Industry representatives talk about a decrease in business optimism

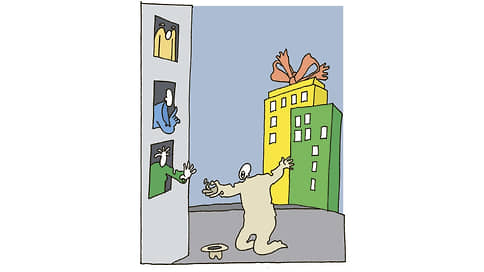

The results of the market surveys of industry representatives from the Institute of People’s Economic Forecasting of the Russian Academy of Sciences (Inp RAS) testify to the strongest decrease in business optimism of enterprises since 2022. According to data, the demand for the products of Russian companies is compressed, and it is growing for imports.

“Cooling in Russian industry begins to turn into hypothermia,” said the author of the study from the Inp RAS Sergey Tsuhlo. He says that before the crisis minimums of 2020, 2008, 1998, 1996 and 1994, there are still enough reason to talk about “soft landing”, “But the enterprises would definitely prefer to return from the cold to the more comfortable temperatures of the business climate.”

The dynamics of demand for the products of Russian industrialists has worsened for all five months of 2025: industrialists about the reduction in sales are more than about their growth, are recorded in the RAS Inp.

In May, sales volumes were estimated as normal only 45% of enterprises – at least from May 2020. This led to the fact that assessments of the stocks of finished products were estimated as excessive after the modest values of the ratio of these assessments in 2021–2024. However, before the crisis values of this indicator in 2009, and even more so the 90s, it will not come, according to IPN RAS: « Industry has learned to control its stocks of finished products. »

“The May decrease in output plans is quite logical in conditions of weak dynamics of demand and modest redundancy of finished products. The industry has not yet completely outplayed optimism: the balance of plans remains positive. Even in the conditions of a reduction (negative balance of assessments) of the actual issue in May, ”experts concluded.

The dynamics of the indicator (calculated by the RAS INC according to the method used by the OECD) passed to a decrease against the background of its turn up in Germany and Poland (while the mood of Russian enterprises, far from the pessimism, which respondents in these two countries experience; see graphics). “We can say that anti -Russian sanctions cooled the German industry overheated at the exit from the covid crisis. On the Polish enterprises, neither the exit from the Covid or the sanctions had a significant impact: the mood there stably remain below zero, ”said Sergey Tsukhlo.

In the center of macroeconomic analysis and short -term forecasting, exploring the data of Rosstat, fix the decline in production in industries focused on investment demand and intermediate consumption.

There is also a decrease in private demand for non -food goods in the first quarter (with the exception of seasonal fluctuations).

At the same time, analyzing the data of the Central Bank about foreign trade, Raiffeisenbank records that the Russian trade balance in April sagged a little even with the exception of seasonality ($ 8.6 billion against $ 9.9 billion in March) due to the outstanding increase in the import of goods, which has been detected over the past three months. “Export remains stable. This occurs in the conditions of smooth deterioration in oil and gas sales (due to reducing oil prices; physical volumes, according to the IEA, remain stable) with an increase in non-Neneftegas export, ”the bank analysts say.

What exactly and to what extent is responsible for the return of imports against the background of compression of the internal issue of civilian goods, due to partially closed statistics of departments, it is difficult to say exactly. Sberindex analysts, however, recorded that in May, compared with April, consumer expenses increased less than last year (3.6% versus 6.2%), due to a lower increase in food waste (1.2% versus 3.8%), catering (2.2% versus 9.1%) and services (2.9% versus 10.9%). At the same time, non -food expenses returned to growth and increased more than last year (6.2% versus 4.7%). However, the annual growth rate of real consumer expenses from May 12 to 18 compared to the previous week slowed down from 5.4% to 0.5% and became lower than the level of April (2.4%) due to the slowdown in all types of expenses, records Sberindex.