Growth in motion, uncertainty on the horizon

In the current demanding environment of geopolitical tensions and, consequently, the diverging monetary policies and US trade dynamics, in contrast to Europe, show relative economic resistance.

Despite the seemingly unstable atmosphere, the data at least for now indicate the continuation of the US stock market expansion. Although the volatility is visible in the jump of the VIX index (volatility index) due to structural growth factors such as developing artificial intelligence and digital infrastructure, increasing demand for energy and possible alleviation of regulations, markets remain prepared for recovery.

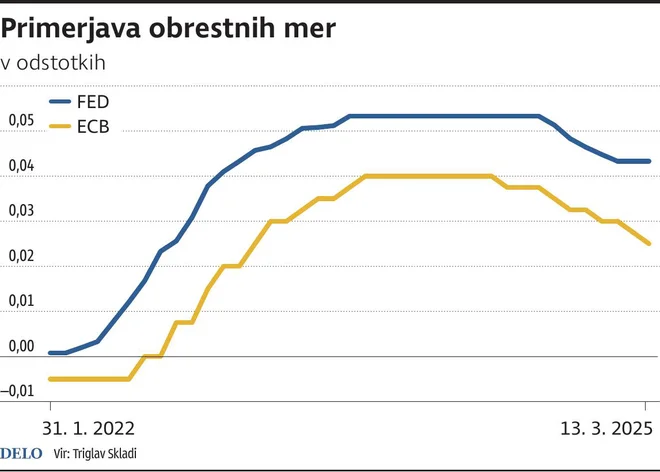

The US economic resistance is based on proactive and flexible monetary policy. While all countries, including the US, had to increase interest rates to fight inflation, the US advantage is currently that significant interest rates, contrary to Europe, have not yet been implemented. Reducing interest rates to promote growth, which is an additional tool for maintaining economic stability despite global uncertainty, is therefore still possible.

In sharp contrast, the European Union is facing increasing economic vulnerability. Due to the historically low interest rates of the European Central Bank (ECB), it is not sufficiently flexible for effective anti -crisis measures. In addition, trade disputes, including the introduction of customs duties on US products, threaten stability. For example, a 25 % tax on US corn could disproportionately affect the European livestock sector, which depends heavily on the import of US cereals. The European Federation of Feed Manufacturers has therefore called for negotiations to reduce these risks and propose to increase US imports as a solution to reduce the EU agricultural trade deficit.

Compared to the compare photo TT IgD

Canada is also facing economic problems, which has led to the fact that the key interest rate has been reduced seven times in the last nine months, as they would like to alleviate the economic slowdown caused by trade tensions with the US. Nevertheless, the introduction of retaliatory customs worth $ 29.8 billion per US imports only increases uncertainty and further burdens on the already fragile Canadian economy.

The US and China trade tensions, especially customs, present a greater challenge for the US and will affect global trade patterns. Higher customs duties could stimulate Chinese self -supply in key sectors and limit growth in the US, while additional customs duties to Canadian and Mexican imports could reduce US GDP by 1.3 percent and cause inflation growth. The US budget deficit in the full -time period emphasizes the need for fiscal reforms that could generate new sources of government revenue and help manage increasing expenditures.

Despite the US trade challenges, the top -notch investment destination remains, supported by a strong economy, capital markets, an army and technological advances in artificial intelligence and quantum computer. Although short -term volatility can cause concerns about recession or stagflation due to adjustments in the production sector and reduced imports, these challenges are expected to be short -lived. The flexibility of the US fiscal and monetary policies provides a stable basis for capital allocation, while limited EU tools and Canada vulnerability increase the risk of investment. In this environment of global uncertainty of the American stock, especially in growth sectors, they represent important opportunities for long -term returns.

Canada is also facing economic problems, leading to the fact that the key interest rate has been reduced seven times in the last nine months to alleviate the economic slowdown caused by trade tensions with the US. Photo Arlyn Mcadorey/Reuters

In order to improve its position, Europe should focus on strengthening fiscal flexibility and reducing dependence on historically low interest rates. Strengthening economic cohesion, investing in innovation and rescuing trade imbalances could help reduce vulnerability. In addition, a more proactive approach to technological advances and development of infrastructure could improve Europe's competitiveness and resistance in the global market.