Global markets get power from balance sheets and tariff optimism – Cyprus Newspaper

In global markets, a positive course is observed with optimism about the US-China trade talks and strong technology balance sheets.

While the policies carried out by the US administration with the understanding of ‘America first’ continued to be decisive in the markets, it was observed that the focus of investors shifted from concerns about tariffs, positive expectations and strong balance sheets for the negotiation process.

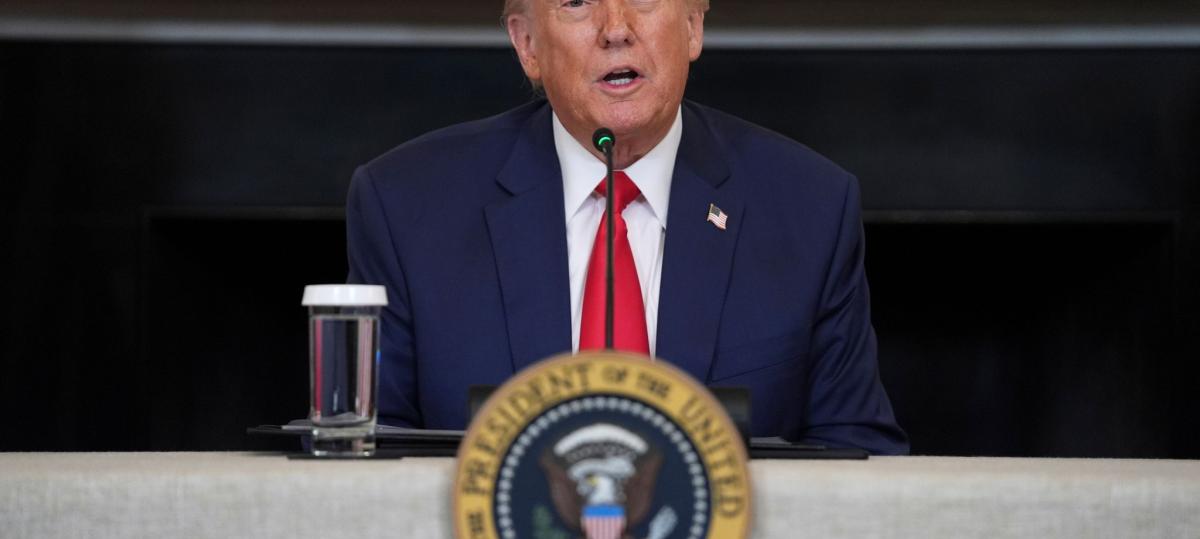

Although US President Donald Trump’s statements about the ongoing negotiations on tariffs with China are denied by the Beijing administration, it remains optimistic air influence in the markets.

Trump reiterated that they had met with China in his latest statement.

On the other hand, the US administration continues to negotiate with other countries after tariffs. US Treasury Minister Scott Bessent said that the US and South Korea had a ‘very successful’ trade talks, and that the two countries could reach an understanding based on an early date like next week.

President Donald Trump is trying to put into practice, stating that he is looking for a way to alleviate the harsh tariffs, « We may be moving faster than I think and we will start talking about technical terms from next week. » he said.

In addition, the International Monetary Fund (IMF) President Kristalina Georgieva emphasized that uncertainty is very costly, and called for rapidly solving tensions and reconciliation in trade policies.

While the statements of the US Federal Bank (FED) officials were also followed, the FED Board Member Christopher Waller said that the dismissal may begin due to tariffs and would support interest rate cuts if there was a significant increase in unemployment.

Waller said that he did not believe that the tariffs will have a significant impact on the economy before July, but said that unemployment may increase rapidly if mutual tariffs come into force. Waller, the inflationary effect of tariffs will probably be temporary, he said.

Cleveland Fed President Beth Hammack also said that if there is clear and convincing data, the Fed could take action in June on interest cuts. Hammack said it was early to think about lowering interest rates at the FED meeting on May 6-7.

In the pricing in the money markets, the FED will not change the policy interest in May, while the bank is priced that the bank will go to interest rate cut at 66 percent probability.

Alphabet announced profit above expectations

Alphabet, one of Google’s main organization, one of the technology giants on the corporate side, announced income and profit above market expectations. The company’s income increased by 12 percent in the first quarter of this year to 90.2 billion dollars. In the first quarter of 2024, the company, which provides 80.5 billion dollars of revenue, announced that it will not make any changes in artificial intelligence targets.

The company’s net profit increased by 46 percent in the first quarter compared to the same period last year and reached 34.5 billion dollars. Alphabet had a net profit of $ 23.7 billion in the first quarter of last year.

The income of the technology company IBM increased by 1 percent in the first quarter of this year to $ 14.54 billion.

The revenue of the US chip company Intel, which publishes the balance sheet for the first quarter of the year, did not change compared to the same period of the previous year and was $ 12.7 billion.

Intel CEO Lip-This Tan said, “The first quarter was a step taken in the right direction, but there is no quick solution to gain market share and return to sustainable growth.” evaluated. Stating that they have taken quick steps to provide operational efficiency, Tan said that they had changed the necessary changes to build “New Intel.

On the macroeconomic data side, the amount of durable goods orders in the US increased by 9.2 percent in March with an increase of expectations. Second -hand housing sales in the country decreased by 5.9 percent in March and was below market expectations.

Withdrawal under ounce is observed

With these developments, the price of ounce of gold, which has been at record levels due to the impact of uncertainties for a while, completed the day at 3 thousand 325 dollars with an increase of 1.5 percent yesterday. On the new trading day, a small decrease in global risks, the tendency of investors to realize profit and the dollar index gains strength. Onk Gold is currently trading at 3 thousand 323 dollars with a decrease of 0.9 percent at the moment.

The US 10 -year bond interest decreased to 4.31 percent by carrying the decline to the 4th trading day. The dollar index increased by 0.3 percent to 99.8.

Brent oil price of the barrel yesterday after the value of 0.6 percent of the new day increased by 0.6 percent of $ 66.1 is traded.

Yesterday at the New York Stock Exchange, the S&P 500 index was 2.03 percent, the NASDAQ index was 2.74 percent and the Dow Jones index gained 1.23 percent. Index futures contracts in the US started the new day with a positive course.

Geopolitical developments are gaining importance in Europe

While the tariff agenda, which calms down in European stock exchanges, increased risk appetite in the share markets, developments in the Russian-Ukraine war have been concerned that geopolitical risks could be revived.

The Russian army reportedly died in the attack on Kiev, the capital of Ukraine, with missiles and unmanned aerial vehicles (UAV). Kiev City Military Administration President Timur Tkaçenko, Telegram account in a written statement, the Russian army’s attack on Kiev with missiles and UAVs, said the search and rescue work continues.

Sviyatoshin district of the building in the wreckage of the search and rescue work continued to record Tkaçenko, according to recent findings, 12 people lost their lives shared.

US President Trump also evaluated the Russian-Ukraine War in his meeting with Norwegian Prime Minister Jonas Gahr Store at the Oval Office. Trump clearly expressed that Russia was not satisfied with the latest attacks on Kiev, and said that it was bad to experience these attacks while the peace talks were in progress.

On the other hand, the European Central Bank Board Member and Austrian Central Bank President Robert Holzmann, yesterday, said in a statement, the uncertainties for tariffs should be expected to wait for interest rates until the disappearance of the uncertainties, he said.

On the other hand, Germany Economy and Climate Protection Minister Robert Habeck held a press conference in the capital Berlin on the economic growth report published by the government. This year, announced as 0.3 percent in January for the official growth expectation to be reduced to 0 percent of the Habeck, the growth forecast for next year was revised from 1.1 percent to 1 percent, he said.

Yesterday, the FTSE 100 index in the UK was 0.05 percent, DAX 40 in Germany, 0.47 percent in France, the CAC 40 index in France 0.27 percent and the FTSE MIB 30 index in Italy rose by 0.96 percent. Index futures contracts in Europe started the new day with a positive course.

Asian stock exchanges are positive

In Asian stock exchanges, the market -supporting steps of regional economies and the increase in the profit of Alphabet in the USA in the USA, the increase in the risk appetite to the region is a positive course.

On the other hand, while the optimism continues to negotiate in tariffs, China and the United States continue to be another element that supports market markets that the Chinese administration will continue to commercially with the European Union (EU).

The Chinese Central Bank (PBOC) today carried out an inverse repo transaction of 159.5 billion Yuan (approximately $ 22.3 billion) through a fixed interest rate tender.

Analysts said that the Chinese Central Bank may have been realized to inject liquidity to the market in order to reduce the impact of the US tariffs, and that the economy may have been aimed to help the economy cope with difficulties in the trade environment.

Japanese Prime Minister Isiba Sigeru said that the Japanese government has decided to help alleviate the problems faced by the industrial and household people caused by comprehensive US tariffs.

According to macroeconomic data, Tokyo Consumer Price Index (CPI) increased 3.5 percent annually in Japan in April. The core CPI also increased with 3.4 percent above expectations.

With these developments, the Nikkei 225 Index in Japan in Japan and the Shanghai compound index in China in China increased by 0.2 percent, KOSPİ index in South Korea increased by 1.1 percent and Hong Kong increased by 1.4 percent in Hong Kong.

Standard & Poor’s in Turkey is expected to evaluate Türkiye

BIST 100 Index in Borsa İstanbul, which follows a purchase -oriented course in the country, finished the day at 9.490,90 points by gaining a value of 1.92 percent. Borsa Istanbul Futures and Options Market (VIOP) BIST 30 index -based April futures contract yesterday evening session in the session of the regular session increased by 0.3 percent to 10.455.00 points were traded.

Treasury and Finance Minister Mehmet Simsek, US Treasury Minister Scott Bessent X social media account with him quoting his meeting with him quoted. Şimşek thanked BESSENT for an efficient meeting and said, “Turkey is determined to deepen and expand strategic partnership with the US in all areas from trade and investment to defense, space, energy, artificial intelligence and robotics under the leadership of President Erdoğan and President Trump.” He said.

Dollar/TL, yesterday with an increase of 0.1 percent of 38,3460, today, today at the opening of the interbank market of 0.2 percent of the previous closing is traded at the level of 38,4220.

Analysts, today, the Central Bank of the Republic of Turkey (CBRT) Monetary Policy Committee meeting, sectoral inflation expectations, weekly money and bank statistics, international credit rating agency Standard & Poor’s expected Turkey evaluation, abroad in the United States Michigan University Consumer Confidence Index will be followed by expressing the technical and 9.500 levels in the BIST 100 and 9.500 levels, 9,300 and 9,200 points are supported.

The data to be followed in the markets today is as follows:

09.00 England, April retail sales

10.00 CBRT, Sectoral Inflation Expectations

14.00 Türkiye, PPK meeting summary

14.30 Türkiye, weekly money and bank statistics

17.00 USA Michigan Consumer Confidence Index