In order for oil prices to increase the price of fuel, inflation and interest rates in Serbia? – Economy

In the world who tells green agenda, the energy transition and leaving fossil fuels every day, one old pattern remains relentlessly: Any geopolitical spark returns oil to the throne of global care in the Middle East.

After the most recent armed conflict between Israel and Iran, the price of oil jumped for as many as seven percent on Friday, which is the greatest growth in one day since March 2022. year, when the war broke out in Ukraine.

At the same time, the price of gas at the Dutch TTF Stock Exchange increased on Friday, for more than four percent, confirming once more the world economy is still related to « dirty » energy.

Remind, the growth of oil and gas prices was the main culprit of inflation growth around the world in 2022. year, with which central banks fought by raising interest rates.

This new episode of energy instability comes at the moment when the world was happening to relief: inflation began to heal, and central banks have begun the process of gradual reduction in interest rates.

Neither Serbia is immune to these shocks. Possible further growth of oil and gas prices on the world market will also affect the price of fuel prices in Serbia, and they are further on the increase in inflation that is according to the last statistical data In May this year it was 3.8 percent.

Due to still relatively high inflation, the National Bank of Serbia (NBS) Holds interest rate to level 5.75 percent And since September 2024. years, which says that inflation is still a threat.

How could the growth of oil prices be influenced by fuel prices in Serbia?

Fury oil Brent increased on Friday with about $ 69 at $ 74 per barrel, which is an increase of about seven percent.

The price of crude oil Brent is an important indicator for the world energy market and often affects the economy, price growth (inflation) and fuel prices on pumps worldwide, including Serbia.

The growth of oil prices from Friday will certainly be felt through the growth of fuel prices in Serbia in front of us.

However, relief is that Brenta price fell on Monday for more than one percent.

The Secretary General of the Association of Oil Companies of Serbia (UNKS) Tomislav Mićović, which is to be careful when it comes to the latest price prices, but indirectly changes in the oil market and increase in price of oil as it happened in 2022. Years due to the Ukrainian crisis.

« Caution on the market exists, but we are still from the prices of the Ukria, and when the price of the fuel on the pump was 220 dinars. It is 40 dinars for you more than today, » Micović said the FoNet agency.

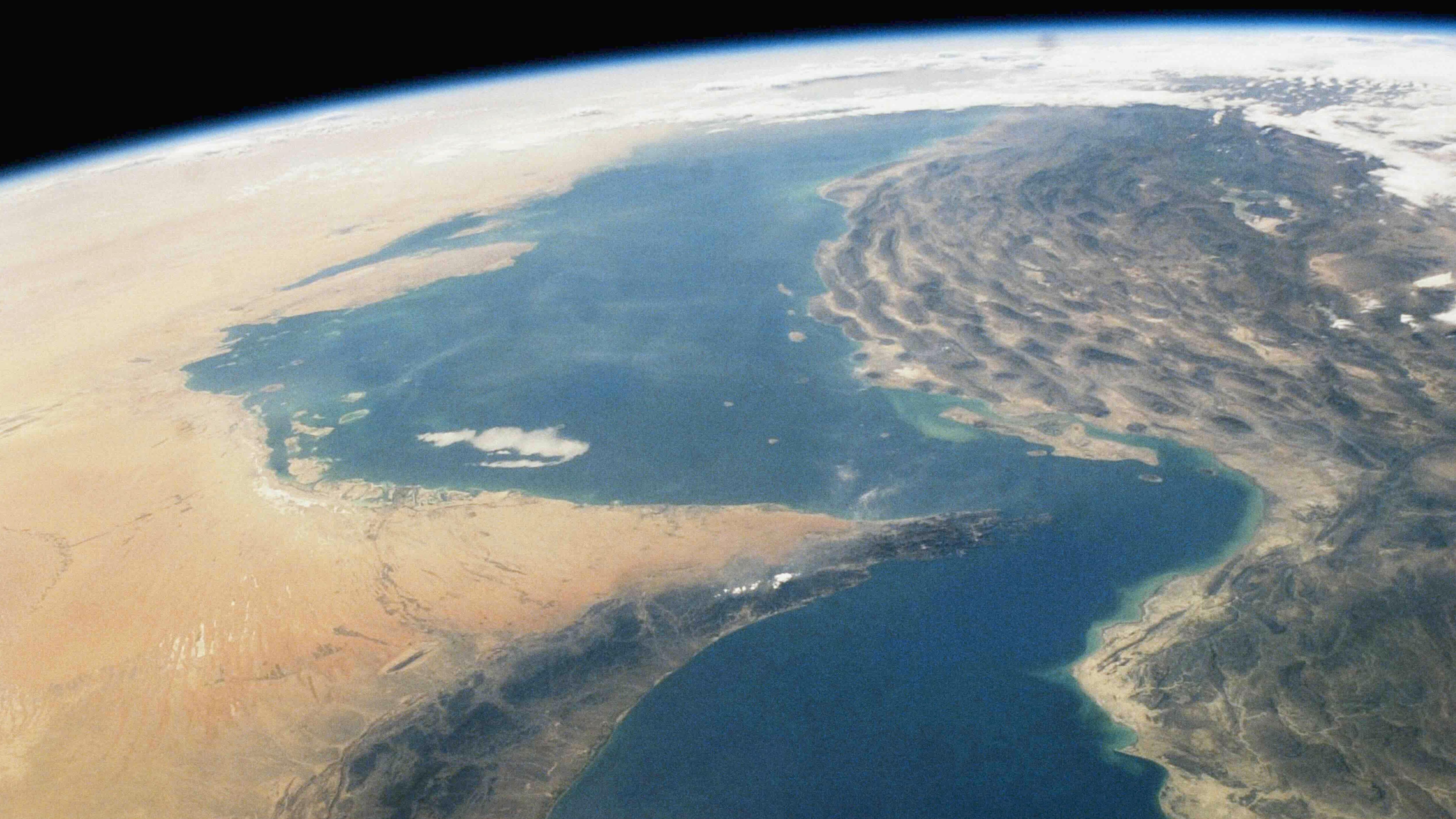

Further growth of oil prices could follow if Iran closes the organism vital point of transport for a third of world production production, where to shape oil from Kuwait, Iraq, Saudi Arabia, Katara.

Micovic pointed out that such a scenario has not happened in history so far, so he expects to stay only at the level of threats only.

World analysts forecast that in that case, the price of oil could increase at between 100 and $ 120 per barrel, and then the price of fuel in Serbia could drastically increase.

Fuel prices are on Friday, June 13, rose for two dinars. The current price of diesel in Serbia is 189 dinars per liter, and gasoline 179 dinars per liter.

Influence of oil price growth on inflation and interest rates?

The economist of the Center for High Economic Studies (CEVES) Lazar Ivanović told today that despite global movements in the oil market, the price of fuel in Serbia is often not proportional, primarily due to, as stated, high state imposes. He pointed out that in Serbia a key role in the formation of fuel prices has states.

Ivanovic pointed out that the growth of fuel prices directly affects inflation growth, which, reminds, also showed over the previous global crises.

« After the pandemic and during the Ukrainian crisis 2022. years, the main drivers of inflation were food and energy. So that the price of fuel affects inflation, » Ivanovic stated.

However, Ivanovic pointed out that more fuel prices could have a positive fiscal effect.

« If the fuel prices increase, it will be reflected on budget revenues. Excise will be larger, and this can further push the budget, » Ivanovic emphasized.

When asked if the possible new wave of inflation could stop the lowering of interest rates, Ivanovic replied that the possibilities of the National Bank of Serbia were influenced through the infration through interest policy.

« We are a very Euroized market, most of the citizens’ loans are in euros, not in dinars. Therefore, the MSBe maneuvering space is quite limited to inflation, » our interlocutor assessed.

When it comes to possible reducing the European Central Bank’s interest rate (ECB), Ivanovic said that the situation is currently uncertain due to Iranian conflict, and the leaders of this bank are not confident in which direction to focus monetary policy.

At risk and economic growth

High energy sources affect inflation growth, inflation growth affects retaining or raising interest rates, and high interest rates further discourage economic entities to indebted.

There is another danger to the economy, because high interest rates slower investment activity and overall economic growth.

Remind, ECB reduced the Reference interest rate at the beginning of this month, precisely supporting companies and consumers more affordable, because, as they stated, the trade war of American President Donald Tramp was threatened to slow down growth. Then the ECB dropped the reference interest rate at two percent.

They are now the Iranian-Israeli conflict « New Headache ».

Follow us on our Facebook and Instagram page, but also on X account. Subscribe to PDF List release today.