Global oil prices rise after Israel attacks Iran

Global oil prices have risen after Israel said it had attacked Iran, in a dramatic escalation of tensions in the Middle East.

The price of raw oil Brent increased by more than 10% immediately after the news was published, reaching the highest level since January.

Traders are concerned that a conflict between Iran and Israel can stop supplies coming from the energy -rich region.

The cost of raw oil affects everything, from which it costs to fill the car with fuel to the price of food in the supermarket.

As the financial markets were opened in Europe, prices were slightly lowered, about 5% higher than the closure price the day before. London-traded raw brunt oil was $ 72.80 per barrel, while the oil traded in NYMEX, US, was $ 73.20.

The stock prices also fell in Asia and Europe. UK FTSE 100 Index opened 0.6% drop.

Safe assets such as gold and Swiss francs have made profits.

Some investors see these assets as more reliable investments in times of uncertainty.

The price of gold reached the highest level for nearly two months, rising by 1.2% to $ 3,423.30 per ounce.

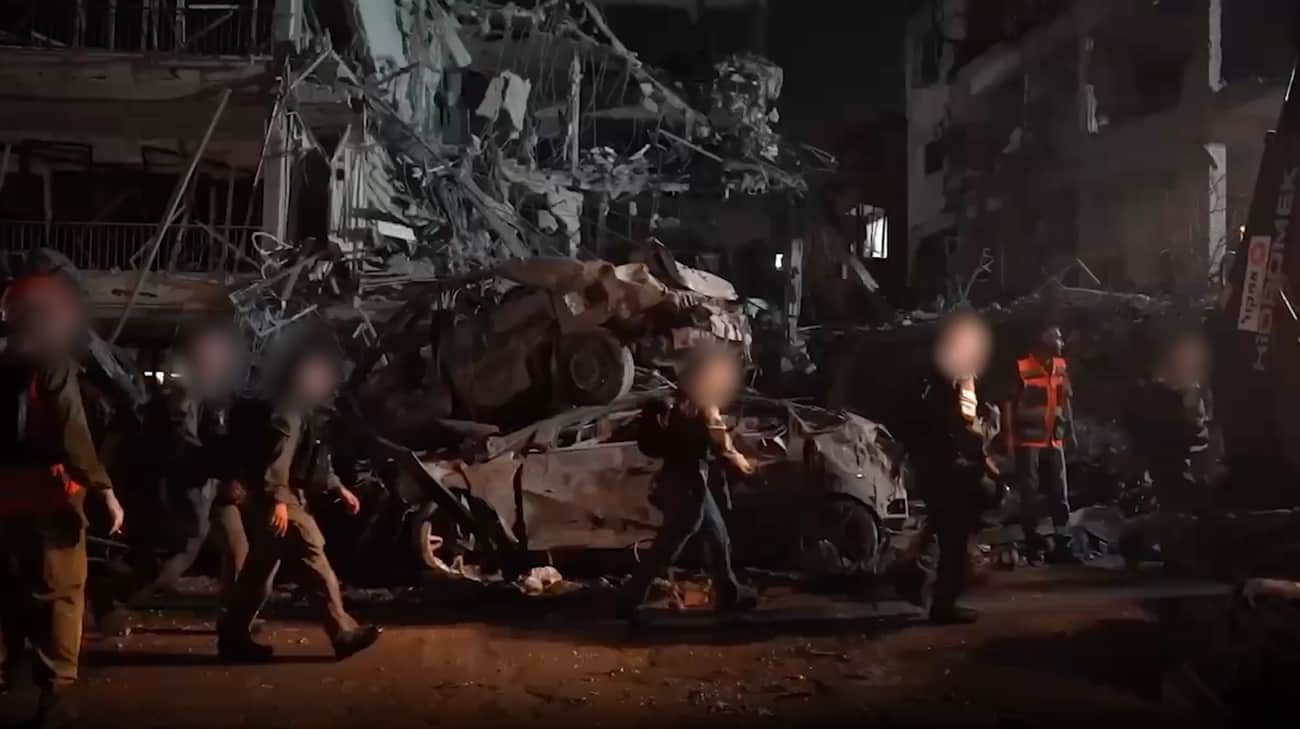

Following the Israeli attack, the Israeli defense (IDF) said Iran had issued about 100 drones to the country.

Analysts said energy traders will now observe how much conflict will worsen in the coming days.

« It’s an explosive situation, though a situation that can quickly be deactivated as we saw in April and October last year, when Israel and Iran hit each other directly, » said Vandana Hari and Vanda Insights.

« It can also turn into a bigger war that interrupts oil supply in the Middle East, » she added.

In an extreme scenario, Iran can interrupt supplies of millions of barrels of oil per day if it aims for infrastructure or maritime transport in the Hormus Strait.

The strait is one of the most important routes of maritime transport in the world, with about one fifth of the world oil passing through it.

At all times, there are several tens of tankers on their way to the Hormuz Strait, or moving away from it, while the main manufacturers of oil and gas in the Middle East and their customers transport energy from the region.

Restricted to the north by Iran and south by Oman and the United Arab Emirates (UBA), the Hormuz Strait connects the bosom with the Arabian Sea.

« What we see now is a very beginner reaction to the risk. But over the next one or two days, the market will have to consider where this can escalate, » said Saul Kavonic, head of energy search in MST financial. / Monitor.al