House in Dubai: prices, profitability (10%) and capital gain (at 30%) in the event of a resale, the reasons for the boom of requests for Italians

In the first quarter of 2025 there were about 45,500 real estate transactions (+22% compared to 2024), for a total value of 142 billion dirham (about 33.94 billion euros) uphill of 30%

Buy house in Dubai today ever more convenient. The strengthening of the euro on the dirham and 10% duties imposed by the United States, among the lowest in the worldare making the Emiratine real estate market particularly attractive for Italian investors. This was confirmed by Gabetti Middle East, the first Italian real estate agency in the Arab Emirates: In the last three months, requests from Italy have increased by 35%.

Revaluation

An opportunity made even more interesting by the Euro/Dirham exchange rate: in January 2025 it was at 3.93, today it went up to 4.19. A revaluation of over 6%, which translates into a higher purchasing power for those who invest in European currency. In concrete terms, a 150,000 euro studio at the beginning of the year today can cost around 140,000 euros, or even 135,000 euros if you consider promotions or launch discounts.

«Today buying a house costs less, but all the indicators tell us that the value of the emiratine brick will continue to grow in the coming years – he explains Fabio Bardelli, Head of Sales by Gabetti Middle East -. This means that buying today is more advantageous and with prospects for capital gains, in case of resale, greater than 30%. The new policy of duties is also leading many European and Chinese companies to decide to open their headquarters in the Arab Emirates, where the duties are among the lowest ever ». To further push the market is also the development of new free areas, such as the one under construction in Umm Al Quwain’s Emirate.

The investment

The boom of interest is supported by a well -defined audience: Men and women between 30 and 50 years old, professionals residing especially in Lombardy, Campania, Lazio and Veneto, often looking for a safe investment for himself or for children. 40% of the properties are sold before even that the buyer sets foot in Dubai, thanks to the coordination between the Italian offices and the local one of Gabetti.

The brick race in Dubai is also reflected in the general numbers of the market: In the first quarter of 2025 there were about 45,500 real estate transactions (+22% compared to 2024), For a total value of 142 billion dirham (about 33.94 billion euros) uphill of 30% on an annual basis). Performance that exceed those of many European capitals: in the same period, London scored -5%, Milan grew by 6%.

Returns

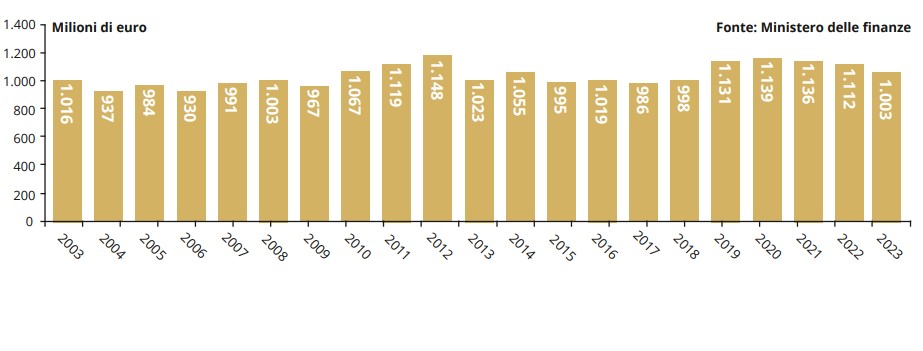

Another key element are the lease yields: Dubai guarantees an annual profitability between 8% and 10%, against even lower purchase values than cities such as Milan, London or Paris. Over the past two years, the prices of the houses in Dubai have increased by over 40%, but the growth trend still appears solid.

Among the most promising projects marketed by Gabetti Middle East there is Atelis in Dubai Design District, developed by the government group Meras. A neighborhood destined to transform into a residential pole, already animated by fashion brands, galleries and creative spaces today. An 85 sqm two -room apartment with sea view is worth about 500,000 euros, with expanded payment and balance on delivery within five years.

:format(webp)/s3/static.nrc.nl/wp-content/uploads/2024/03/08144852/data112647696-322d44.jpg)