How to add kerosene to the fire

Accountants methods

Recently, the minimum monthly salary (MMA), fuel excise duties, US President Donald Trump’s Customs War is rampant, Lithuania is in a hurry to invest in defense capabilities. Marius Horbačauskas, CEO of Volfas Engelman, President of the Association of Industrialists and Employers of Kaunas Region, believes that it is dangerous to raise a tax burden for business during such a busy period. « Here’s how to add kerosene to the fire, » Horbachauskas describes the potential effect of such a policy.

« One bad method that governments are mostly based on working is the work of an accountant, not an entrepreneur. The accountant performs calculations of excell tables, and the businessman sees opportunities that may be and in the ex -ex -existence, » he emphasizes. «

« Why are pricing campaigns? Not because it wants to sell something cheaper, but because, when the price is sold, more sold and more earned. Examples are fuel excise duties. Multiply from the liters for sale and counted how much it will gather. The budget would be more consumed, ”says M. Horbačauskas.

Zigmantas Dargevičius, president of Kaunas Chamber of Commerce, Industry and Crafts (KPPAR), says that business is well aware of the importance of paying taxes to the state and its well -being. According to him, the current proposed tax reform raises many discussion issues and businesses seek to offer decision -makers to offer balanced ways to make a significant contribution to the country’s defense and growth.

« The geopolitical environment, high customs duties in the United States and the potential stages of the EU and China’s announcement are a lot of anxiety in all world markets. It is a disproportionately sudden difficulty in exporting their goods and services, which immediately affects income and their prediction, » Dargevich explains the situation. » In the local markets, the rapidly increasing competition also creates an additional pressure: a possible supply of cheaper goods from Asia, which would affect local manufacturers and their viability. «

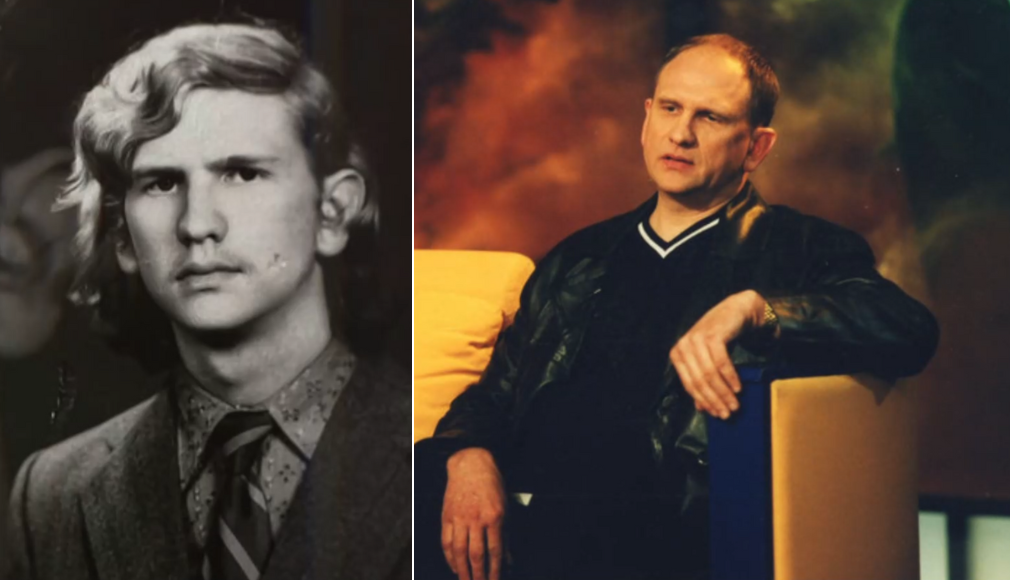

Evaluated: According to M. Horbačauskas, it is dangerous to raise the tax burden on business during such a busy period. / Photo by Regimantas Zakšensk

The threat of GPM tariffs

Government plans include income tax raising 1 percent. – For large companies, it would grow up to 17 %, preferential – up to 7 %. The President of the KPPAR emphasizes that raising income tax 1 percent. There is no critical factor that will determine the decision of business owners to move businesses or to seek ways to artificially reduce the taxable profit base. However, in the context of geopolitical uncertainty, increasing income tax for the second year in a row, even 1 %. causes distrust of the stability of the tax system.

« The stability and consistency of the tax system is critical of long -term business management solutions designed 5 to 10 years ahead, assessing the cost level, assumed and reinforced loans to ensure employee wages, etc., » says Z. Dargevičius. A temporary increase could only be justified by the need to directly allocate collected funds to fund the country’s defense. ”

He considers a much greater danger to the Personal Income Tax (PIT) intended transformation. According to the current proposal of the Ministry of Finance, the income of the population, regardless of the source, would be taxed by progressive – 20, 25 and 32 %. – at rates. The fourth is offered – 36 percent. rate for the highest income exceeding 120 average wages.

According to Z. Dargevičius, it is the worst and unjustifiable part of this tax reform, contrary to the principle of equality against the Law on Tax Administration. This is how taxpayers are discriminated against by others.

« The treatment of various taxpayers as entities reduces the clarity and justice of the tax system, promotes tax minimization and the shadow economy. The PIT total rate with Sodra and compulsory health insurance (PSD) approaches half wages, which is a direct adverse effect on the middle class, » says Z. Dargevičius. – The rise of the GPM rate will complicate the maintenance and attracting specialists, especially those with high qualifications. It can also encourage you to move businesses to other countries. All types of income must be guaranteed by a total tax rate that promotes transparency and honesty. ”

One bad method that governments most often rely on working is the work of an accountant, not an entrepreneur.

Fighting for professionals

According to Evaldas Sauliūnas, director and shareholder of Kauno stubar, manufacturing in Lithuania, according to KPPAR, director and shareholder of shareholder, is occupied by business structure in Lithuania. About 20 percent The country’s gross domestic product (GDP) is an industrial contribution, so increasing PIT will directly negatively affect companies. « The cost of labor will increase. Most importantly, it will reduce the competitiveness of companies and production, » says E. Sauliūnas.

Remigijus Daugėla, the head of Tango Print Print, a company that offers the press solutions, is also in the case of pressure to keep employees with increased taxes. According to him, a small production company with up to 20 employees is extremely painful that the leadership professionals are so difficult to develop the team. The reason is that with taxes rising prices.

« There is a great threat – a wave of emigration of mature professionals. It is no secret that the current geopolitical situation also contributes to emigration, » says a member of the KPPAR Council.

According to him, the increase in PIT will narrow the ability to have more qualified professionals. « There is a business owners’ squingering with employees. It must be understood that when we pay more to the state, less to the employee. Or we will become uncompetitive, » says the businessman.

R. Daugėla also draws attention to the areas of smaller cities – there is no shortage of challenges: « Finding highly qualified employees in regions is almost an impossible mission. »

« While municipal leaders actually make a lot of efforts to attract business, tax increases leads to companies to less opportunities to compete. This affects decisions – simply to stop or raise activities. This would particularly affect young people who want and try to build business in the region, earn and build new jobs, » says Daugėla.

He also points out that the expected taxation of insurance contracts is 10 percent. will directly touch all the companies and will be painfully struck by small ones, which must be required to prohibit production tools and other entities. « This is especially true for small companies that do not have financial reserves and borrow from banks is tricky and expensive. Like other taxes, it increases costs and reduces competitiveness compared to close foreign countries, such as Poland, » says Daugėla.

Nuances: Z. Dargevičius says that business is well aware of the importance of paying taxes to the state and its well -being, but the proposed tax reform raises many discussions. / Photo by Regimantas Zakšensk

Return to VAT

The Ministry of Finance recognizes that proposed tax amendments can reduce Lithuania’s GDP by 0.2 %. According to M. Horbačauskas, there are calculations that prove that if the current economic growth rate is unchanged, the usual taxes collected from business would be sufficient and would not be significantly raised. « But if the business stops and slows down, there will be no income that is expected, all the illusory tax income will disappear, » he asserts.

« I know how difficult it is to raise income, how difficult it is to sell, to raise that money, so I know there will be no guaranteed number. The excele shows that raising taxes will be one result, but in reality not the excele decides – M. Horbačauskas knows from experience.

He does not contradict the profit tax, even on the contrary, he says it could be further increased because the profit is earned. « We all understand that defense requires income because there will be no state and our companies. There is no need to talk about it. The basket would be universal because the defense is probably equally relevant to everyone, ”he says.

Z. Dargevičius also believes that in order to raise the necessary share of funds for defense purposes in the near future, it is worth returning to the consideration to increase VAT 1 %.

« Discussions about the fact that this will affect the lowest income or the most vulnerable social groups should not become a cover from responsibility to contribute to the defense of the country. On the other hand, the rise in the cost of consumption of goods and services 1 % from EUR 1 000 monthly expenditure. funding, ”emphasizes Z. Dargevičius.

A sense of dishonesty

M. Horbačauskas would also support VAT incentives and the global real estate (real estate) fee, as it would give an even greater sense of honesty and equality in the state. In addition, such taxes would be easy to collect and count.

« The feeling of dishonesty is tension. If some pay more, others are less, perhaps a threat to a larger shadow. If taxes are too high, jobs can be raised to another country, such as Latvia. showed that people immediately started buying fuel in Sweden or Poland. Asks M. Horbačauskas.

« It is often imagined in politics that money comes from an ATM rather than the taxes paid by business. We need to earn, pay taxes and bring them to the budget, well, unless the subsidy from the EU can still fill the country’s budget but other major sources.

M. Horbačauskas is well aware that when taxes rise, the business will not go anywhere – they will have to pay them. « We only think that by promoting and growing the economy, we would have a much larger cake to take tax and income to the state, » he says.

R. Daugėla is also convinced that the country’s defense budget should grow more through work and earning, consuming, transparency and providing funds. « In our opinion, tax rates for business are sufficient to finance the basic needs of the state, » says the businessman.

According to Z. Dargevicius, the threat of recession is more of the extent of the current numbers, but from the uncertainty of the future, especially due to the increase in tax burden, geopolitical tension in the region, high interest rates and other factors. « Suspended investment, cautious development, interruption of activities can be real scenarios. Business is constantly in the field of various risks, will have to efficiency, diversify markets, reduce financial risks and take other possible measures depending on activities, » he says.

The business community monitors the situation and hopes that global changes in international trade changes will not be long -term. However, Z. Dargevičius admits that these are only expectations and hopes of having a more predictable business environment.