Geopolitical tensions are shaped by the raw material market

In recent days, global raw material markets have been at a turning point, as they have greatly influenced by geopolitical tensions, trade customs and uncertainty in financial markets. Prices for oil, natural gas, metals and agricultural produce are subject to rapid changes, and above all, they are a considerable challenge for the direction of movement in the future.

Energy market under the influence of geopolitical risks

The oil market has faced two conflicting moments last week. On the one hand, oil prices rose due to the increase in tension in the Middle East, mainly due to US attacks on the Hutijevca in Yemen, which brought about retaliation and threats by escalation. US President Donald Trump has clearly warned Iran that he would be responsible for the possible expansion of the conflict. On the other hand, the International Energy Agency (IEA) announced a surplus on the oil market of 600,000 barrels per day for this year, creating pressure on prices and increasing uncertainty about future demand. There is also a danger that this will grow to a million barrels per day if OPEC+ eliminates production reductions during the year.

The price of gold

The natural gas market experienced a drop in prices in Europe, expecting an agreement to calm the fighting between Russia and Ukraine, which could release some energy flows. Nevertheless, European gas reserves are rapidly decreasing (currently at 35 percent, which is below the five -year average of 46 percent), which could again raise prices in the event of a sharper winter.

Metal Square: Customs and Chinese Economic Policy

Slavko Rogan, Senior Investment Fund Manager at Triglav Photo Jernej Lasic Funds

Under the pressure of trade policies and fluctuations in demand is also a metal market. The European Commission has launched an investigation into the import of aluminum due to new US customs duties. This is an important question for the European industry, which is based on the import of primary aluminum, with Russia being one of the main suppliers, although the amounts of imports after sanctions in 2022 have decreased by half.

The price of copper is higher and reached a five -month peak, as China is taking stimulation measures to increase consumption. The Chinese government has presented a special program for increasing economic activity, which involves raising the available household income and supporting population growth. Nevertheless, the Chinese real estate sector remains weak, which could reject the growth of demand for copper and other industrial metals in the long run.

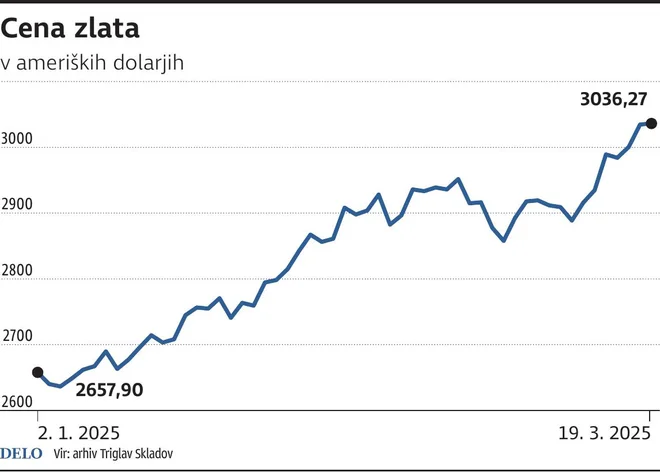

Gold has also achieved a record value in dollars, which is currently just over $ 3,000 for an ounce. Price growth promotes, in particular, the uncertainty of the further trade war, so demand for gold has increased as a safe investment since the beginning of the year.

Fresh economic growth forecasts for this year are lower than originally intended, which in favor of reducing the demand for oil. Increasing the capacity of pumping in the US (Trump policy), of course, would only increase excess oil. Both indicate that the price of oil could be lowered during the year, which, in turn, would lower inflation and open the space to the central banks for further reduction of interest rates.