Government bonds with triple a on the report card: who are the 10 « early class » (now that the US there are no more)

Economies with lowest credit risk weigh for just over 10% of the world’s GDP. And the budget under discussion at the American congress creates nervousness on the markets

Once upon a time, when Moody’s arrived, governments got nervous. Especially in Italy: the financial rating agency, as well as other similar ones, was a punishment of the prolifery of the expense of politicians. He had a lot of work on the peninsula.

Then, a little around the world, Le Moody’s, Standard & Poor’s (S&P), Fitch, DBRS continued to be relevant but have made less high waves among public opinions. In these days, however, the rating – the assessments on the financial solidity of a country, expressed with the famous A or B and even C – has returned to being central not only for investors, but also for public opinions. For two reasons.

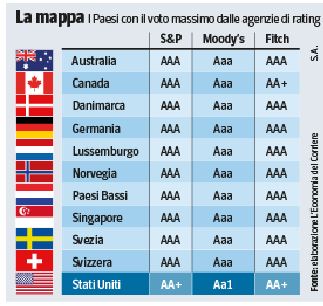

The first, which has already been discussed, is given by the fact that Moody’s removed the triple A, that is, the maximum vote, to the United States, and lowered it by a step to AA1. S&P had already done so in 2011 and Fitch in 2023 Among other things, in a situation of high global turbulence caused by the policy of the duties of the White House. On the other hand, it has not been talked about of the second reason, but from many points of view it is equally significant in the state of the world.

The tendencies of the world ….

The countries that maintain triple a for all the main rating agencies represent just over 10% of the global GDP. It means that 90% of the world product is not made by countries in the best financial conditions. Not dramatic situations, in many cases, however, a worrying trend is underway, strongly underlined by the International Monetary Fund (IMF): the global increase in public debts.

There are ten countries assigned by three of the major rating agencies. The most important of these economies is that of Germany. Berlin has lived, in recent years until a few weeks ago, with the debt brake constraint, which has allowed the government to keep the growth of the debt controlled, in 2024 just below 64% of the GDP. The other large European nations (for public accounts, at least) are Switzerland, Holland, Sweden, Denmark, Norway, Luxembourg, Liechtenstein (the latter analyzed only by S&P). Many of these in Italy are called, not always with appreciation, « the frugali ». At the summit there are the non -European Canada (the third triple attributes DBRS but not Fitch), Australia, Singapore. Even the European Union emissions have an AAA rating, but at the moment they are of modest entity.

Overall, the number of stainless countries has been at least from the early years of the century. For the rest, there are countries in excellent financial conditions, others with public budgets under pressure at different degrees and others who have rating so low as to make enormous effort to go loan on the markets.

The accounts with expansion

Everyone, in reality even those with a triple in full, have to deal with a worrying global growth of public debts. Based on data from the World Economic Outlook last April, the IMF scheduled it at 2.8% this year. It means that the debt will exceed 95% of the world GDP and probably by the end of the decade it will go above one hundred percent. A level that turns on spies to increase instability. With the connected risks. Based on the calculations of the FMI Fiscal Monitor, « in a global scenario severely against public debt could touch 117% of GDP by 2027 ». He adds the fund: « The growing geo -economic uncertainties could increase the risk of debt ».

The term geoeconomics is taking space in the debate on the future. It is the use of the economy for purposes linked to the objectives of power of governments, in particular those of the countries with ambitions of world hegemony. It is a bit the militarization of the economy in the comparison between powers. This new reality involves difficult risks to keep under control. For this, the IMF always says, it is important to keep the debt of states low, to have budget space when instability requires unwashed expenses. It is necessary to create buffers, invites the IMF, that is, tax spaces to which to resort to the moment of maximum crisis. Germany model.

The worsening of the financial position of the USA can become one of the greatest elements of instability, if it ends out of control. It is not said that it happens. A not small part of the economists, however, does not exclude that the situation can deteriorate. The American treasure measures public debt to over 35 thousand billion dollars at the end of 2024, 123% of GDP.

American lessons

Already now, the weight of this stock of securities on which to pay the interest is high: last year 880 billion dollars, more than Washington allocates defense. With heavy consequences shortly: in the next twelve months, the US Treasury must refinance nine thousand billion titles expiring at tendentially growing rates not so much for Moody’s downgrading, but for the uncertainties created by Trump’s policies. With possible consequences even in the long term: a great power that spends the most for the service of the debt which for the defense is likely to cease to be a great power, explained the historian Niall Ferguson.

Of his, the budget wanted by the White House and under discussion at the Congress – the « Big Beautiful Bill Act » – It could also increase the public debt by at least 4 thousand billion more in a decade. In this situation of possible deterioration, many great investors have started looking for « safe ports » alternative to American assets. The US economic and financial power is still enormous: to draw hasty conclusions is not wise. Risking trends, however, are at work.

On the Financial Times, the Columnist Gillian Tett wrote that, at the White House there are those who, ironically, call the Trump budget not « Big and Beautiful » but « Triple B plan », to say where the rating could end. The terrible agencies that sift through the debt have returned to the conversation.

:format(webp)/s3/static.nrc.nl/wp-content/uploads/2025/04/04111243/data130287438-072114.jpg)