty, since integration into Russian legislation continues in the new territories, which creates the risks of changing regulation, says Yuri Mirzoev, CEO of the MITRA national legal company. In addition, according to experts, disputes are possible to recognize insured events, especially in hostilities or emergency.

/s3/static.nrc.nl/images/gn4/stripped/data131299547-60a89f.jpg|https://images.nrc.nl/IAJm4vl2Fs0F7f_fdeFH_wAavpo=/1920x/filters:no_upscale()/s3/static.nrc.nl/images/gn4/stripped/data131299547-60a89f.jpg|https://images.nrc.nl/dy0EKKGlzHsyrRUXkFbLrNI-zRw=/5760x/filters:no_upscale()/s3/static.nrc.nl/images/gn4/stripped/data131299547-60a89f.jpg)