How to become rich in 2025

'The surest way to become rich is not the hard work but the wedding with the right person. «

Anyone who has read Jane Astin's novel « Pride and prejudice understands what the » four or five thousand a year « meant by Mr. Bingley. Mr. Bingley was a heir. This is how the Economist begins to look like developed countries in his article, about someone who wants to become rich.

How to become rich in 2025

Although, as government statistical services explains, they publish hardly any information on the inheritance, as their investigations are not sufficiently equipped to record huge, one -off payments, it has, however, gathered academic estimates of the annual « flow of inheritance » –

In 1900 the value of the inheritance exceeded 20% of GDP in some countries, as people inherited huge portfolios and property portfolios.

Subsequently, the value of the inheritance was reduced in the 20th century, before it was recently returned. In the late 2010s the legacies were worth 10% of GDP. This year people all over the rich world will inherit about $ 6 trillion.

In many countries, the percentage of wealth derived from inheritance is also increased. UBS Bank estimates that in 2023, 53 people will become billionaires inheriting money, not much less than 84 who will become billionaires working.

As a percentage of national production, annual French heritage has doubled since the 1960s. In Germany they have almost tripled since the 1970s.

In Britain it is twice as important than in income, for those born in the 1980s than for the previous generation. Heritages in Italy today are more than 15% of GDP.

Only Ireland seems to resist this tendency as since the inheritances are minimal. And they haven't increased much in recent years.

In America today, for every $ 100 that employers pay annually on wages, the deceased leaves $ 20 behind.

The average size of the family has been reduced abruptly in recent years. A specific heritage is therefore distributed to fewer people, the Economist points out.

Using British data, he estimates that in recent decades the birth reduction will increase the amount that goes to the average heir by about £ 60,000 ($ 75,000), or 24%. « Having a brother or a sister may be nice, but it has a price, » the Economist commented.

The reduction in inheritance taxes also increases the share of the property that a heir can maintain.

At the beginning of the 20th century, inheritance tax revenue represented a significant part of the total tax revenue in America and Britain.

But in the second part of the century, politicians turned against taxes. Some were influenced by pressure. Others were afraid that, in a globalized world, taxes on wealth would push the rich to leave their homes.

Today inheritance taxes represent much less than 1% of government revenue in rich countries. Several countries, such as Australia, Canada, India, Norway and Russia, have completely abolished them. More than 20 US states abolished the tax transfer taxes between 1976 and 2000.

The rise of the inheritance reflects three factors: increasing wealth, change of demography and slowing economic growth. After the first and second world war, the value of wealth, in relation to national income, collapsed. Many of Europe's buildings were destroyed. High inflation reduced the value of cash and government bonds. Politicians have developed a preference for heavy taxation of wealth and nationalization.

Since then, the residence, in particular, has become more valuable, partly because of restrictive planning policies that limit the offer. The value of the British buildings increased from just over 1 trillion pounds (130% of GDP) in the mid -1990s to just below 7 pounds (270% of GDP) in recent years. Property taxes are no longer popular, stock markets have fantastic performance, and inflation, at least until recently, was low.

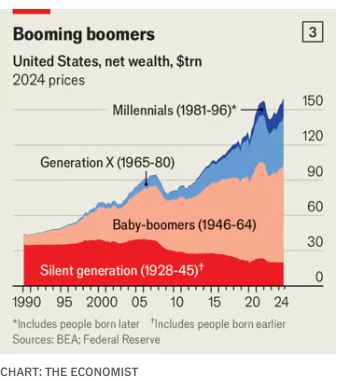

The second factor is demographic. Baby-boomers gathered wealth, as they reached adulthood just when housing prices and stock markets began to launch. The Germans over the age of 65, who are one -fifth of the population, hold one -third of the country's wealth. The American Baby-Boomers, who are also one-fifth of their country's population, hold half of its pure wealth, ie 82 trillion. dollars. Now the boomers are starting to die, leaving great possessions to their heirs.

Lucky Irish

Economic growth is the third factor. In 2014, Thomas Piketty of the Paris School of Finance and Gabriel Zucman, then of the London School of Economics, presented evidence that countries with slow growth accumulate more wealth than national income.

According to Economist data, the fastest growing countries (to become rich), such as America and Ireland, appear to be less affected by the legacy compared to the slower growing, such as Germany and Italy.

The explosion of inheritance will create particular inequalities in the housing market, whether wealth transfers occur during death or during life. A survey by Legal & General, a financial services company, on America shows that if the « Mom and Dad Bank » was a business, it would be among the ten largest mortgage lenders.

:format(webp)/s3/static.nrc.nl/images/gn4/stripped/data132608616-d34711.jpg)